FBT Return Due Date 2025: Lodgment & Payment in Australia

- Aesha Shah

- May 7, 2025

- 6 minutes

Fringe Benefits Tax (FBT) is a critical compliance requirement for many Australian businesses. If you’re an employer providing perks like cars, entertainment, or expense reimbursements to your employees, understanding the FBT return due date 2025 is essential.Many businesses opt to work with an external tax consultant to ensure their tax filings are accurate, timely, and compliant with all regulations. Missing key lodgment or payment deadlines can lead to penalties and unnecessary stress.

In this blog, we’ll walk through everything you need to know about the Fringe Benefits Tax deadline, key lodgment and payment dates, and how to prepare and stay compliant. Whether you’re handling it in-house or relying on professional help, this guide ensures you don’t miss a beat.

What is Fringe Benefits Tax (FBT)?

FBT is a tax paid by employers on certain benefits they provide to their employees or associates in place of, or in addition to, salary or wages. This includes non-cash benefits such as:

- Company cars used for private purposes

- Low-interest loans

- Entertainment (meals, event tickets, etc.)

- Reimbursement of private expenses

FBT is separate from income tax and calculated on the taxable value of the fringe benefits provided. If your business provides these benefits, you’re required to lodge a fringe benefits tax return annually.

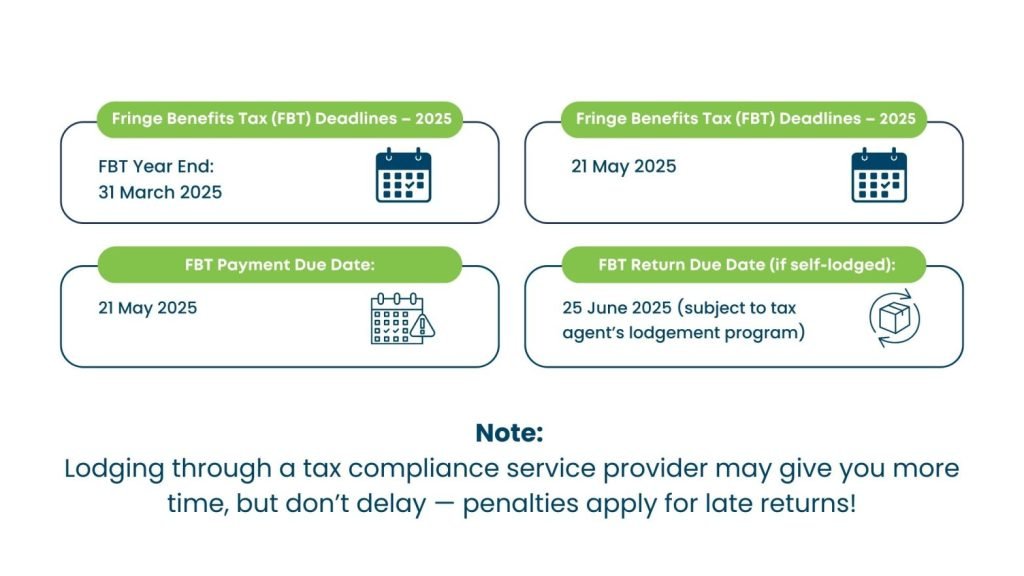

FBT Year for 2025: Key Dates

The FBT year is not aligned with the standard income tax year. The 2024–2025 FBT year runs from:

1 April 2024 to 31 March 2025

Employers need to ensure all relevant records are maintained for this period. This includes benefit calculations, employee declarations, logbooks (for car benefits), and any other supporting documentation.

FBT Return Due Date 2025: Lodgment Explained

The FBT return due date 2025 depends on how you submit your return:

If Lodging by Paper (Manually):

Lodgment deadline: 21 May 2025

Payment deadline: 21 May 2025

This applies if you are not using a registered tax or BAS agent to lodge your return. This applies if you are not using a registered tax or BAS agent to lodge your return.

If Lodging Through a Registered Tax Agent:

Lodgment deadline: 25 June 2025

Payment deadline: 25 June 2025

(Only if you are eligible for the lodgment extension and lodge electronically through your agent.)

Make sure your tax agent is registered and listed with the ATO in advance to qualify for the extended FBT lodgment due date 2025.

Why Deadlines Matter: Penalties and Interest

Missing the Fringe Benefits Tax deadline may result in:

- Failure to lodge (FTL) penalties: These increase the longer your return is overdue.

- General interest charge (GIC): Applied daily on unpaid amounts.

- Audit risk: Late lodgment increases the likelihood of ATO scrutiny.

ATO penalties are based on your business size (small, medium, or large entity), and fines can quickly accumulate.

How to Prepare for Your FBT Return

To ensure you’re ready for the fbt return due date 2025, follow these preparation steps:

Keep accurate records:

- Track all fringe benefits provided to employees.

- Maintain odometer readings and logbooks for car benefits.

- Record any employee contributions (these reduce your FBT liability).

Identify exempt benefits:

Some benefits are exempt (e.g., work-related items like laptops), and understanding these can help reduce your taxable value.

Calculate reportable benefits:

Some benefits must be reported on employees’ payment summaries if the total taxable value exceeds $2,000.

Get employee declarations:

These are essential for certain benefits to apply concessional treatment.

Having your documentation in order ahead of the fbt lodgement due date 2025 saves time and reduces the chance of errors. Many small businesses choose to outsource bookkeeping to maintain accurate records throughout the year and simplify FBT compliance when deadlines approach.

FBT Payment Due Date 2025

Whether you lodge manually or via an agent, your fbt payment due date typically aligns with your lodgment due date:

- 21 May 2025 for manual lodgment

- 25 June 2025 if lodged through a registered tax agent with an extension

Payments can be made via BPAY, credit card, or direct debit using your ATO payment reference. Ensure that your payment clears on or before the due date to avoid interest charges.

