Top 6 Payroll Processing Tips for Accountants in Australia

- Aesha Shah

- February 28, 2025

- 5 minutes

- Blogs

Australian Payroll Processing Tips for Accountant

Payroll is more than just paying employees—it involves tax compliance, superannuation contributions, and record-keeping obligations. Errors in payroll processing can lead to ATO penalties, employee dissatisfaction, and legal issues.

Common Challenges in Australian Payroll Processing

- Changing regulations:

Minimum wage updates, Fair Work compliance, and Single Touch Payroll (STP) requirements. - Superannuation obligations:

Ensuring correct Superannuation Guarantee (SG) contributions. - Payroll tax complexities:

Different thresholds apply across Australian states. - Employee misclassification:

Incorrectly categorising contractors vs. employees can lead to compliance issues.

How This Blog Helps

This guide outlines six essential payroll tips to help accountants stay compliant, work more efficiently, and reduce payroll errors.

If you’re an accountant managing payroll for clients, whether in-house or through an online payroll service, you know that keeping up with changing regulations and payroll tax rules is a never-ending task. But don’t worry! We’ve got six practical tips to help you stay on top of your payroll game and ensure a smooth monthly payroll cycle.

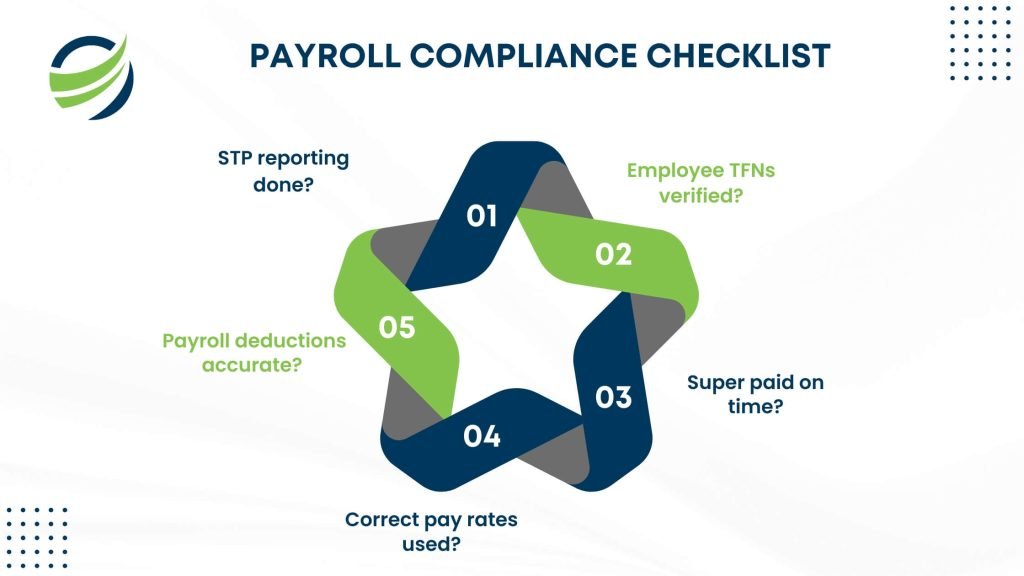

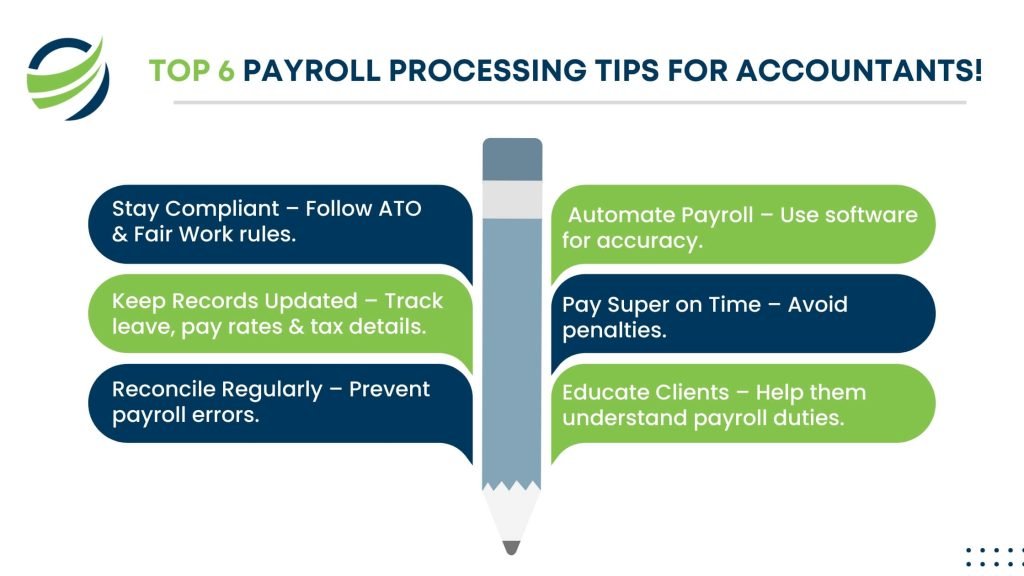

1. Stay Up to Date with Payroll Compliance

One of the biggest challenges with payroll processing in Australia is staying compliant with the ATO and Fair Work Ombudsman regulations. Wage rates, tax rules, and reporting obligations change frequently, and missing an update can land you in hot water.

