When Is SMSF Tax Return Due Date 2025 in Australia?

- Aesha Shah

- June 23, 2025

- 6 minutes

Running a Self-Managed Super Fund (SMSF) comes with a lot of responsibility, from managing investments to keeping your fund compliant with ever-evolving tax laws. One of the most important obligations trustees have is meeting the SMSF tax return due date 2025. Missing key dates can lead to penalties, audit scrutiny, or even a loss of compliance status.

So, when exactly is your fund’s tax return due next year? And what should you have ready before you lodge?

Let’s break down the key SMSF lodgement dates 2025, who they apply to, and how to stay on track.

Why SMSF Tax Return Deadlines Matter?

Every year, the ATO sets specific SMSF annual return due date 2025 deadlines for different types of lodgers. These lodgement dates depend on whether your SMSF is newly registered, if you’ve missed prior deadlines, or whether you lodge through an outsourced tax expert or on your own.

The consequences of missing your self managed super fund tax return deadlines can be serious, administrative penalties, a potential loss of fund compliance status, and complications in your investment strategy.

But more than that, lodging on time helps maintain your fund’s credibility, ensures timely processing of benefits, and avoids unnecessary administrative stress.

SMSFs are evolving. According to the Financial Review, there has been a significant shift in demographics, with younger women aged 25 to 45 now representing a growing portion of new SMSF setups. These trustees are more engaged with their investments and long-term goals, but like all SMSF members, they must stay on top of lodgement timelines and compliance obligations to avoid serious consequences.

Key SMSF Lodgement Dates 2025

Here’s a breakdown of the most important ATO SMSF tax return due date 2025 information you need to know, based on your lodgement status:

| Lodger Type | SMSF Tax Return Due Date 2025 | Notes |

|---|---|---|

| Newly registered SMSFs (via tax agent) | 28 February 2025 | For funds with a balance date of 30 June 2024 |

| SMSFs with overdue returns | 31 October 2025 | Required to lodge on time to avoid being flagged |

| All other SMSFs using a tax agent | 15 May 2025 | Most common lodgement date |

| Self-preparers (not using tax agents) | 31 October 2025 | No extensions unless applied and approved by the ATO |

If your SMSF has prior year returns overdue, the ATO is likely to place you on their watchlist. Lodging before the self managed super fund tax return deadlines not only avoids penalties but also reduces your chances of being subjected to ATO audits.

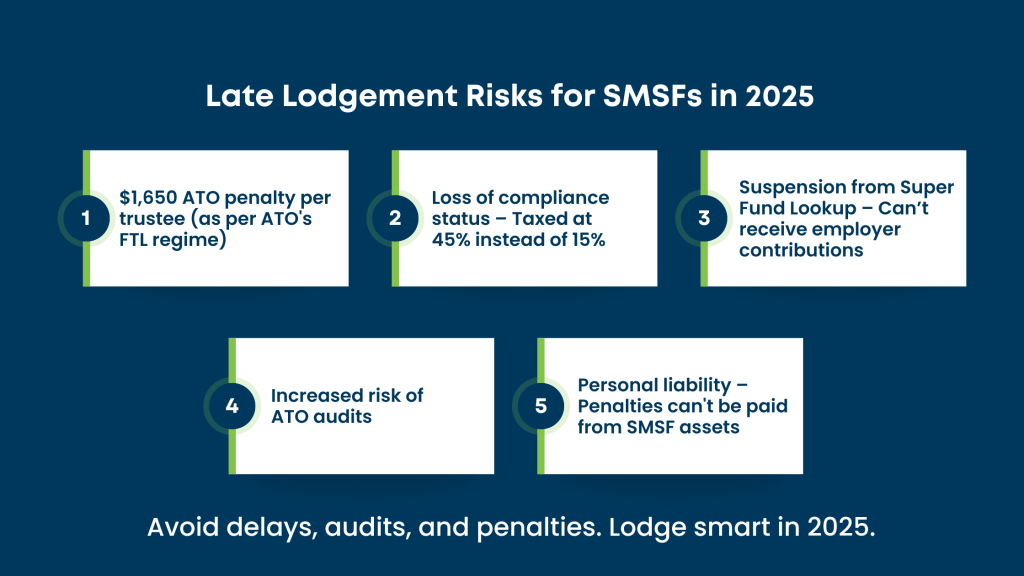

What Happens If You Lodge Late?

Missing your SMSF annual return due date 2025 doesn’t just result in a simple late fee—it can trigger a series of compliance issues that may affect your fund’s tax status, its credibility with employers, and your standing with the ATO.

Here’s what’s at stake:

Administrative Penalties:

If the ATO considers your late lodgment a breach of trustee responsibilities, they may issue an administrative penalty of up to $1,650 per trustee. For funds with two or more trustees, that amount can multiply quickly. These penalties are personally payable by the trustee and cannot be reimbursed from the SMSF’s assets, making it a direct financial hit.Loss of Compliance Status:

Lodging late can jeopardise your fund’s complying status, which is crucial for receiving tax concessions like the 15% concessional tax rate. If your SMSF is deemed non-compliant, its income could be taxed at the highest marginal rate of 45%, significantly reducing your retirement savings. Regaining compliance also involves time, cost, and additional scrutiny.Suspension on Super Fund Lookup:

The ATO may suspend your fund’s listing on Super Fund Lookup, which is the platform employers and other funds use to verify whether an SMSF can receive contributions or rollovers. A suspended fund cannot legally accept employer contributions, personal contributions, or rollovers from retail or industry super funds. This can disrupt your investment plans and erode trust with stakeholders.Extra Scrutiny:

Lodging late flags your fund for potential compliance risks, increasing the likelihood of being selected for a review or audit. The ATO may investigate not just your tax return, but also your investment decisions, contribution strategies, and trustee conduct. This can lead to time-consuming correspondence, record requests, or even enforcement action if further issues are found.

