10 Best Invoice Automation Software for Accountants in 2025

- Aesha Shah

- July 24, 2025

- 7 minutes

- Blogs

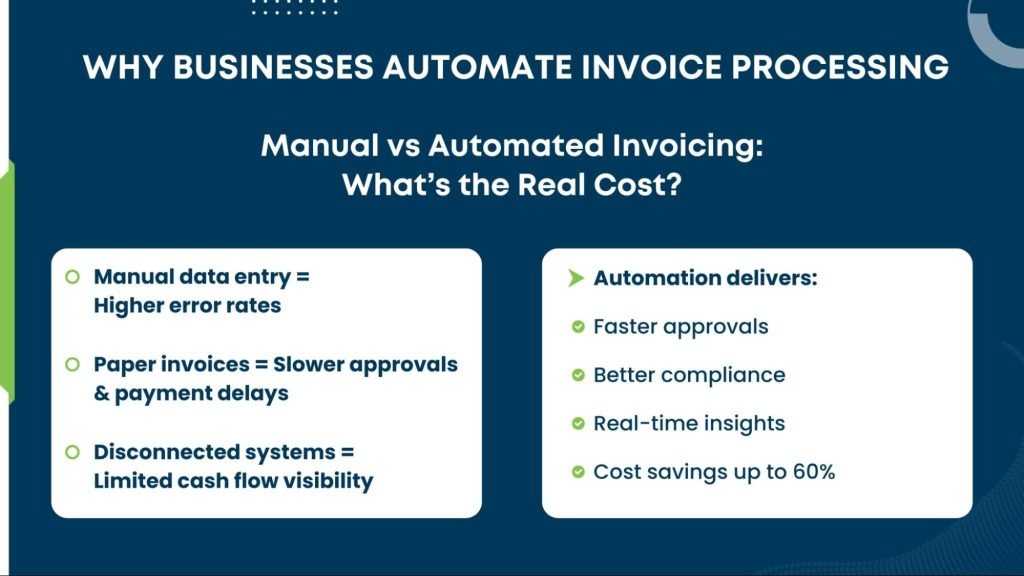

Processing invoices manually is no longer sustainable in a digital-first economy. Accountants are increasingly under pressure to improve accuracy, reduce costs, and accelerate payment cycles. Adopting the right tools and tailored automation approaches can significantly improve how finance teams manage invoicing, while also supporting broader operational efficiency goals. It’s an area where outsourcing services that align technology with business needs are making a tangible impact.

The right invoice automation software can significantly enhance financial control and efficiency. Whether you’re managing a few dozen invoices or thousands, these tools simplify tasks, improve compliance, and free up your team to focus on strategic work.

From small practices to large firms, the benefits are measurable and impactful. According to Gartner, businesses that adopt automation reduce invoice processing costs by up to 60% and cycle times by 70%.

What is Invoice Processing Automation?

Invoice processing automation uses technology to replace manual invoice handling with a streamlined, end-to-end digital workflow that improves speed, accuracy, and control. It captures, validates, and routes invoice data automatically, ensuring accuracy, speed, and compliance with internal approval processes.

More than simple digitisation, these systems apply intelligent rules aligned with organisational structures to flag discrepancies and route invoices to the right approvers. This scalable approach reduces errors, improves control, and frees accounting teams from repetitive tasks, enhancing efficiency across the accounts payable outsourcing services function and broader finance operations.

How Does Invoice Automation Work?

When an invoice is received, via email, post, or electronic portal, invoice automation software uses Optical Character Recognition (OCR) to extract key data such as vendor details, invoice number, amount, and due date. This removes the need for manual data entry, ensuring greater accuracy and efficiency from the outset.

For accounting firms looking to streamline complex compliance workflows, leveraging outsourced smsf accounting services alongside automation tools can further enhance accuracy and scalability.

The software then validates the invoice against purchase orders or supplier records and routes it through predefined approval workflows based on company policies. This automated process ensures timely approvals, enforces compliance, and provides real-time visibility across the accounts payable cycle.

Similarly, companies implementing payroll outsourcing in Australia achieve comparable gains in accuracy and compliance across their HR and finance departments.

