ESG Reporting Requirements Australia 2025: a Quick Guide

- Aesha Shah

- April 8, 2025

- 5 minutes

- Blogs

ESG Reporting Requirements Australia 2025: A Quick Guide

Introduction

Australia Set to Mandate ESG Reporting for Businesses by 2025 – headlines like these have been making waves in the corporate sector.

The conversation around ESG reporting requirements Australia has shifted from being a voluntary initiative to a regulatory necessity. As businesses face increasing scrutiny from investors, consumers, and regulators, ESG reporting Australia 2025 is set to bring significant changes. Companies will be required to disclose their environmental, social, and governance (ESG) impact in a structured and transparent manner.

But what exactly does this mean for Australian businesses, and how can they prepare for these new reporting requirements?

This guide breaks down the key aspects of ESG reporting in 2025 and beyond.

Why ESG Reporting is Important

The growing emphasis on sustainability and ethical business practices has made ESG reporting a critical aspect of corporate governance. It provides transparency, builds investor confidence, and ensures compliance with evolving regulatory standards. With the introduction of SEC ESG disclosure requirements, companies are expected to align their sustainability efforts with global frameworks to remain competitive and compliant.

Key benefits of ESG reporting include:

- Enhanced Reputation:

Businesses that prioritise ESG initiatives gain trust from stakeholders, consumers, and investors. - Regulatory Compliance:

Adhering to ESG guidelines helps businesses avoid penalties and legal risks. - Investor Attraction:

Many institutional investors now consider ESG factors when making investment decisions. - Operational Efficiency:

Sustainable practices often lead to cost savings and improved long-term profitability.

Current ESG Reporting Landscape in Australia

Before 2025, ESG reporting in Australia was largely voluntary, with companies following guidelines set by the Australian Securities Exchange (ASX) Corporate Governance Principles and Recommendations. However, the upcoming changes will introduce stricter compliance measures that align with international standards such as the sustainability reporting standard developed by the International Sustainability Standards Board (ISSB).

Key reporting frameworks used in Australia include:

What’s Changing in 2025?

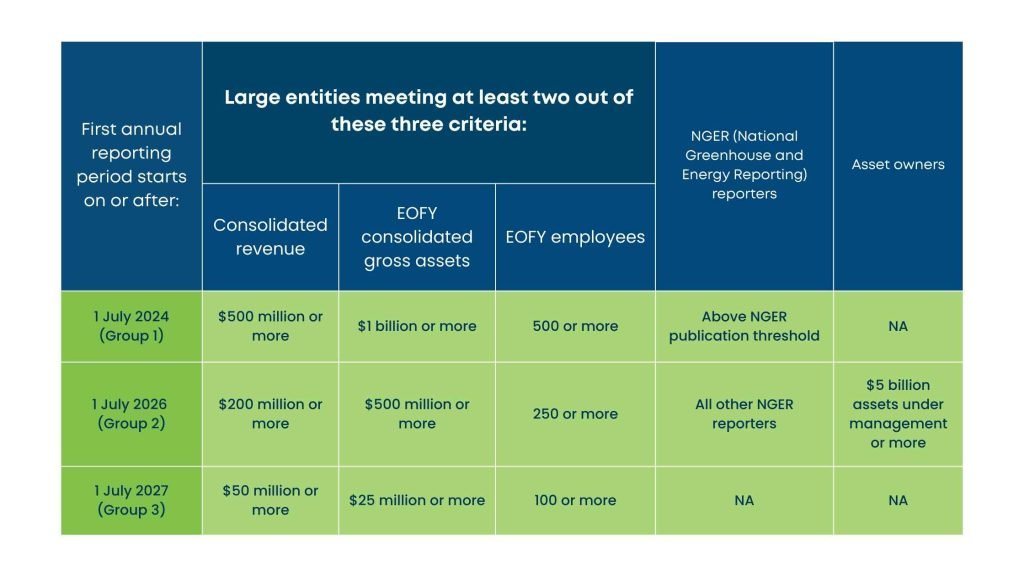

From 2025, ESG reporting will become mandatory for larger corporations and gradually expand to include medium-sized businesses. Companies will be required to submit an ESG report requirement that details their environmental impact, social initiatives, and governance policies.

Some key changes include:

- Mandatory climate-related financial disclosures

- Stricter corporate governance regulations

- More standardised ESG metrics and reporting frameworks

- Integration of ESG factors into financial statements

A recent survey by the Australian Financial Review found that over 70% of ASX-listed companies are already investing in ESG initiatives to prepare for the upcoming regulations.

