Australia is gearing up to make ESG (Environmental, Social, Governance) reporting mandatory by 2025, shifting from voluntary guidelines to strict regulatory standards. This shift means businesses will have to disclose their sustainability efforts more transparently, aligning with global frameworks like the ISSB. Get ready, Australia—2025 is just around the corner!

Continue readingAASB Australian Accounting Standards List: Complete Overview

The Australian Accounting Standards Board (AASB) plays a crucial role in ensuring financial transparency and consistency across industries in Australia.

Continue readingMust Attend Accounting & CPA Conference 2025 in Australia

Stay ahead in the ever-evolving accounting industry by attending key conferences in 2025. These events provide valuable insights into regulatory changes, emerging technologies, and business strategies, while offering networking opportunities with industry experts.

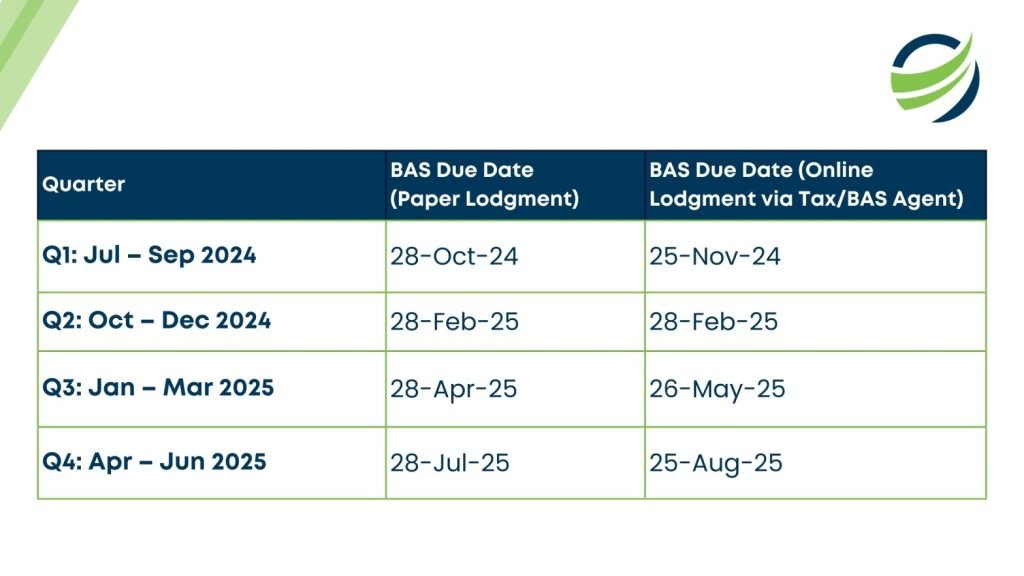

Continue reading2025 BAS Due Dates Lodgment & Payment in Australia

2025 Working from Home Tax Deductions to Claim in Australia

Maximise your 2025 work-from-home tax deductions in Australia! Learn what expenses you can claim, ATO-approved methods for calculating deductions, and essential record-keeping tips to ensure compliance.

Continue readingATO SMSF Supervisory Levy 2025 Fees & Guidelines Australia

The ATO SMSF Supervisory Levy 2025 is a key regulatory fee that helps maintain compliance and oversight for Self-Managed Super Funds (SMSFs) in Australia. It supports the ATO’s efforts in monitoring funds, enforcing regulations, and guiding trustees. Understanding this levy is essential for SMSF trustees to manage their obligations efficiently and avoid penalties.

Continue readingTop 6 Payroll Processing Tips for Accountants in Australia

Payroll goes beyond salaries—it involves tax compliance, superannuation, and strict record-keeping. Errors can lead to ATO penalties and legal risks. This guide covers six essential payroll tips to help accountants navigate changing regulations, manage payroll taxes, and avoid common pitfalls. Stay ahead with expert insights for a smooth payroll process!

Continue reading2025 Financial Year Date in Australia with Planning Tips

Find out exact dates for 2025 to 2026 Financial Year Date in Australia, essential planning strategies, and crucial deadlines for businesses and individuals

Continue readingAre Superannuation Fees Tax Deductible in Australia 2025?

Not all superannuation fees are tax deductible, but knowing which ones are can save your SMSF money! Administration fees, investment costs, audit fees, and actuarial expenses are generally deductible, while setup costs and personal financial advice are not.

Continue readingSMSF Capital Gains Tax Rate, Accountants, Cost in Australia

Wondering about SMSF capital gains tax in Australia? Learn tax rates, CGT discounts, and strategies to reduce CG tax on superannuation and SMSF property.

Continue reading