A Complete Guide to SMSF Administration and Compliance in Australia 2025

- Aesha Shah

- September 17, 2025

- 5 minutes

- Blogs

Managing a self-managed super fund (SMSF) is both empowering and demanding. Trustees gain greater control over retirement strategies, but they also carry the burden of meeting strict regulatory expectations.

With the Australian Taxation Office (ATO) intensifying its focus on compliance, robust SMSF administration and compliance processes are now essential to safeguard members’ wealth and avoid costly penalties.

The sector continues to grow, with more than 653,000 SMSFs and over $1 trillion in assets under management as of June 2025, highlighting the importance of accurate record-keeping, reporting, and audits.

For trustees and self-managed super fund administrators, this means ensuring every detail, from contributions to investment reporting, aligns with regulatory standards.

NCS Australia’s guide explores administration best practices, compliance obligations, and how outsourcing solutions can help trustees and firms stay efficient, scalable, and fully audit-ready in 2025.

Why Compliance Has Become Non-Negotiable for SMSFs in 2025

- Tighter ATO scrutiny: The ATO has intensified its oversight of SMSFs, with a greater focus on trustee behaviour, timely lodgments, and investment compliance.

- Penalties for non-compliance: Administrative penalties for breaches such as late reporting, loans to members, or record-keeping failures can be significant. In severe cases, trustees risk having their funds disqualified.

- Growing regulatory pressure: Accurate SMSF administration and compliance are essential not only for meeting deadlines but also for safeguarding trustee reputations and member retirement savings.

- Sector scale: As of June 2025, there are 653,062 SMSFs with over $1.05 trillion in assets, representing around 28% of total superannuation assets in Australia.

- Industry-wide responsibility: With SMSFs holding such a large share of retirement wealth, even small compliance failures can have wider implications for confidence in the system.

Core SMSF Administration Tasks Every Fund Must Manage

Effective administration is the foundation of a compliant SMSF. Trustees and advisers rely on accurate processes to ensure that every transaction and obligation is accounted for throughout the financial year. High-quality SMSF administration services typically cover:

- Record-keeping: Maintaining accurate documentation of all trustee decisions, member contributions, investment purchases, and fund expenses.

- Contributions and rollovers: Tracking contributions against annual caps, managing rollovers between funds, and ensuring compliance with contribution rules.

- Pension calculations: Accurately calculating pension payments and minimum drawdowns to meet both member needs and ATO requirements.

- Tax compliance: Preparing and lodging the SMSF annual return, including income tax, CGT, and regulatory information.

- TBAR and SuperStream reporting: Meeting real-time reporting requirements for transfer balance caps and complying with the electronic data standards for contributions and rollovers.

- Investment reconciliation: Matching investment records against bank statements to ensure valuations and reporting are accurate.

- Financial statements and lodgement: Preparing financial accounts and coordinating timely lodgement with the ATO to avoid penalties.

By managing these tasks consistently and correctly, trustees can ensure their SMSFs remain compliant while also creating a clear foundation for audits and long-term investment strategies.

For trustees and self-managed super fund administrators, following these core tasks ensures the SMSF remains compliant and audit-ready throughout the year.

Key SMSF Compliance Requirements & Reporting (what trustees must do)

- Auditor appointment & annual audit: Trustees must appoint an approved SMSF auditor at least 45 days before the annual return is due. The audit must be completed each year, and any contraventions must be reported to the ATO.

- SMSF Annual Return (SAR): The annual return must be lodged on time (e.g., 31 October for many funds, with extensions via tax agents). Late lodgement affects fund status and rollovers.

- Trustee responsibilities: Trustees must act in members’ best interests, keep assets separate, and comply with SIS rules. Breaches can lead to penalties or disqualification.

- Documentation & evidence: Strong records, minutes, valuations, and transaction evidence are vital to meet audit and SMSF reporting requirements.

- Additional reporting (TBAR & SuperStream): Trustees must meet TBAR and SuperStream deadlines for contributions and rollovers or risk penalties.

- ATO & ASIC penalties: Non-compliance can result in administrative fines, loss of tax concessions, or trustee disqualification.

The Benefits and Risks of SMSF Outsourcing

Many trustees and firms rely on SMSF outsourcing services to handle the increasing complexity of administration and compliance. Outsourcing offers access to specialised expertise, improved efficiency, and audit readiness.

