2025 Top Superannuation Tax Benefits in Australia

- Aesha Shah

- May 29, 2025

- 6 minutes

- Blogs

When it comes to planning for retirement in Australia, superannuation is one of the most tax-effective ways to build long-term financial security. With the right strategies and a clear understanding of the superannuation system, you can maximise valuable tax benefits and watch your retirement savings grow.

In 2025, a few key changes and ongoing rules continue to make super an attractive place to park your retirement savings. Whether you’re employed, self-employed, or running your own SMSF, there are ways to make your super work better for you. Let’s explore how.

Why Superannuation Offers Tax Benefits in the First Place

Superannuation was designed with incentives built in to encourage Australians to save for their retirement. These incentives come in the form of superannuation tax benefits, which reward people who regularly contribute to their super fund and follow the guidelines set by the ATO.

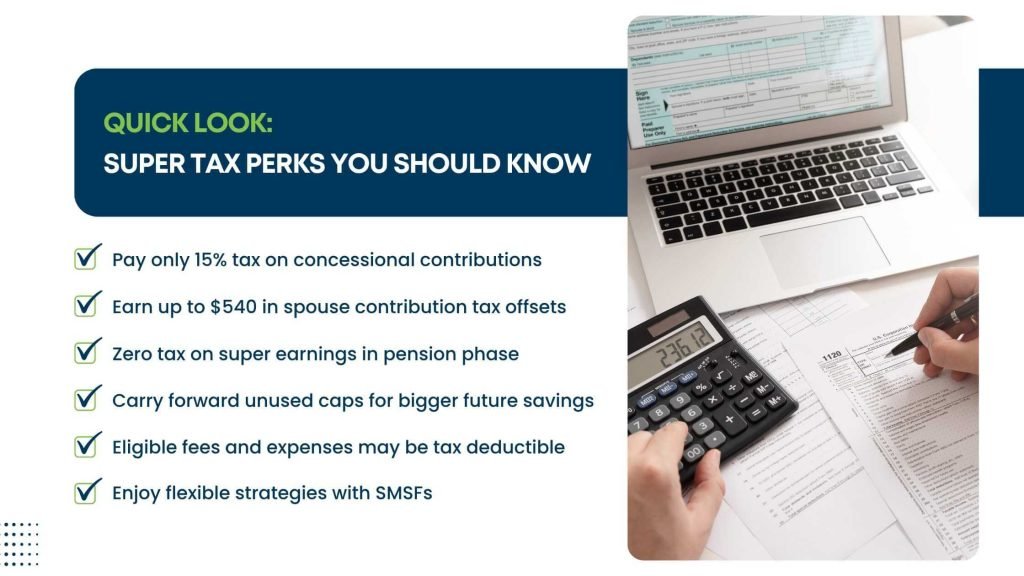

The three main areas where these tax benefits show up are:

- Tax savings on contributions (both before and after-tax),

- Reduced tax on investment earnings inside the fund, and

- Tax-free withdrawals once you meet certain retirement conditions.

Boosting Your Super with Concessional Contributions

One of the most common and effective strategies is making concessional contributions. These are before-tax contributions and include employer Super Guarantee payments and extra amounts you put in through salary sacrifice superannuation arrangements.

The big tax benefit here?

These contributions are taxed at just 15% inside your super fund. If your marginal tax rate is higher than that (which it often is), this can lead to meaningful savings. As of 1 July 2025, the concessional contributions cap has increased to $30,000 for all individuals, regardless of age.

This higher cap gives Australians more room to grow their retirement savings using before-tax income, while enjoying the benefit of a flat 15% tax rate on those contributions. You can also carry forward any unused portion of this cap for up to five years, provided your total super balance is under $500,000.

This rule is beneficial for anyone who has had inconsistent income or paused contributions in previous years. It gives you a chance to catch up and enjoy the tax deduction for super contributions you may have missed out on.

.

The Power of Non-Concessional Contributions

Then there are non-concessional contributions, which are made from after-tax income. These don’t reduce your taxable income, but they do allow you to contribute more into super without paying additional tax on the way in.

In 2025, the cap for non-concessional contributions is $120,000 per year. Under the bring-forward rule, you may be able to contribute up to $360,000 over three years, depending on your age and total super balance. This can be a useful option if you’ve received a windfall, like an inheritance or a large business sale, and want to move it into a more tax-friendly environment.

