Finance & Accounting Outsourcing Guide for Startups in Australia

- Aesha Shah

- September 22, 2025

- 5 minutes

- Blogs

For Australian founders, time often carries the same weight as capital. Every hour spent balancing books, reconciling accounts, or chasing overdue invoices is an hour not invested in building innovative products, strengthening customer relationships, or attracting investors.

With more than 98,000 startups, Australia has emerged as the seventh-largest startup hub globally as per StartupBlink, and in such a fast-paced ecosystem, founders simply cannot afford to lose focus on their core mission.

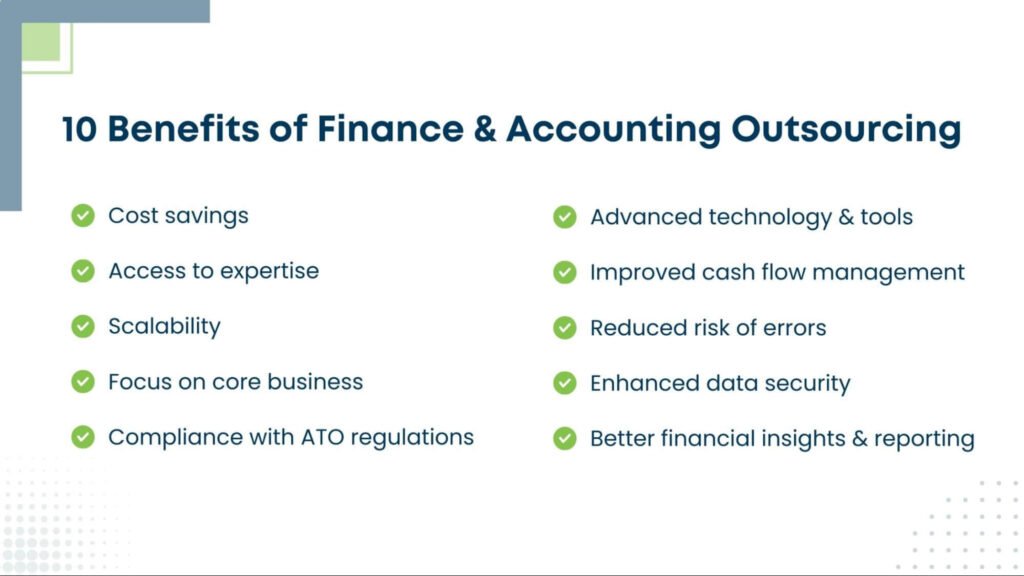

Outsourcing finance and accounting services offers a strategic advantage. By entrusting bookkeeping, compliance, and financial management tasks to specialised professionals, entrepreneurs can redirect their energy toward growth and innovation.

Outsourcing not only ensures accuracy and compliance but also delivers cost efficiency, helping startups remain agile and competitive in a market that demands both speed and precision.

How Finance and Accounting Outsourcing Saves Australian Startups Time and Money

For Australian startups, managing finances in-house can be both time-consuming and costly. By leveraging finance and accounting outsourcing for startups, founders gain access to specialised expertise, streamline compliance, improve cash flow management, and utilise advanced financial tools, all without the overhead of a full internal team.

Whether through local providers or trusted offshore partners, accounting outsourcing turns finance from a back-office task into a strategic growth advantage, allowing startups to focus on innovation, scale efficiently, and make smarter business decisions.

Cost Savings

Outsourcing finance and accounting can help startups manage costs efficiently:

- Lower overheads: No need to hire a full-time accountant, pay salaries, superannuation, or provide office space.

- Flexible service levels: Pay only for what you need, monthly bookkeeping, payroll processing, or quarterly reporting.

- Local or offshore options: Engage Australian firms or offshore providers of offshore outsourcing services in India, Vietnam, or the Philippines to access quality support at competitive rates.

- Scalable as you grow: Services can expand as the startup grows, making outsourced bookkeeping services a cost-effective long-term solution.

Access to Expertise

- Specialised knowledge: Startups gain access to qualified professionals who understand Australia’s tax and regulatory requirements, including GST and payroll obligations.

- Accurate compliance: Outsourced services ensure timely BAS lodgements, tax returns, and structured financial advice.

- Support for growth: Founders can focus on scaling their business with confidence, knowing their finances are managed by experts. Many outsourced bookkeeping companies in Australia now offer tailored solutions for startups, ensuring accuracy, scalability, and complete financial visibility from day one.

Scalability

- Flexible service levels: Accounting services can expand or contract based on the startup’s workload, from a few invoices to hundreds.

- No recruitment burden: Startups avoid hiring and training additional finance staff as their operations grow.

- Adaptable tools and processes: Cloud-based accounting and reporting systems adjust seamlessly to evolving business needs.