Breakdown of ESG Reporting Components

Environmental Factors

This section of the report covers a company’s impact on the environment, including:

- Carbon emissions and reduction targets

- Energy consumption and renewable energy adoption

- Waste management and recycling efforts

- Water usage and conservation strategies

Social Factors

This includes disclosures related to a company’s relationships with employees, customers, and communities:

- Workplace diversity and inclusion efforts

- Employee well-being and fair labor practices

- Community engagement and social impact programs

- Human rights policies in supply chains

Governance Factors

Governance disclosures focus on corporate ethics, leadership, and risk management:

- Board diversity and independence

- Executive compensation and ethical leadership

- Anti-corruption policies and compliance frameworks

- Risk management and shareholder rights

Challenges Businesses May Face

As businesses adapt to the new ESG reporting requirements Australia, they may encounter several challenges:

- Data Collection and Accuracy:

Gathering reliable ESG data across operations can be complex, especially for businesses that lack dedicated sustainability teams. Ensuring accuracy in carbon emissions tracking, energy consumption, and governance disclosures requires a structured approach and the right technological tools. Some companies choose to work with a third-party accounting provider to handle ESG-related financial data, reducing errors and ensuring compliance with evolving reporting standards. - Compliance Costs:

Implementing ESG reporting frameworks comes with financial and human resource costs. Businesses may need to invest in software for data tracking, hire sustainability experts, or train existing employees. While large corporations may have the budget for these transitions, small and mid-sized businesses may find it more cost-effective to partner with accounts payable outsourcing providers to manage reporting-related financial and compliance responsibilities efficiently. - Changing Regulations:

ESG reporting is a rapidly evolving space, with regulations being updated frequently to align with international standards. Companies must stay informed about new disclosure requirements and compliance deadlines to avoid potential penalties. Partnering with industry experts or subscribing to regulatory updates can help businesses stay ahead of these changes. - Integration with Existing Systems:

Many businesses already have established financial and operational reporting structures in place. Upgrading these systems to accommodate ESG reporting can be challenging, particularly when integrating sustainability metrics with financial statements. Companies may need to adopt new reporting frameworks or modify existing processes to align with the ESG reporting requirements in Australia. Engaging CFO virtual services can make this transition smoother by combining sustainability compliance with strong financial governance.

How Businesses Can Prepare

To ensure a smooth transition into the new ESG reporting era, businesses should take the following steps:

- Conduct an ESG Audit:

Assess current ESG policies and practices to identify strengths, weaknesses, and gaps. Review existing sustainability initiatives, governance structures, and social responsibility efforts to determine areas for improvement. Businesses should also benchmark their ESG performance against industry standards to understand where they stand compared to competitors.

- Implement Data Collection Systems:

Accurate ESG reporting relies on comprehensive data. Businesses should invest in technology-driven solutions such as ESG management software to track key metrics like carbon emissions, energy usage, workforce diversity, and corporate governance practices. Companies that lack internal expertise may consider partnering with an external bookkeeping firm to manage ESG-related financial data and reporting obligations efficiently. - Align with Global Standards:

With ESG regulations evolving, aligning with internationally recognised frameworks is crucial. Companies should familiarise themselves with the ISSB’s sustainability reporting standard, Global Reporting Initiative (GRI), and Task Force on Climate-related Financial Disclosures (TCFD). Adopting these frameworks will help businesses comply with both Australian and global reporting expectations. - Engage Stakeholders:

ESG success depends on the involvement of key stakeholders, including investors, employees, customers, and suppliers. Companies should develop clear communication strategies to share ESG goals, progress, and challenges. Regular engagement, whether through sustainability reports, investor meetings, or internal discussions, helps build trust and accountability.

- Stay Updated:

Regulatory requirements for ESG reporting will continue to evolve. Businesses must actively monitor changes in legislation, industry best practices, and investor expectations. Subscribing to regulatory updates, participating in ESG-focused conferences, and seeking professional guidance from ESG consultants can help companies stay ahead of compliance requirements. - Seek Professional Guidance:

Collaborating with a finance and accounting consultant can provide businesses with expert insights into ESG frameworks and help them navigate the complexities of compliance.

Conclusion

With ESG reporting Australia 2025 set to become a key compliance requirement, businesses must take proactive steps to align with new regulations. Meeting the ESG report requirement is not just about regulatory compliance—it also presents opportunities for businesses to enhance their reputation, attract investment, and contribute to a more sustainable future. By understanding the SEC ESG disclosure requirements and the evolving sustainability reporting standard, Australian companies can position themselves for long-term success in a rapidly changing business environment.