The persistent talent and skills shortage in Australia continues to pose a significant challenge for organisations across multiple industries. A recent Robert Half study revealed that 89% of Australian employers are concerned about securing top-tier talent to drive their businesses forward.

This growing concern has made business processing and outsourcing an increasingly strategic choice for companies seeking reliable access to high-quality professionals.

In fact, IBISWorld reports that Australia hosts 36,428 business process outsourcing (BPO) businesses in 2024, reflecting a 3.2% growth rate between 2019 and 2024.

With many options available, selecting the right partner is crucial for your outsourcing business. A reliable outsourcing company ensures your goals are met efficiently, while the wrong choice can cause costly setbacks.

Providers must deliver dependable outsourcing services aligned with long-term objectives.

Key Points

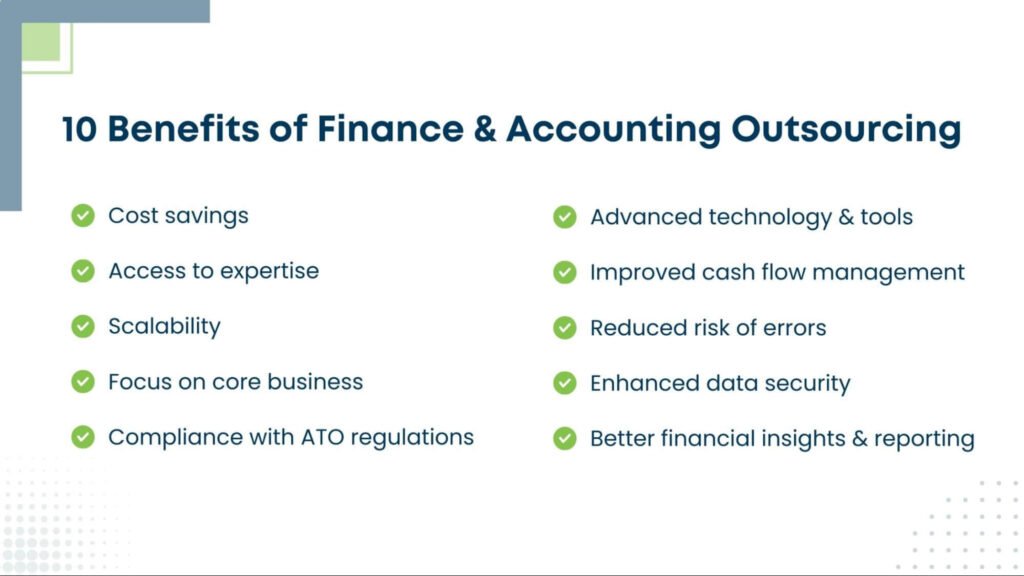

- Australia faces a severe talent and skills shortage, driving demand for outsourcing solutions.

- Business processing and outsourcing are a strategic way to access skilled global professionals cost-effectively.

- India stands out as a hub, with over 4 million professionals powering the global BPO industry.

- Choosing the right outsourcing partner is crucial to ensure efficiency, security, and long-term business growth.

- A reliable outsourcing company provides not just cost savings but also expertise, scalability, and compliance support.

Why Offshore Staffing Matters for Australian Businesses

Offshore staffing, a form of outsourcing, is no longer just a trend, it’s a smart strategy to overcome Australia’s talent shortage. Here’s why:

- Cost Efficiency – Significant savings compared to local hiring, allowing businesses to reinvest in growth.

- Access to Global Talent – Wider pool of qualified professionals to meet skills in demand.

- Competitive Advantage – Staying agile and efficient in the global business landscape.

- Proven Strategy – 86% of Australian business leaders hire overseas staff to address the skills gap, as per Globalisation Partners.

- India as a Hub – Over 4 million professionals work across thousands of BPOs, making India a top destination for offshore staffing. Around 300+ Australian companies currently engage skilled Indian talent for their operations.

Selecting the right partner is critical, choosing a reliable outsourcing company ensures your outsourcing strategy aligns with long-term business goals.

Experience and Expertise: Choosing the Right Outsourcing Partner

Selecting a reliable outsourcing company in Australia requires careful evaluation of their experience and expertise. A partner with a proven track record in your industry can ensure that your offshore team contributes to growth, efficiency, and seamless operations.

