Key Self Managed Super Fund Rules and Regulations

- Aesha Shah

- April 15, 2025

- 6 minutes

- Blogs

Key Self Managed Super Fund Rules and Regulations

Self Managed Super Funds (SMSFs) offer an unparalleled level of control and flexibility in how Australians manage their retirement savings. However, this autonomy is tightly governed by a comprehensive framework of legislation, obligations, and oversight mechanisms.

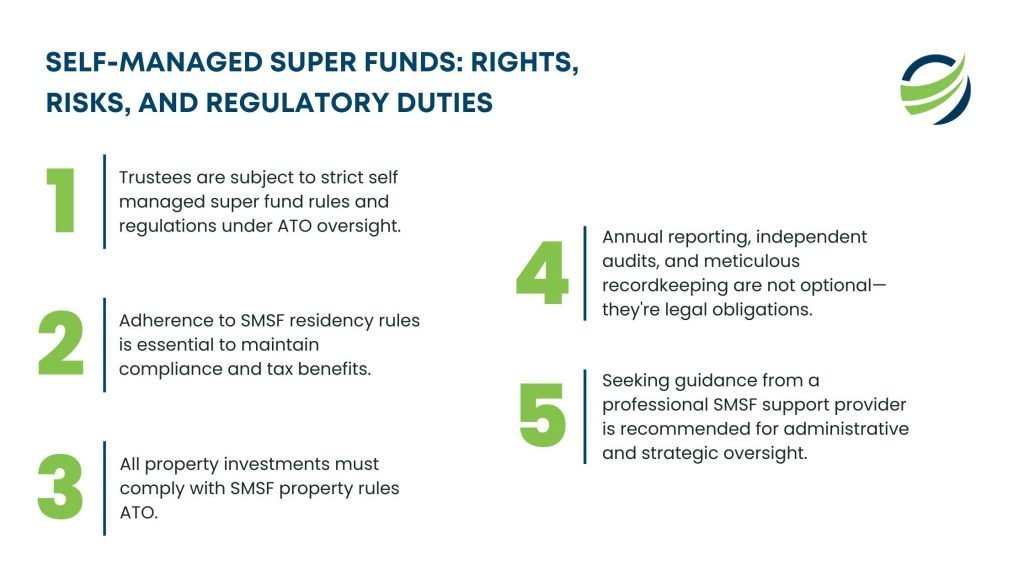

Understanding the self managed super fund rules and regulations is not optional—it is a legal obligation. Trustees who fail to comply risk not only the fund’s concessional tax status but also personal liability for breaches.

This article outlines the critical compliance and governance requirements every SMSF trustee needs to be across—from trustee obligations and investment rules to tax compliance and residency tests.

The Foundation: What an SMSF Is and How It Operates

An SMSF is a trust structure that allows individuals to manage their own superannuation. It can have up to six members, and all members must be either individual trustees or directors of a corporate trustee. Regardless of structure, trustees hold full legal responsibility for managing the fund in accordance with the rules for self managed super funds as set out in the Superannuation Industry Supervision Act 1993 (SIS Act).

Key obligations include:

- Acting in the best interests of all members

- Ensuring the fund is maintained for the sole purpose of providing retirement benefits

- Complying with all ATO reporting, tax, and audit requirements

- Managing the fund’s investments according to a documented strategy

Trustee Obligations: More Than a Title

Being a trustee is not symbolic—it comes with substantial fiduciary duties. Upon becoming a trustee, each individual must sign the ATO’s Trustee Declaration to confirm their understanding of the responsibilities. These include:

- Keeping accurate and timely records

- Lodging annual returns

- Appointing an approved auditor

- Reviewing and maintaining an appropriate investment strategy

- Staying informed of changes in smsf rules and regulations

Failure to meet these obligations can lead to administrative penalties, disqualification, or even civil or criminal sanctions in cases of severe breaches.

Contribution and Benefit Payment Rules

Trustees must understand how contributions are regulated within an SMSF. Contributions fall into two categories: concessional (before-tax) and non-concessional (after-tax). Each has annual caps that must be observed to avoid excess contribution taxes.

Trustees must also observe preservation rules—super benefits generally cannot be accessed until members reach their preservation age and meet a condition of release. Once benefits commence, especially through a pension phase, additional minimum drawdown requirements apply annually.