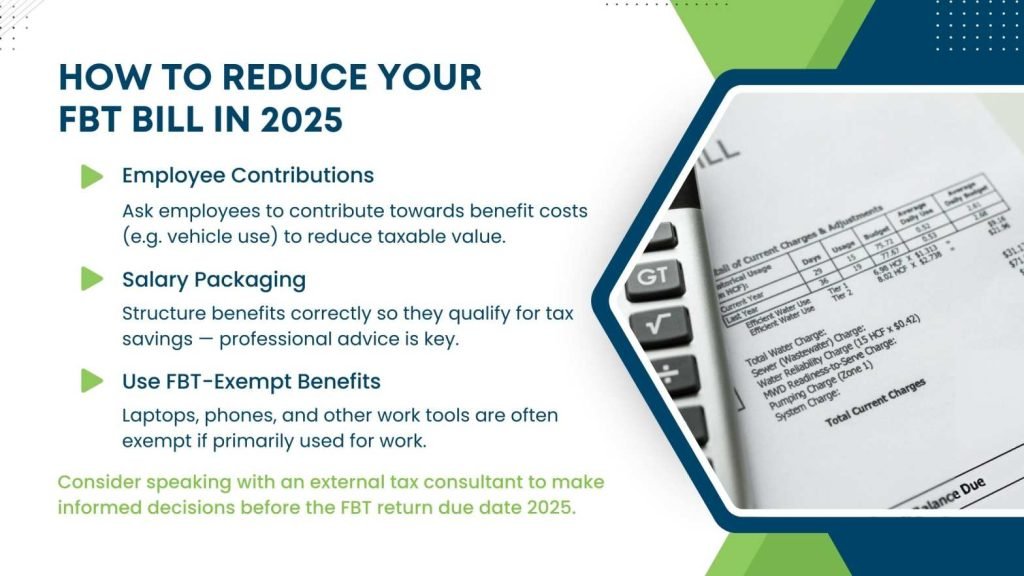

Reducing Your FBT Liability: Can It Be Done?

Yes, there are practical and compliant strategies to reduce your FBT liability, but timing and structure are key. Employers should review their benefits ahead of the FBT return due date 2025 to ensure opportunities aren’t missed.

1. Employee Contributions

If an employee makes an after-tax contribution toward the cost of a fringe benefit. Such as paying part of the private use of a company vehicle, it directly reduces the benefit’s taxable value. For example, if an employee pays $1,000 toward a $5,000 car benefit, only $4,000 is subject to FBT.

This method is simple, but contributions must be documented and paid before 31 March 2025 to be counted in the current FBT year.

2. Salary Packaging

Salary packaging (or salary sacrifice) lets employees receive certain benefits instead of part of their cash salary. Done correctly, this can reduce FBT liability, especially when using benefits that are either exempt or concessionally taxed.

Examples include:

- Superannuation contributions beyond the compulsory 11.5%

- Novated car leases

- Work-related portable devices (like laptops)

However, poor structuring or including high-FBT items can lead to increased liabilities. It’s best to set up packaging agreements in writing and review them regularly.

3. Use of Exempt Benefits

Certain benefits are fully exempt from FBT if they meet ATO conditions. These include:

- One work-use electronic device (e.g., mobile phone or tablet) per FBT year

- Minor benefits (under $300, provided infrequently)

- Protective gear and tools used primarily for work

These exemptions allow employers to offer valuable non-cash benefits without triggering FBT, and are worth considering before finalising the fringe benefits tax return.

While these strategies can certainly help, consulting with an independent tax advisor can provide invaluable insights tailored to your business’s specific needs, ensuring that you meet the FBT return due date 2025 while minimising your tax exposure.

Checklist Before Lodging Your Fringe Benefits Tax Return

Here’s a quick checklist to review before the fringe benefits tax return is submitted:

- All benefits identified and valued

- Employee declarations collected and verified

- Contributions recorded and deducted from taxable value

- Car logbooks and travel diaries up to date

- Exempt and reportable benefits correctly recorded

- Calculations reviewed by a professional if needed

Don’t forget, once the return is submitted, it becomes part of your tax record and may be reviewed by the ATO at any time.

Using Professionals to Simplify FBT Compliance

FBT can get complicated quickly, especially with different benefit types, employee contributions, and recordkeeping requirements. Many businesses choose to work with tax professionals to:

- Ensure timely lodgment by the FBT lodgement due date 2025

- Accurately calculate FBT liabilities

- Identify exemptions or concessions

- Manage and prepare employee declarations

Outsourcing FBT preparation can free up internal resources while reducing compliance risks. Many businesses also engage specialised virtual CFO services to streamline compliance and manage reporting obligations more effectively.

When choosing an external tax consultant or independent tax advisor, make sure they’re registered with the Tax Practitioners Board (TPB), the official regulator of tax professionals in Australia, to ensure you’re receiving advice that meets national standards.

In Summary: Don’t Miss the 2025 FBT Deadlines

Here’s a final summary of the key due dates:

Action | Due Date (Manual Lodgment) | Due Date (Lodgment via Tax Agent) | FBT Return Lodgment & FBT Payment

| 21 May 2025

| 25 June 2025

|

|---|---|---|

Staying ahead of the fbt return due date 2025 is not just about ticking boxes. It protects your business from penalties and demonstrates good governance.

As the FBT return due date 2025 draws near, consider partnering with a tax compliance service provider to streamline the process. These specialists can guide you in managing your fringe benefits efficiently and help ensure that you’re fully compliant, allowing you to focus on growing your business.