2025 BAS Due Dates: Lodgment & Payment in Australia

As businesses in Australia prepare for the upcoming financial year, understanding the intricacies of the Business Activity Statement (BAS) is essential for maintaining compliance with the Australian Taxation Office (ATO). The BAS serves as a critical tool for reporting Goods and Services Tax (GST), Pay As You Go (PAYG) withholding, and other tax obligations. This document is not only vital for compliance but also plays a significant role in effective cash flow management and strategic financial planning.

Navigating the 2025 BAS due dates is crucial for businesses of all sizes, as timely lodgment and payment can prevent costly penalties and ensure smooth operational processes. In this comprehensive guide, we will delve into the key BAS statement due dates, explore the implications of late submissions, and provide practical tips for successful BAS management.

Whether your business lodges monthly or quarterly, staying informed about the due dates will empower you to handle your financial reporting efficiently.

Understanding BAS

The Business Activity Statement (BAS) is a form that businesses use to report their tax obligations, primarily concerning GST and PAYG withholding. Understanding how the BAS works is essential for proper compliance and effective financial management.

Key Components of BAS

- GST: The Goods and Services Tax is a value-added tax on most goods and services sold or consumed in Australia. Businesses must report the GST they collect from customers and the GST they pay on purchases. This ensures that the tax is correctly accounted for within the supply chain.

- PAYG Withholding: This system requires businesses to withhold a portion of tax from payments made to employees and contractors, which is then remitted to the ATO. Ensuring accurate calculations and timely remittance is crucial for maintaining compliance.

- Other Obligations: Depending on the nature of the business, there may be additional reporting requirements, such as luxury car tax or wine equalisation tax. Understanding these obligations is essential to avoid penalties.

Businesses can choose to submit their BAS monthly or quarterly based on their GST turnover. Smaller businesses typically opt for quarterly lodgment, which can ease the administrative burden and allow more time for cash flow management.

Importance of Meeting BAS Due Dates

Meeting the BAS statement due dates is crucial for several reasons:

- Avoiding Penalties: Failing to lodge your BAS on time can result in significant penalties. The ATO imposes late lodgment penalties, which can accumulate over time, impacting your business’s financial health.

- Cash Flow Management: Timely BAS lodgment and payments help businesses manage their cash flow more effectively. Knowing when your obligations are due allows you to plan your finances accordingly.

- Compliance: Staying compliant with ATO regulations fosters a good relationship with the tax authority, reducing the likelihood of audits or other investigations. A strong compliance record can also enhance your business reputation.

- Accurate Financial Reporting: Regularly submitting BAS helps maintain accurate financial records, making it easier to track your business’s performance and make informed decisions.

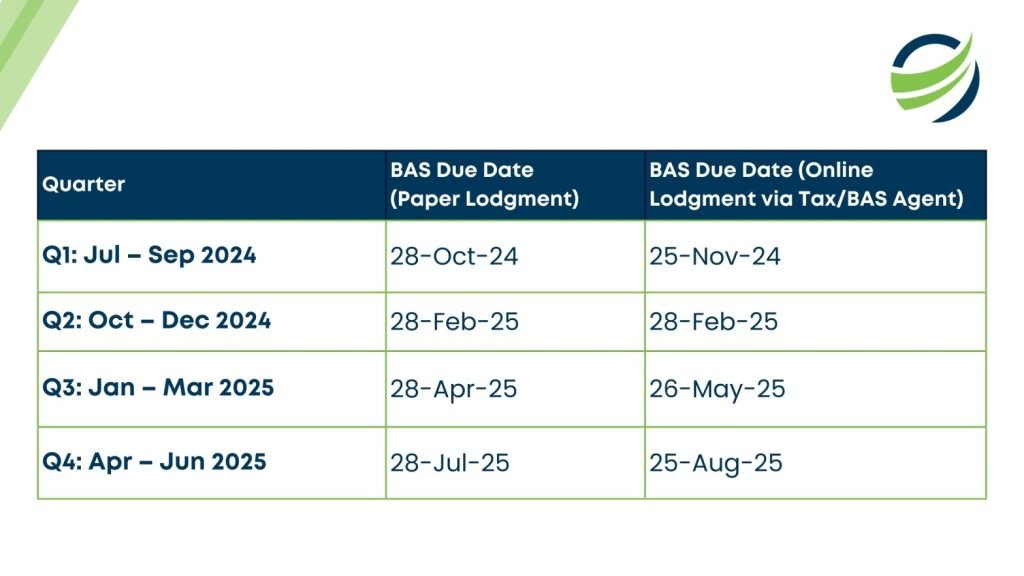

2025 BAS Due Dates Overview

For businesses operating in Australia, the 2025 BAS due dates for lodgment and payment are as follows:

Monthly BAS Lodgment and Payment Dates

Businesses that lodge their BAS monthly have specific due dates each month. The due date for lodgment and payment is the 21st day of the following month. Below are the BAS lodgement dates 2025 for monthly lodgers:

