AASB Australian Accounting Standards List: Complete Overview

- Aesha Shah

- April 2, 2025

- 6 minutes

- Blogs

AASB Australian Accounting Standards List: Complete Overview

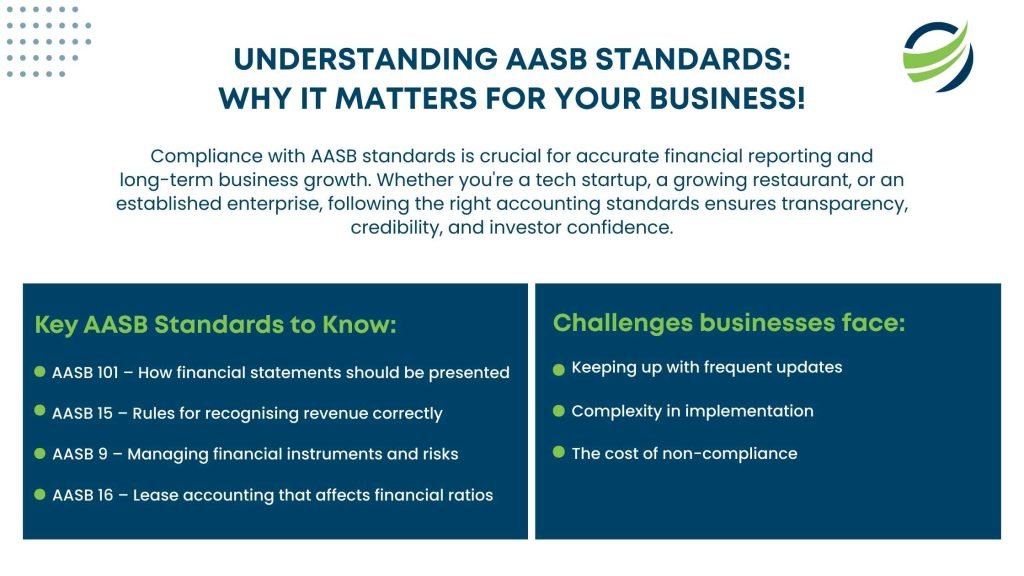

The AASB Australian Accounting Standards List plays a critical role in ensuring transparency and consistency in financial reporting. The Australian Accounting Standards Board (AASB) is responsible for developing and maintaining these standards, which are in line with the financial reporting standards set by the International Financial Reporting Standards (IFRS).

These standards are designed to promote credibility, reliability, and comparability in financial statements across various industries in Australia.Understanding the list of Australian Accounting Standards Board requirements is essential for businesses, financial professionals, and investors to ensure compliance and informed decision-making.

This blog provides a complete overview of the AASB, its purpose, key accounting standards, and their implications for Australian businesses.

What is the AASB and Its Purpose?

The Australian Accounting Standards Board (AASB) is an independent entity established under the Australian Securities and Investments Commission Act 2001. The board is responsible for developing and maintaining accounting standards applicable to all entities that prepare financial reports under the Corporations Act 2001. The primary objectives of the AASB include:

- Ensuring that financial reports provide a true and fair view of an entity’s financial position.

- Aligning Australian standards with IFRS to maintain international comparability.

- Providing guidance on the interpretation and application of accounting standards.

By setting high-quality Australian accounting and auditing standards, the AASB enhances transparency and investor confidence in financial reporting.

Who Needs to Follow AASB Standards?

AASB standards apply to various entities, ensuring financial consistency and compliance across multiple sectors. These include:

- Publicly listed companies –

All publicly traded companies on the Australian Securities Exchange (ASX) must comply with AASB standards. Compliance ensures investor protection, fair valuation, and transparency in financial disclosures. These companies must prepare financial statements in line with AASB requirements to provide accurate financial insights to stakeholders. - Large proprietary companies –

A company is classified as large if it meets at least two of the following criteria:

- Annual revenue of $50 million or more.

- Gross assets of $25 million or more.

- At least 100 employees. Large proprietary companies are required to lodge financial reports with ASIC, ensuring their financial records adhere to AASB standards. This enhances credibility for investors, lenders, and regulatory bodies.

- Government entities –

All federal, state, and local government agencies are required to comply with AASB standards to ensure transparency in public financial reporting. Compliance supports accountability in public sector spending, budgeting, and asset management. - Not-for-profit organisations (NFPs) –

NFPs, including charities, foundations, and associations, are required to follow specific AASB guidelines. These standards ensure accountability in financial management, donor transparency, and compliance with reporting obligations set by the Australian Charities and Not-for-profits Commission (ACNC). Depending on the size of the organisation, different reporting thresholds may apply. - Superannuation funds –

Superannuation entities are also required to adhere to AASB standards to ensure proper accounting for member contributions, fund investments, and benefit payments. - Small businesses (in specific cases) –

While most small businesses are not legally required to follow AASB standards, many opt for small business bookkeeping services to ensure compliance when seeking external financing or reporting to investors..