The 10 Best Automated Invoice Software Solutions

The right invoice automation software can simplify invoice processing, improve accuracy, and enhance control over cash flow. For startups and enterprises alike, automation reduces manual work and boosts efficiency.

Below are ten top platforms built to simplify automated invoice management, ensure compliance, and integrate seamlessly with your existing systems.

1. Brex

Brex offers an all-in-one financial platform that unifies invoice automation software with spend management, bill pay, and corporate cards. Designed for fast-growing and tech-forward businesses, Brex streamlines the entire financial workflow from a single dashboard.

Key Features:

- OCR-powered invoice digitisation

- Customisable approval workflows

- Automated receipt matching and reconciliation

- Real-time spend tracking and analytics

- Integrations with QuickBooks, NetSuite, and Xero

- Automated payment scheduling and virtual corporate cards

- Policy-based spending controls

Best For:

- Companies seeking intelligent, automated invoice processing

- Businesses needing real-time spend visibility and control

- Teams using integrated platforms like QuickBooks or NetSuite

Limitations:

- May offer more features than small businesses require

- Best suited for tech-forward or fast-scaling organisations

2. QuickBooks

QuickBooks combines decades of accounting expertise with modern automation to deliver a reliable financial management platform. Evolving from basic bookkeeping software, it now offers robust tools for invoicing, reporting, and day-to-day financial operations, trusted by millions of businesses worldwide.

Key Features:

- Recurring invoice automation and scheduling

- Smart payment reminders

- Mobile invoice management

- Multi-currency and time-tracking support

- Inventory tracking

- Bank reconciliation automation

- Built-in reporting tools

- Integration with a wide ecosystem of third-party apps

Best For:

- Small to mid-sized businesses already using QuickBooks for accounting

- Companies that need combined invoicing and bookkeeping.

- Teams looking for ease of use and wide integration options

Limitations:

- Limited customisation for larger enterprises

- Basic automation compared to specialised platforms

- Performance can decline with high transaction volumes

3. Xero

Xero is a cloud-based accounting platform that streamlines financial operations through intuitive design and smart invoice automation software features. It supports real-time collaboration, making it an ideal solution for modern businesses seeking mobility and visibility in their financial workflows.

Key Features:

- Automated invoice scheduling and reminders

- Customisable branded invoice templates

- Real-time bank feeds and reconciliation

- Multi-currency support with live exchange rates

- Time tracking and billing for projects

- Inventory and purchase order management

- Mobile invoicing through a feature-rich app

Best For:

- Small to mid-sized businesses wanting a cloud-first solution

- Companies with international operations needing multi-currency support

- Users who value mobility and ease of use

Limitations:

- Limited customer support in certain time zones

- Reporting tools less advanced than enterprise platforms

- Role-based access restricted in lower-tier plans

4. FreshBooks

FreshBooks is a user-friendly platform designed to simplify invoice automation for service-based businesses. Initially built for freelancers, it has matured into a powerful solution that links time tracking, project management, and billing in one seamless workflow.

Key Features:

- Automatic time tracking to invoice generation

- Recurring invoice scheduling

- Client credit card storage for auto-billing

- Double-entry accounting

- Expense tracking with receipt capture

- Project profitability insights

- Client portal for payments

- Automated late payment reminders

Best For:

- Service-based businesses and consultants

- Agencies with project-based billing

- Teams that require integrated time tracking and invoicing

Limitations:

- Limited reporting for complex requirements

- Basic inventory tracking

- Higher cost when scaling with additional team members

5. Docsumo

Docsumo is an AI-powered platform focused on intelligent document processing, offering advanced capabilities in automated invoice processing software. Known for its precision and adaptability, it excels in extracting data from diverse and complex invoice formats with minimal human intervention.

Key Features:

- AI-driven OCR with continuous learning

- Custom data extraction and validation rules

- Automated workflow routing

- Bulk document processing

- API integrations for system connectivity

- Multi-language and multi-format support

- Real-time data accuracy monitoring

Best For:

- Large enterprises handling high volumes of varied invoices

- Organisations working with international vendors and formats

- Teams needing custom automation and advanced data extraction

Limitations:

- More complex to set up than traditional platforms

- Limited built-in accounting functionalities

- Requires technical resources for optimal configuration

6. Bill.com

Bill.com is a dedicated accounts payable automation software platform built to streamline the entire invoice-to-pay cycle with a strong focus on compliance, security, and visibility. It offers enterprise-level tools for managing approvals, payments, and vendor relationships with precision.