It also allows firms to scale resources during peak lodgement periods, helping trustees stay on top of reporting deadlines while focusing on investment decisions.

That said, choosing to outsource SMSF administration comes with risks. Sensitive financial data must be safeguarded, and poor vendor selection can lead to errors or compliance breaches.

Partnering with experienced self-managed super fund administrators or choosing to outsource SMSF administration can provide trustees with both expertise and peace of mind.

SMSF Compliance Audits — What Auditors Look For

During SMSF compliance audits, approved auditors typically examine:

- Trustee meeting minutes – to confirm decisions are properly documented.

- Investment strategy – ensuring it is in place, reviewed regularly, and aligned with members’ retirement goals.

- Arm’s-length transactions – checking that all dealings are conducted on commercial terms.

- Contribution caps – verifying contributions comply with ATO limits.

- Segregated assets – ensuring fund assets are kept separate from trustees’ personal or business assets.

- Supporting evidence – Such as valuations, contracts, and transaction records, to validate compliance.

Auditors are required under ATO and ASIC guidance to report any contraventions, which can lead to penalties or regulatory enforcement if not rectified.

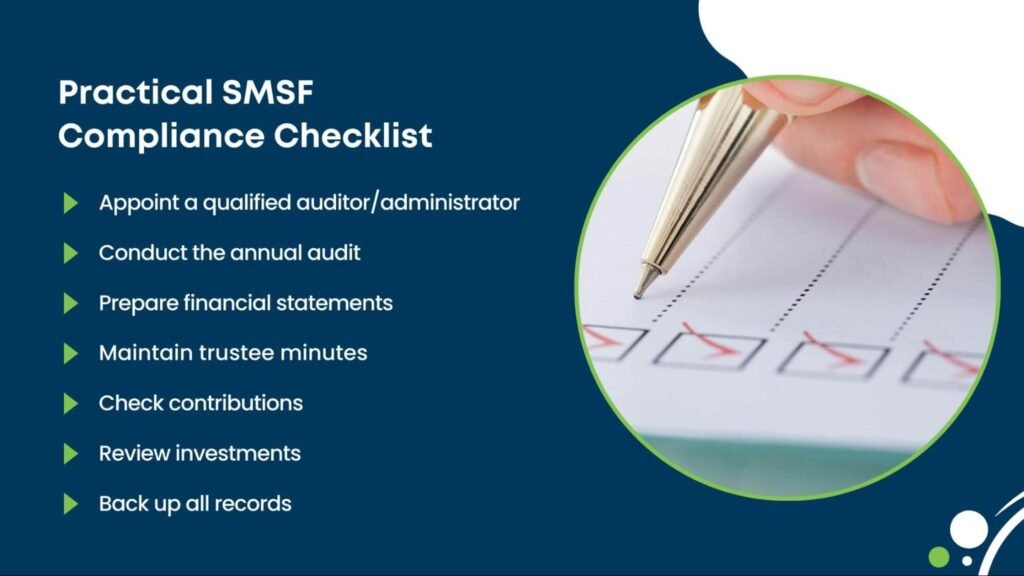

Practical Checklist for Trustees & Administrators

- Appoint a qualified auditor/administrator – ensure they are approved and experienced in SMSF compliance.

- Conduct the annual audit – schedule early to allow sufficient time before lodgement.

- Prepare financial statements – accurate, complete, and ready for audit review.

- Maintain trustee minutes – document all key decisions and meetings.

- Check contributions – ensure caps and limits are not exceeded.

- Review investments – verify strategy compliance and arm’s-length dealings.

- Back up all records – secure storage of digital and physical documentation using professional document digitization services.

This checklist helps trustees and administrators stay compliant, reduces audit risks, and supports efficient SMSF administration and compliance.

Conclusion

Effective SMSF administration and compliance is no longer optional; it is a critical responsibility for trustees and advisers to protect member assets and meet regulatory standards. Consistent record-keeping, timely lodgements, and adherence to reporting requirements form the foundation of a compliant and well-managed SMSF.

Trustees can also benefit from leveraging professional expertise through self-managed super fund administrators or by choosing to outsource SMSF administration.

Doing so ensures accuracy, enhances audit readiness, and allows trustees to focus on strategic investment decisions. Get in touch with our team to explore how expert SMSF administration services can help your fund remain compliant and efficient in 2025.