The Low-Income Super Tax Offset (LISTO)

If you earn less than $37,000 a year, the government offers the low income super tax offset (LISTO). This offset refunds up to $500 into your super to compensate for the 15% tax paid on concessional contributions.

In short, it ensures lower-income earners aren’t penalised for saving through super. It’s automatic; you don’t need to apply, but you must ensure your fund has your tax file number to receive the payment.

The Role of Spouse Contributions and Tax Offsets

Another way to enjoy superannuation tax benefits is by contributing to your spouse’s super. If your spouse earns less than $37,000, you could be eligible for a tax offset of up to $540 when you contribute at least $3,000 to their fund. The offset reduces as your spouse’s income exceeds $37,000 and is completely phased out once their income reaches $40,000.

This can help grow both partners’ retirement balances, especially in cases where one person has taken time off work or is working part-time.

Tax-Effective Investment Earnings

While your super fund is in the accumulation phase, investment earnings are taxed at a flat 15%. For capital gains on assets held for more than 12 months, the effective tax rate is even lower, just 10%.

Once you enter the retirement or pension phase, the tax rate on earnings within your super fund drops to 0%. That’s right, any income your fund earns on investments is tax-free during this stage. This is one of the most powerful superannuation tax benefits, especially when compared with how your personal investments outside of super are taxed.

Tax Deductions for Self-Employed and SMSF Members

If you’re self-employed or running your own business, you can still claim a tax deduction for super contributions. This applies even if you don’t have an employer contributing on your behalf. Just make sure you submit a Notice of Intent to claim the deduction and keep within the concessional cap.

For those managing their own fund, SMSFs offer flexibility and control, but also bring rules around contributions and expenses. That’s why many trustees now consider outsourced SMSF services in Australia to handle administration, compliance, and reporting requirements more efficiently.

You can claim deductions for investment advice costs, administration and audit fees, life insurance premiums (if paid through super), and other eligible fund expenses.

If you’re wondering whether costs like SMSF setup costs are deductible, the ATO’s general rule is: if the cost relates to earning assessable income within the fund, it may be deductible. Setup costs are generally not deductible, but ongoing admin and accounting fees often are.

SMSF trustees can also be reimbursed for out-of-pocket expenses related to fund management, provided proper records are kept. This is referred to as SMSF reimbursement of expenses and must follow ATO compliance guidelines.

Thinking About a Transition-to-Retirement Strategy

If you’re over 60 but not ready to retire fully, you might consider a transition-to-retirement (TTR) strategy. This allows you to draw down some of your super as income while still working.

The tax advantages come in two forms:

- The income stream is taxed at a lower rate or not at all if you’re over 60.

- Your super balance can still receive concessional contributions from your employer or salary sacrifice.

It’s a great way to reduce working hours without compromising your income, and enjoy continued superannuation tax benefits.

Are You Managing Your Super the Hard Way?

Many Australians don’t realise how much admin is involved in making the most of their super. Keeping up with changing caps, tax rulings, or even just making sure fees are reasonable can be time-consuming.

That’s where a little help goes a long way.

For example, managing an SMSF means you need to understand tax law, stay compliant, and document expenses correctly. Outsourcing to professionals, whether for accounting support or compliance checks, can help you make sure you’re not missing out on any superannuation tax benefits simply because of oversight.

For time-poor professionals, business owners, or retirees who just want peace of mind, having an expert look after the finer details of your super can save time and potentially money.

Final Thoughts: Super’s Tax Edge in 2025

Superannuation remains one of the smartest, most tax-effective savings tools available in Australia. Something to keep in mind: from 1 July 2025, the federal government plans to introduce an additional 15% tax on earnings for superannuation balances exceeding $3 million.

According to News.com.au, this change is expected to affect around 80,000 individuals, or 0.5% of Australians, based on Treasury estimates. While it impacts a small group, it’s an important consideration for high-net-worth individuals managing large super balances.

In summary, here are some key actions to consider:

- Maximise your concessional contributions within the cap

- Use the non-concessional contributions cap if you have additional funds

- Take advantage of government offsets if you’re eligible

- Review SMSF expenses and understand what’s deductible

- Get advice if you’re unsure where to start or if you’re missing out on potential savings

In a world of complex rules and evolving tax policies, financial services outsourcing is becoming a smart move for individuals and businesses looking to stay compliant while maximising tax advantages. Your future self will thank you.