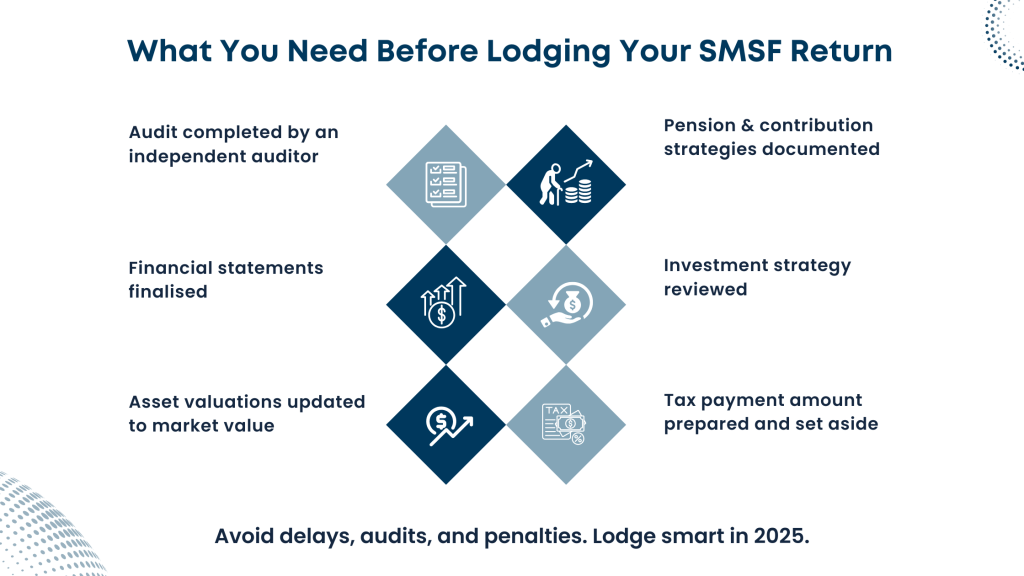

What You Need Before Lodging Your SMSF Return

Before you hit “submit” on your return, make sure your SMSF is ready. Here’s a quick checklist:

Audit Completed

You cannot lodge your return unless your SMSF audit deadlines Australia have been met. An independent auditor must review your fund and issue an audit report.

Note: According to The Australian, while SMSF audit fees have previously dipped as low as $150 per year, they are now under pressure to rise due to increased ATO and ASIC scrutiny, fewer approved auditors in the market, and tighter compliance requirements. Starting your audit early can help you avoid last-minute stress and inflated fees.Financial Statements Finalised

Ensure your fund’s income, expenses, and member balances are accurately reported.Asset Valuations Up to Date

The ATO expects all assets, including property and shares, to be reported at market value.Pension & Contribution Strategies Documented

If your SMSF is paying pensions or has received concessional/non-concessional contributions, documentation is key.Investment Strategy Review

Make sure your investment strategy reflects your current asset mix and risk profile.

Meeting your SMSF tax payment due date 2025 also means you’ve calculated any tax liabilities and set aside funds accordingly.

Common Reasons for Late Lodgment

While most trustees want to do the right thing, certain issues often delay lodgement:

- Delays in receiving data (e.g., bank feeds, asset reports)

- Unresolved auditor queries

- Missing records or incomplete reconciliations

- Outdated trustee details or compliance breaches

Sometimes, these aren’t just delays, they become compliance red flags. For many trustees and even accounting practices, outsourcing of SMSF admin and reporting helps prevent these issues from snowballing.

Can You Get an Extension?

Yes, but it’s not guaranteed.

You (or your registered tax agent) can request an extension from the ATO, but it must be backed by a valid reason, such as:

- Natural disasters

- Medical issues

- Technical or auditor delays

Working with a tax agent can help improve your chances of securing an extension, but only if your fund is otherwise in good standing.

Staying Ahead of Your SMSF Lodgement Dates in 2025

Here are some ways to keep your fund on track and avoid last-minute scrambling:

1. Get Your Audit Done Early

Don’t wait till May. Independent auditors are often booked out closer to deadlines. Early audits mean more time to fix any compliance issues.

2. Use a Bookkeeper or Admin Specialist

A well-managed file saves hours of back-and-forth with your accountant. Whether you’re a trustee managing your own fund or a small practice juggling multiple clients, having organised records goes a long way.

3. Set Internal Reminders

Add the SMSF tax return due date 2025, audit deadlines, and payment due dates to your calendar. Set reminders for 30 days before each.

4. Automate Where You Can

Using accounting tools that sync directly with your SMSF bank feeds and investment platforms can save time, and reduce the risk of errors that delay lodgment.

Final Thoughts

The SMSF tax return due date 2025 isn’t just a date on a calendar, it’s part of a larger responsibility that every SMSF trustee must take seriously. Whether you’re lodging via a tax agent or on your own, understanding your obligations helps you keep your fund in good standing.

Here’s a quick recap of the most critical SMSF lodgement dates 2025:

- 28 February 2025 – Newly registered SMSFs (via tax agent)

- 15 May 2025 – Most SMSFs lodging via a tax agent

- 31 October 2025 – SMSFs with overdue returns or self-preparers

Also, remember your SMSF audit deadlines Australia come before the lodgement, and the SMSF tax payment due date 2025 applies once the return is assessed.

If you’re feeling overwhelmed managing compliance, audits, or reporting, know that you’re not alone. Many small practices and trustees are moving toward outsourced support systems that take the weight off their shoulders.