Investment Governance: Strategy, Risk, and Restrictions

An SMSF must have a documented investment strategy that outlines:

- Risk tolerance for each member

- Diversification of assets

- Liquidity needs and the ability to pay benefits

- Insurance considerations for members

The strategy must be reviewed regularly and updated as necessary, particularly after changes in market conditions or fund membership.

There are strict rules around the types of investments an SMSF can hold. While the fund can invest in assets like shares, property, and managed funds, all investments must comply with the sole purpose test, which ensures the fund exists only to provide retirement benefits to its members.Developing and maintaining an investment strategy that meets all regulatory requirements often calls for professional smsf support, especially when the fund holds diverse or complex assets.

Real Property and Borrowing: Navigating the ATO’s Framework

SMSF investment in property is common but tightly regulated. The smsf property rules ATO sets out are specific and non-negotiable. Key points include:

- Property purchased must be for investment purposes, not personal use

- The fund cannot rent residential property to related parties unless the property is classified as business real property

- Any borrowing arrangement to acquire property must comply with Limited Recourse Borrowing Arrangement (LRBA) provisions

An LRBA allows an SMSF to borrow to purchase a single asset (or a collection of identical assets with the same market value), but the asset must be held in a separate trust until the loan is repaid.

These transactions must be executed at arm’s length—if the terms of the arrangement would not occur in a commercial setting, the ATO may deem the income from that asset to be non-arm’s length income (NALI), which is taxed at the highest marginal rate.

Maintaining Compliance: Reporting and Audit Obligations

Every SMSF must lodge an annual return with the ATO, which includes:

- Financial statements

- Member contributions

- Asset valuations at market value

- Investment income and expenses

- Tax calculations

- Auditor’s report

An independent auditor must be appointed at least 45 days before the annual return is due. The auditor reviews both the financial statements and the fund’s compliance with smsf rules and regulations.

The ATO also expects SMSFs to keep meticulous records for at least five to ten years, depending on the type of document.Many trustees choose to work with an smsf administration service provider to manage reporting, annual returns, and auditor coordination—freeing up their time while ensuring compliance.

SMSF Residency Rules: An Often Overlooked Risk

The smsf residency rules are critical, particularly for trustees planning to live or work overseas temporarily. For an SMSF to remain compliant, it must satisfy three residency conditions:

- Established in Australia or at least one asset located in Australia.

- Central management and control must ordinarily be in Australia.

- Active member test – if the fund has active members contributing, the majority of those members must be Australian residents.

Temporary absences are allowed, but if central control shifts offshore for an extended period, the fund could become non-compliant and lose its concessional tax status. This is an area where trustees often slip up unintentionally.

Taxation: Rates, Deductions, and Penalties

Compliant SMSFs benefit from a concessional tax rate of 15% on investment income. Capital gains on assets held longer than 12 months are taxed at an effective rate of 10%. Once a member enters the retirement phase and begins drawing a pension, earnings on those assets can become tax-free.

However, breaches such as operating at non-arm’s length or acquiring prohibited assets from related parties can trigger NALI, taxed at 45%. Other penalties include administrative fines, disqualification of trustees, or freezing of SMSF bank accounts.

Trustees must also be aware of:

- Division 293 tax on high-income earners.

- Superannuation transfer balance caps.

- Reporting of events such as rollovers, pension commencements, and LRBA repayments.

Winding Up an SMSF: A Final but Formal Process

Winding up an SMSF must be done in accordance with ATO guidelines. It involves:

- Finalising outstanding tax obligations

- Paying out or rolling over all member balances

- Appointing an auditor for final accounts

- Lodging final returns with the ATO

- Cancelling the fund’s ABN and closing bank accounts

Even if a fund holds no assets or members decide to consolidate elsewhere, the compliance process must be completed properly to avoid long-term issues.

Final Word: Control Requires Commitment

Running an SMSF is not a “set and forget” financial decision. It demands continuous attention to compliance, documentation, and fiduciary care. While the appeal of control, flexibility, and tax concessions is understandable, trustees must fully grasp the self managed super fund rules and regulations that apply.

Whether it’s adhering to smsf property rules ATO provisions, understanding smsf residency rules, or keeping pace with evolving smsf rules and regulations, informed trustees are the cornerstone of a compliant and successful SMSF.

For those unsure about meeting all these obligations, engaging an outsourced smsf advisor can provide clarity and direction while ensuring the fund remains compliant.