Market growth insight: The Australian bookkeeping and accounting outsourcing sector is projected to grow at an 8.8% CAGR from 2025 to 2030, reaching US$1,318.3 million according to ResearchAndMarkets, 2024, highlighting increasing adoption among startups.

Focus on Core Business

- Maximise productive time: Outsourcing finance and accounting allows founders to spend less time on chasing invoices or fixing spreadsheets.

- Strategic focus: Entrepreneurs can dedicate more energy to building products, engaging customers, and pitching investors.

- Reliable support: Startups receive consistent financial management from online specialists without losing focus on core business activities.

- Flexible collaboration: Services can be provided by local accounting teams or remote business outsourcing solutions, ensuring seamless integration with the startup’s operations.

Compliance with ATO Regulations

- Avoid costly penalties: Late BAS lodgements, GST reporting errors, or PAYG withholding mistakes can negatively impact a startup’s finances.

- Manage regulatory obligations: Outsourced services handle Single Touch Payroll (STP) reporting, superannuation guarantee contributions, and other ATO requirements.

- Expert oversight: Professional financial compliance services ensure accuracy and compliance across all reporting areas.

- Peace of mind for founders: Startups can focus on growth while trusting that financial regulations are met without errors or delays.

Advanced Technology & Tools

- Access to premium software: Partnering with the right outsourcing firms provides startups with best-in-class accounting technology without the high implementation costs.

- Automation & efficiency: Tools like Xero, QuickBooks, Zoho Books, Wiise, and NetSuite automate reconciliation, integrate bank feeds, and offer cloud-based dashboards to reduce manual work and improve accuracy.

- Real-time visibility: Founders gain instant insights into invoicing, payroll, and reporting, enabling faster and more informed decision-making.

Improved Cash Flow Management

- Monitor working capital: Outsourced accountants track payables and receivables to identify potential cash shortfalls early.

- Maintain liquidity: Regular monitoring helps startups manage late payments, operating costs, and tax obligations efficiently.

- Financial stability: Enables founders to make timely decisions and maintain steady cash flow.

Reduced Risk of Errors

- Qualified oversight: Professionals handle payroll, GST, and expense coding to minimize mistakes.

- Accurate records: Reduce audit issues and ensure reliable financial statements.

- Less founder burden: Founders can focus on growth instead of correcting bookkeeping errors.

Enhanced Data Security

- Robust systems: Outsourcing firms use multi-factor authentication, encrypted storage, and secure cloud access.

- Protect sensitive data: Startups benefit from enterprise-level security measures that are often too costly to implement in-house.

- Reduced risk: Mitigates the chance of costly data breaches.

Better Financial Insights & Reporting

- Actionable analysis: Outsourced teams provide monthly or quarterly reports that go beyond filing, helping founders understand burn rates, margins, and profitability.

- Strategic decisions: Financial insights are translated into actionable strategies for growth.

- Informed planning: Founders can make smarter, data-driven business decisions with clarity and confidence.

What Services Startups Are Outsourcing

Startups can leverage finance and accounting outsourcing services and outsourced CFO services for a range of critical tasks, including:

- Bookkeeping: Maintaining accurate and up-to-date financial records.

- Tax Filing and Compliance: Ensuring timely and precise tax returns while meeting regulatory requirements.

- Financial Reporting and Forecasting: Delivering actionable insights into financial health and future projections.

- Payroll Management: Managing payroll processing, including tax deductions and outsourced payroll services.

- Audit Support and Risk Management: Assisting with audits and identifying potential financial risks.

- Strategic Finance Leadership: Through outsourced CFO services, startups gain access to high-level financial planning, fundraising support, and investor-ready reporting without hiring a full-time CFO.

By outsourcing these essential functions, startups can ensure their finances are expertly managed while focusing on growth, innovation, and core business objectives.

Choosing the Right Provider

Experience and expertise: Select finance outsourcing companies with proven knowledge in startups and compliance.

Service offerings: Ensure they provide comprehensive support, from bookkeeping to outsourced CFO services and strategic forecasting.

Technology integration: Use firms that leverage cloud-based tools and automation.

Scalability and flexibility: The provider should adapt services as the startup grows.

Reputation and support: Check client reviews and responsiveness to ensure reliable collaboration.

Conclusion

For Australian startups, managing finances in-house can be time-consuming, costly, and prone to errors. Finance and accounting outsourcing for startups offers a strategic solution, providing access to expert knowledge, advanced tools, and scalable services that allow founders to focus on growth and innovation.

From bookkeeping and payroll to tax compliance and financial reporting, outsourcing transforms accounting into a growth enabler rather than a burden.

By partnering with trusted providers like NCS Australia, startups can ensure their financial operations are accurate, compliant, and efficient.

With the right outsourced support, businesses can streamline processes, improve cash flow, reduce risks, and gain insights that drive smarter, data-backed decisions, empowering founders to concentrate on building their vision and scaling their startup successfully.