Here’s how to stay compliant:

- Regularly check the Fair Work Ombudsman website for updates on minimum wage and award changes.

- Ensure all employees receive the correct tax and superannuation contributions.

- Use ATO-compliant payroll software that auto-updates with regulatory changes.

Pro tip: If managing multiple clients, working with an outsourcing payroll provider can help ensure compliance across different industries without missing critical updates.

2. Master Single Touch Payroll (STP) Reporting

By now, we all know that Single Touch Payroll (STP) reporting is mandatory for businesses in Australia. Every time you process payroll, you must report wages, PAYG withholding, and superannuation directly to the ATO. Sounds simple, right? Well, not always.

To ensure smooth STP reporting:

- Use STP-enabled payroll software for automated reporting.

- Double-check tax and super calculations before submission.

- Reconcile payroll reports monthly to avoid end-of-year headaches.

If you’re working with an online payroll service or a payroll processing company, make sure they handle STP reporting correctly so your clients remain compliant.

3. Superannuation and Payroll Tax: Get It Right

Superannuation might seem straightforward—pay 11% (as of 2024) of an employee’s ordinary earnings into their super fund. But when payments are late or incorrectly calculated, employers face hefty penalties.

Tips to avoid superannuation headaches:

- Always pay super contributions on time—quarterly deadlines apply.

- Use payroll software that tracks SuperAnnuation obligations and flags errors.

- If your client’s payroll exceeds the state-specific payroll tax threshold, ensure they’re registered for payroll tax.

Payroll tax is another area accountants need to monitor. It varies by state, with different thresholds and rates, so if a business expands, its obligations might change. Partnering with professional payroll services can help ensure compliance as businesses scale.

4. Classify Employees Correctly & Manage Leave Properly

Misclassifying an employee as a contractor can lead to unpaid entitlements, backpay claims, and legal trouble. Similarly, incorrectly managing leave entitlements can create employee disputes.

How to get it right:

- Clearly differentiate between employees and contractors based on ATO guidelines.

- Track annual leave, sick leave, and long service leave in payroll records.

- Ensure Modern Award entitlements, overtime pay, and penalty rates are applied correctly.

- If handling payroll for multiple businesses, consider using outsourced payroll services to ensure compliance across different industries and streamline your clients’ payroll management.

5. Use ATO-Compliant Payroll Software

Manual payroll processing is a thing of the past. Using outdated or non-compliant payroll software increases the risk of mistakes, missing STP reports, and payroll tax miscalculations.

What makes a great payroll system?

- ATO-compliant and STP-enabled.

- Automates tax and super calculations.

- Integrates with accounting software (like Xero, MYOB, QuickBooks).

- Tracks leave, overtime, and super payments.

If you’re juggling multiple clients, investing in online payroll services can save time and minimise compliance risks. Many businesses also consider hiring a payroll processing company to ensure payroll is handled efficiently without errors.

6. Plan for Payroll Year-End Processing

The end of the financial year (EOFY) is a stressful time for accountants, but if payroll is well-managed throughout the year, it doesn’t have to be a nightmare.

How to prep for EOFY payroll:

- Reconcile all payroll transactions before June 30.

- Review employee earnings, tax, and super contributions.

- Ensure all STP reports are finalised with the ATO by July 14.

- If applicable, issue payment summaries (though STP often replaces this).

Planning ahead helps businesses avoid ATO penalties and ensures employees receive accurate payment summaries and tax information.

Final Thoughts

Managing payroll can feel overwhelming, but when you break it down into these key areas—compliance, STP reporting, superannuation, employee classification, software use, and EOFY preparation—you can simplify the process and avoid common pitfalls.

If handling payroll feels like a full-time job (because, let’s be honest, it often is), many businesses turn to outsourced payroll solutions to lighten the load. Whether you’re using payroll software, hiring a payroll processing company, or running payroll manually, staying informed and organised is the key to getting payroll right every time.

By following these Australian payroll processing tips, you’ll not only keep payroll running smoothly but also ensure your clients stay compliant, avoid penalties, and maintain happy employees.

FAQs

1. What is a typical payroll cycle?

A monthly payroll cycle is the most common in Australia, where employees are paid once a month. However, some businesses use weekly or fortnightly cycles. The cycle includes collecting timesheets, calculating wages, deducting taxes, processing superannuation, and issuing payslips.

2. How long does paycheck processing take?

Paycheck processing time varies depending on the payroll system. Typically, online payroll services can process payments within one to two business days. However, businesses using manual payroll systems or outsourcing to a payroll processing company may experience a longer turnaround.

3. How to process payroll in Xero?

To process payroll in Xero, set up employee details, enter pay templates, and configure tax and superannuation settings. During each monthly payroll cycle, review hours worked, approve timesheets, and run payroll. Finally, submit Single Touch Payroll (STP) to the ATO and issue payslips.

4. How to improve payroll process?

Improving payroll efficiency involves automating calculations, ensuring compliance with payroll procedures and policies, and reducing manual data entry errors. Businesses can also outsource payroll services for small business to specialists, streamlining processes and improving accuracy.

5. What is end-to-end payroll processing?

End-to-end payroll processing Australia covers the entire payroll workflow—from employee onboarding and tax setup to paycheck disbursement, superannuation payments, compliance reporting, and record-keeping. This comprehensive approach ensures payroll accuracy and adherence to regulations.