- January 2025: Lodgment and payment due by February 21, 2025

- February 2025: Lodgment and payment due by March 21, 2025

- March 2025: Lodgment and payment due by April 21, 2025

- April 2025: Lodgment and payment due by May 21, 2025

- May 2025: Lodgment and payment due by June 21, 2025

- June 2025: Lodgment and payment due by July 21, 2025

- July 2025: Lodgment and payment due by August 21, 2025

- August 2025: Lodgment and payment due by September 21, 2025

- September 2025: Lodgment and payment due by October 21, 2025

- October 2025: Lodgment and payment due by November 21, 2025

- November 2025: Lodgment and payment due by December 21, 2025

- December 2025: Lodgment and payment due by January 21, 2026

Quarterly BAS Lodgment and Payment Dates

For businesses that lodge their BAS quarterly, the due dates are as follows:

- 1st Quarter (July – September 2025): Lodgment and payment due by October 28, 2025

- 2nd Quarter (October – December 2025): Lodgment and payment due by January 28, 2026

- 3rd Quarter (January – March 2026): Lodgment and payment due by April 28, 2026

- 4th Quarter (April – June 2026): Lodgment and payment due by July 28, 2026

Preparing for BAS Lodgment

Maintain Accurate Records

Accurate record-keeping is the backbone of effective BAS management. Here are some best practices to ensure your records are in order:

- Daily Tracking: Implement a system for daily tracking of sales and expenses. This could be as simple as using an Excel spreadsheet or as sophisticated as a dedicated accounting software package.

- Digital Receipts: Utilise digital tools to store receipts and invoices. Many accounting software solutions allow you to upload and categorise receipts for easy reference during BAS preparation.

- Regular Reconciliation: Schedule regular intervals for reconciling your accounts. This ensures that any discrepancies are caught early, reducing the risk of errors in your BAS.

Utilise Accounting Software

Investing in reliable accounting software can simplify the BAS process significantly. Look for software that offers:

- GST Tracking: Automatic calculations of GST collected and paid, ensuring compliance with ATO regulations.

- Integration: Compatibility with your existing financial systems and bank feeds to streamline data entry and reduce manual errors.

- Reporting Features: The ability to generate BAS reports quickly and accurately, saving time and minimising stress during lodgment periods.

- User-Friendly Interface: A platform that is intuitive and easy to navigate will help you and your team manage finances more effectively.

Engage a Tax Professional

For businesses that find the BAS process overwhelming, consulting with a tax professional can provide invaluable support. A qualified accountant can ensure that your BAS is accurately prepared and submitted on time, reducing the risk of errors and penalties.

When choosing a tax professional, consider the following:

- Experience: Look for professionals with experience in your industry and familiarity with BAS requirements.

- Reputation: Seek recommendations and reviews from other businesses to gauge the reliability and expertise of the accountant.

- Accessibility: Choose someone who is approachable and willing to communicate regularly about your financial matters.

Common Mistakes to Avoid

- Missing Due Dates: One of the most common mistakes businesses make is failing to keep track of BAS payment due dates 2025. Setting reminders in advance can help mitigate this risk. Consider using calendar apps or task management tools to alert you before the due dates arrive.

- Inaccurate Reporting: Errors in reporting can lead to audits and penalties. It is crucial to double-check all figures before submission. Small mistakes can have significant implications, so take extra care when entering data.

- Neglecting GST Changes: GST laws and regulations can change, impacting how businesses calculate their tax obligations. Staying informed about any changes is essential to ensure compliance. Subscribe to updates from the ATO or consult with a tax professional to keep your knowledge current.

- Overlooking Deductions: Many businesses fail to claim all eligible GST credits. Ensure you are aware of what can be claimed and keep all necessary documentation for purchases that include GST.

- Inconsistent Record-Keeping: Inconsistent or irregular record-keeping can lead to confusion and errors during BAS preparation. Establish a routine for maintaining records, and stick to it.

Additional Considerations

GST Registration:

If your business has a turnover of $75,000 or more, you must register for GST. Ensure that you are registered well ahead of the BAS lodgment dates to avoid complications. Once registered, you are required to include GST in your pricing and charge it on your sales, which must also be reported in your BAS.

Payment Options:

The ATO offers various payment options for BAS, including:

- Direct Debit: Setting up direct debit allows the ATO to automatically withdraw the amount owed from your nominated bank account on the due date. This option helps prevent late payments.

- Credit Card: The ATO accepts credit card payments for BAS, but be aware of any transaction fees that may apply. This method can be convenient if you prefer to manage payments online.

- BPAY: BPAY allows you to pay your BAS through your bank’s online banking platform. Make sure to enter the correct BPAY biller code and reference number to ensure your payment is attributed correctly.

- Cheque: While less common in recent years, businesses can still send a cheque for BAS payment. Ensure that your cheque is mailed well in advance to allow for processing time.

Conclusion

Understanding the 2025 BAS due dates is essential for maintaining compliance and ensuring the financial health of your business. By preparing in advance and staying organised, you can avoid penalties and manage your cash flow effectively. Whether you choose to lodge monthly or quarterly, keeping track of BAS statement due dates, utilising accounting software, and possibly engaging a tax professional or exploring outsourced BAS services can help simplify the BAS process.

As the financial landscape continues to evolve, staying informed and proactive about your BAS obligations will empower your business to thrive in 2025 and beyond. Remember, the key to successful BAS management lies in understanding the deadlines, maintaining accurate records, and ensuring timely submissions.

The combination of diligent preparation, effective use of technology, and professional guidance can lead to a streamlined BAS process, allowing you to focus on what matters most—growing your business.