Key Features:

- Intelligent invoice capture and auto-coding

- Multi-level approval workflows

- International payment support

- Centralised vendor management

- Bank-grade security and fraud prevention

- Cash flow forecasting tools

- Mobile approvals and real-time notifications

Best For:

- Mid-sized to large businesses requiring strong financial controls

- Organisations with international payment operations

- Teams prioritising audit trails, compliance, and payment security

Limitations:

- Premium pricing for advanced features

- Initial setup can be complex

- Limited workflow customisation for niche requirements

7. Zoho Invoice

Zoho Invoice is a free cloud invoicing tool ideal for freelancers and small businesses. With a user-friendly interface and automation tools, it simplifies billing, tracking, and payment follow-ups.

Key features:

- Customisable recurring invoices

- Multi-currency and multi-language support

- Automated payment reminders

- Time tracking and project billing

- Mobile app for invoicing on the go

- Seamless integration with the Zoho ecosystem

Best for:

- Freelancers and microbusinesses seeking a free, easy-to-use invoicing platform

- Businesses looking for mobile accessibility and automation without added cost

- Users who prefer a clean interface with minimal learning curve

Limitations:

- Limited scalability for larger businesses

- Fewer third-party integrations than competitors

- No built-in inventory or advanced reporting features

8. Tipalti

Tipalti is a global payables automation platform that streamlines the entire invoice lifecycle. With strong compliance, fraud prevention, and global payment capabilities, it’s ideal for high-growth businesses.

Key features:

- Invoice approval software with customisable workflows

- Supplier onboarding automation

- Global payments in 190+ countries

- Real-time tax and regulatory compliance

- Payment reconciliation and audit-ready reports

- ERP integration

Best for:

- Rapidly growing or international businesses needing secure invoice automation

- Companies that prioritise compliance and fraud prevention

- Finance teams looking to minimise manual AP tasks with robust automation

Limitations:

- Higher cost compared to mid-market tools

- Requires technical setup and onboarding

- Steeper learning curve for non-finance users

9. Sage Intacct

Sage Intacct is a cloud-based financial management system built for mid-sized and large enterprises. It combines invoice automation with robust accounting and reporting capabilities.

Key features:

- Automated invoice capture and processing

- Role-based invoice approval workflows

- Integration with procurement systems

- Real-time reporting dashboards

- Multi-entity and global consolidation

- Audit-ready transaction records

Best for:

- Enterprises needing deep financial controls and compliance

- Businesses with complex invoice approval routing requirements

- Organisations requiring multi-entity consolidation and real-time reporting

Limitations:

- Higher price point unsuitable for small businesses

- Requires configuration and onboarding support

- Not designed for freelancers or microbusinesses

10. Airbase

Airbase combines invoice automation with complete spend management. It empowers finance teams with real-time control over invoices, employee expenses, and card payments.

Key features:

- Invoice intake, coding, and approval routing

- Corporate card and expense management

- Virtual card issuing and tracking

- Budget controls and spend policies

- Automated syncing with accounting platforms

- Real-time cash flow tracking

Best for:

- Companies seeking an all-in-one platform for invoice and spend management

- Finance teams looking for real-time budget control and compliance

- Businesses with complex approval workflows and multi-channel expenses

Limitations:

- Premium pricing for advanced functionality

- Some features restricted to US/Canada

- Not ideal for businesses focused only on invoicing

Conclusion

As businesses scale and financial operations grow more complex, investing in the right invoice automation software is no longer optional, it’s essential. The solutions featured in this list offer a range of capabilities, from intelligent data capture to seamless approval workflows and global payment processing, helping finance teams stay agile, accurate, and compliant in 2025.

For firms seeking greater control over approval chains, choosing an invoice approval software with multi-level permissions, audit trails, and mobile approval features is especially important. Whether you’re after an end-to-end automation suite or a specialised automated invoice management system, the right tool can reduce processing time, minimise errors, and improve visibility across your accounts payable lifecycle.

If you’re exploring customised solutions or need expert guidance on implementation, getting in touch with experienced offshore accountants can help you move forward with confidence.