When assessing a provider, consider the following in detail:

- Review Their Projects – Investigate the outsourcing company’s previous projects, especially those similar to what you plan to execute. Examine the scope, complexity, and outcomes of these projects to determine whether they have successfully handled challenges comparable to yours.

Understanding their project history provides insights into their operational capabilities and problem-solving skills.

- Evaluate the Management Team – The leadership team is a strong indicator of the company’s professionalism and expertise. Explore the About Us page on their website and review LinkedIn profiles of key managers.

Look for experience in managing projects within your industry, the qualifications of team leaders, and evidence of a proven track record in scaling remote teams effectively.

- Check References – Speaking directly with current and former clients can offer an honest assessment of the outsourcing company’s performance. Ask about service quality, responsiveness, and how challenges were addressed.

Additionally, request referrals to gain a broader perspective on their reliability and effectiveness in delivering business process outsourcing services.

A thorough evaluation of experience and expertise ensures that your outsourcing partner not only meets your immediate project needs but also contributes to long-term strategic success.

Importance of Specialised Expertise in Outsourcing

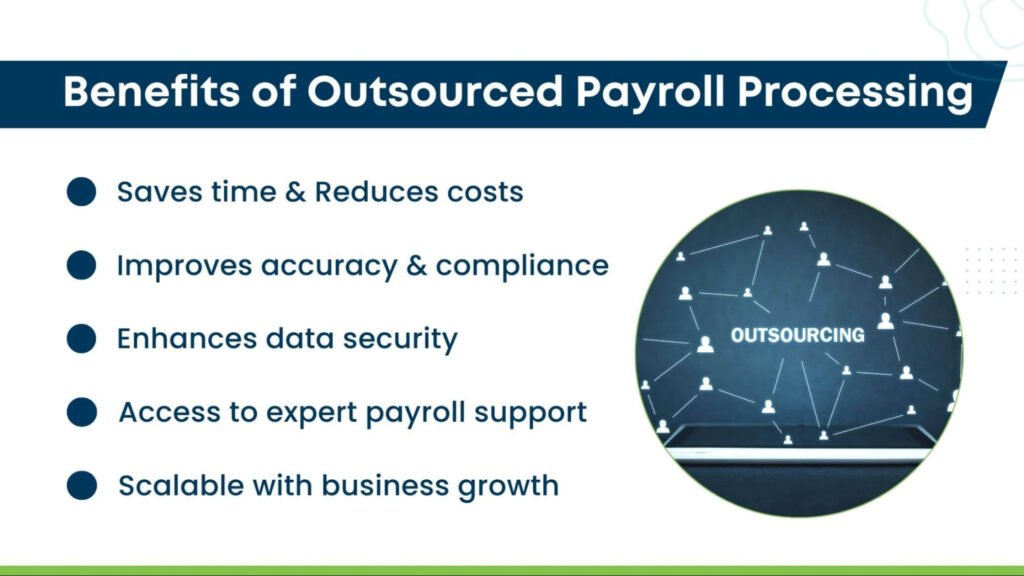

Partnering with a reliable outsourcing company in India can help Australian businesses overcome talent shortages while gaining specialised expertise. Key advantages include:

- Access to Global Talent – With 97% of Australian business leaders highlighting global expansion for competitive advantage, Indian outsourcing companies provide access to highly skilled professionals who can fill critical roles efficiently.

- Cost-Effective Solutions – Engaging offshore teams in India allows Australian companies to leverage expert talent without the high costs of full-time, onshore employees, reducing overall operational expenses.

- Accelerated Business Initiatives – Skilled Indian professionals can handle complex business functions, enabling faster execution of speed-to-market strategies and other critical initiatives.

- Enhanced Focus for Internal Teams – By delegating specialised tasks to Indian offshore teams, local employees can concentrate on core responsibilities, driving growth and efficiency.

- Flexible and Scalable Workforce – Indian outsourcing teams provide the flexibility to scale resources based on business needs while maintaining consistent quality and reliability.

- Proven Expertise – India’s robust BPO and outsourcing industry is renowned for delivering high-quality services across multiple sectors, helping Australian companies innovate and stay competitive without straining budgets.

Choosing a reliable outsourcing company in India with specialised expertise allows Australian businesses to optimise operations, foster innovation, and scale effectively in a competitive market.