Failure to comply with the AASB standards can lead to legal consequences, financial penalties, reputational damage, and increased scrutiny from regulatory bodies such as ASIC and the Australian Taxation Office (ATO). Businesses and entities must ensure they stay updated on AASB requirements to maintain compliance and financial integrity.

Categories of AASB Accounting Standards

The AASB Australian Accounting Standards List is divided into various categories, each addressing different aspects of financial reporting:

1. Financial Statement Presentation & Disclosure

- AASB 101 – Presentation of Financial Statements: Establishes the basis for presenting financial statements, ensuring consistency in financial reporting. It mandates the structure and minimum content of financial statements, including the statement of financial position, profit or loss statement, and cash flow statement.

- AASB 108 – Accounting Policies, Changes in Accounting Estimates and Errors: Governs how businesses disclose changes in accounting policies and correct errors, ensuring transparency in financial reporting. This standard ensures that financial information remains relevant and reliable over time.

2. Revenue Recognition

- AASB 15 – Revenue from Contracts with Customers: Defines the principles for recognising revenue, helping businesses report income in a structured and fair manner.

This includes identifying contracts, performance obligations, transaction prices, and revenue allocation across reporting periods.

3. Asset and Liability Standards

- AASB 116 – Property, Plant and Equipment: Provides guidelines on accounting for fixed assets, including depreciation and impairment rules. This standard requires businesses to recognise the cost of an asset and systematically allocate its value over time.

- AASB 140 – Investment Property: Specifies how investment properties should be measured and reported, including fair value and cost models. It ensures that companies accurately disclose how they value and report properties held for rental income or capital appreciation.

4. Financial Instruments

- AASB 9 – Financial Instruments: Governs the classification, measurement, and impairment of financial assets and liabilities, impacting risk management and financial decision-making.

5. Industry-Specific Standards

- AASB 1023 – General Insurance Contracts: Provides rules for accounting in the insurance sector, ensuring accurate recognition of policyholder liabilities and premiums. It ensures that insurers provide clear and comparable information about their financial position and risk exposure.

Key AASB Standards and Their Implications

Several AASB standards have a significant impact on financial reporting:

AASB 16 – Leases

- Requires lessees to recognise assets and liabilities for most leases on their balance sheets.

- Affects financial ratios, gearing calculations, and company valuations.

- Impacts lease accounting disclosures, increasing transparency in financial reports.

AASB 112 – Income Taxes

- Governs the treatment of deferred tax liabilities and assets, ensuring proper tax accounting practices.

- Helps businesses correctly recognise current and future tax obligations, preventing misstatements in financial reports.

- It plays a crucial role in tax compliance for businesses, helping them correctly recognise tax obligations and avoid misstatements in financial reports.

AASB 137 – Provisions, Contingent Liabilities, and Contingent Assets

- Ensures that businesses account for potential financial obligations, reducing uncertainty in financial statements.

- Helps companies disclose future liabilities, such as legal claims or restructuring costs, enhancing financial accuracy.

Recent Updates & Changes in AASB Standards

The AASB continuously updates its standards to align with international best practices. Some of the recent changes include:

- Amendments to AASB 9 – refine the classification of financial instruments, improve hedge accounting rules, and enhance expected credit loss models for better risk management.

- Updates to AASB 15 – provide clearer guidance on contract modifications, variable consideration, and performance obligations, ensuring more accurate revenue recognition.

Common Challenges in Implementing AASB Standards

Many businesses turn to outsourced accounting services to handle the complexities of financial reporting and regulatory updates:

- Complexity of regulations – Some standards require expert interpretation, especially for entities with complex financial structures.

- Frequent updates – Keeping up with changes can be challenging, requiring ongoing education and system updates.

- Technology integration – Adapting accounting systems to new reporting requirements may involve additional costs and staff training.

- Resource constraints – Smaller businesses often struggle with the cost and expertise needed to ensure full compliance.

How Businesses Can Stay Compliant with AASB Standards

To ensure compliance with Australian Accounting Standards Board AASB, businesses should:

- Stay updated – Regularly review AASB updates and amendments.

- Invest in accounting software – Use technology to automate financial reporting.

- Consult experts – Seek professional advice from accountants and financial consultants.

Conclusion

The AASB Australian Accounting Standards List serves as the foundation for financial reporting in Australia. By following these standards, businesses can maintain transparency, ensure regulatory compliance, and improve investor confidence.

Staying updated with the latest changes and seeking expert guidance can help businesses navigate the complexities of Australian accounting and auditing standards effectively.