Reputation and Reviews: Ensuring a Trustworthy Outsourcing Partner

Selecting a reliable outsourcing company in India is critical for Australian businesses seeking high-quality offshore support. Evaluating the company’s reputation ensures a successful partnership and reduces operational risks. Consider the following best practices:

- Conduct a Thorough Background Check – Research the company online and gather information from trusted sources. Consult your business network for recommendations and verify licences, certifications, accreditations, and industry awards to confirm legitimacy.

- Explore Their Website and Social Media – A credible outsourcing company shares details on services, processes, clients, and team size. Case studies, testimonials, and active social media engagement indicate professionalism and transparency.

- Assess Data Security Measures – Offshore teams often handle sensitive business data. Ensure the provider follows robust data security and privacy protocols to safeguard against cyber threats and maintain compliance with international standards.

- Understand Recruitment Policies and Employee Management – Evaluate the company’s hiring process, including candidate screening, ethical standards, and ongoing performance evaluations. This ensures the offshore team maintains professionalism and accountability.

- Check Reviews and Client Feedback – Online platforms like Glassdoor, Google Business Profile, Google Reviews, and Facebook can provide additional insights into the provider’s reliability, work culture, and service quality. Positive feedback from both clients and employees signals a trustworthy partner.

By thoroughly assessing reputation and reviews, Australian businesses can confidently select a reliable outsourcing company in India that delivers consistent, high-quality business process outsourcing services while protecting operational and data integrity.

This same due diligence applies when engaging payroll outsourcing companies to handle payroll operations securely and accurately.

Importance of Client Testimonials and Case Studies

- Showcase Reputation and Expertise – Testimonials highlight real client experiences and satisfaction.

- Gauge Trustworthiness – Potential clients rely on feedback to assess reliability and capability.

- Demonstrate Proven Performance – Case studies provide detailed reports on strategies, challenges, and outcomes.

- Highlight Problem-Solving Skills – Real client pain points make the testimonials and case studies relatable and compelling.

- Support Decision-Making – Helps Australian businesses evaluate whether the offshore provider can meet their outsourcing needs.

Service Offerings

- Assess Alignment with Business Goals – Ensure the offshore provider supports your growth and strategic objectives.

- Evaluate Service Capabilities – Check the range and quality of outsourcing services offered.

Review Past Successes – Consider case studies and testimonials to verify results for similar projects. - Consider Scalability – Partner should provide flexibility to scale offshore teams as business demands grow.

- Ensure Cost-Effectiveness – Evaluate pricing models to balance quality with budget efficiency.

Communication and Support

- Clear Communication Channels Are Crucial – Poor communication is a leading reason outsourcing partnerships fail.

- Set Expectations Early – Clearly define project requirements and goals from the start to avoid misinterpretation.

- Overcome Language and Cultural Barriers – Address potential misunderstandings between Australian clients and Indian offshore teams to maintain smooth collaboration.

- Provide Regular Updates – Frequent reporting ensures timely decision-making, builds trust, and reduces delays.

Cultural Fit

- Address Cultural Differences Early – Misaligned cultural expectations can derail offshore operations.

- Foster Intercultural Communication – Proactive discussions help Australian clients and Indian offshore teams find common ground.

- Promote Collaboration – Shared understanding improves teamwork, efficiency, and trust.

Technology and Security

- Evaluate Hardware and Software – Ensure systems are updated and compatible with your business tools.

- Check for Scalability – Tech infrastructure should support growth without compromising performance.

- Assess Data Security Measures – Review cybersecurity protocols, encryption, firewall protection, and regulatory compliance.

- Verify Backup and Disaster Recovery Plans – Confirm data restoration and business continuity in case of outages or cyberattacks.

- Review Network Connectivity – Stable, high-speed internet is essential for seamless collaboration.

- Inspect IT Support – Confirm 24/7 IT support, regular maintenance, and quick issue resolution.

- Evaluate Cloud Platforms – Ensure cloud infrastructure is secure, reliable, and suitable for your business needs.

Conclusion

Choosing the right outsourcing partner for your Australian business may feel overwhelming, but with a reliable outsourcing company from India, the process can be streamlined. The right provider ensures your offshoring strategy aligns with business goals, maintains quality standards, and delivers cost-effective solutions without straining operational expenses.

At NCS Australia, we connect businesses with highly skilled Indian professionals through end-to-end managed services. With a proven approach, robust IT infrastructure, and strict data security protocols, your offshore team can operate efficiently while supporting your growth and compliance needs.