Australian Monthly & Quarterly Superannuation Due Dates 2025

- Aesha Shah

- June 11, 2025

- 6 minutes

- Blogs

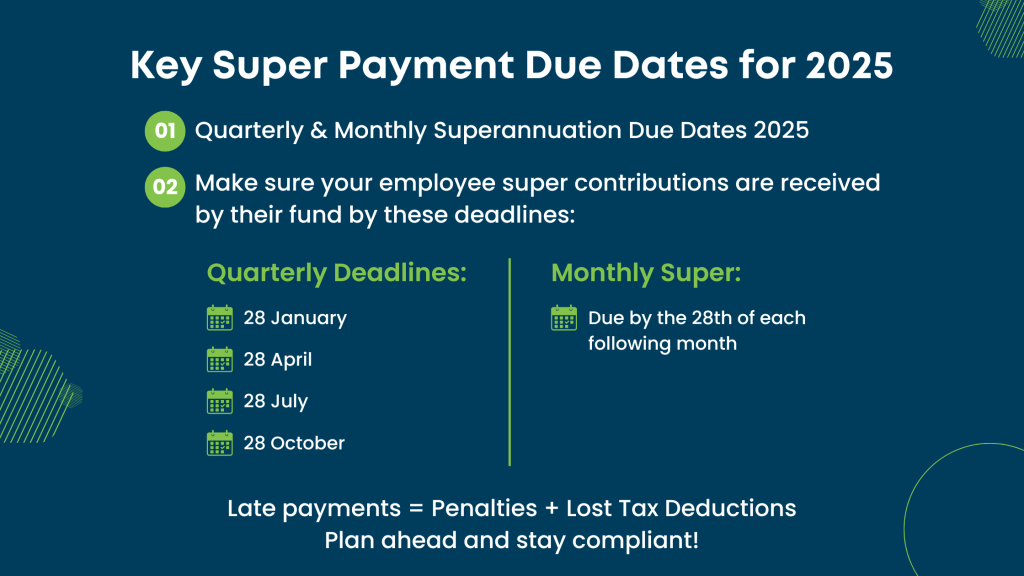

When you run a business in Australia, paying superannuation on time is more than a compliance task, it’s a core responsibility to your employees. Late payments not only hurt your workers’ future savings, but can also result in financial penalties for your business and the loss of tax deductions.

As reported by the Australian Prudential Regulation Authority (APRA) in March 2025, total superannuation assets reached $4.1 trillion, with $2.9 trillion held in APRA-regulated funds. This vast pool underscores the importance of timely contributions. Even minor delays can have a ripple effect across the broader system.

Understanding the quarterly superannuation due dates for 2025, and knowing when you’re expected to pay can help you stay on track and avoid unnecessary trouble. This guide clearly breaks down both the monthly super payment deadlines and the key super guarantee due dates for Australia in 2025, so you can plan ahead with confidence.

Who Needs to Pay Superannuation?

If you’re an employer in Australia, you must pay super for:

- Full-time, part-time, and casual employees

- Contractors who are paid mainly for their labour

The Super Guarantee (SG) requires you to contribute a percentage of an employee’s ordinary time earnings into their nominated super fund. The superannuation guarantee (SG) rate increases to 11.5% on 1 July 2024 and is legislated to rise to 12% on 1 July 2025.

Understanding Monthly vs Quarterly Super Obligations

Most employers in Australia are required to make super payments quarterly. However, some employers may have obligations to pay monthly based on industrial awards, enterprise agreements, or internal business policies.

- Quarterly: Default for most businesses

- Monthly: May apply if you’re in certain industries or under specific agreements

Choosing to pay monthly voluntarily can help smooth out cash flow and reduce the risk of missing deadlines, especially for smaller businesses.

Quarterly Superannuation Due Dates 2025

These are the standard quarterly superannuation due dates 2025 that apply to most employers:

| Quarter | Period Covered | Payment Due Date | Notes |

|---|---|---|---|

| Q1 | 1 Jan – 31 Mar | 28 April 2025 | Payments made after this date are not tax-deductible |

| Q2 | 1 Apr – 30 Jun | 28 July 2025 | Consider EOFY activities and staff leave |

| Q3 | 1 Jul – 30 Sep | 28 October 2025 | Avoid clashes with Q1 BAS deadlines |

| Q4 | 1 Oct – 31 Dec | 28 January 2026 | Plan ahead for holiday closures |

These superannuation payment due dates 2025 are non-negotiable. If a due date falls on a weekend or public holiday, payment must be made by the next business day.

For now, employers must follow the quarterly timeline carefully to remain compliant, but change is coming.

As covered by 7News Australia, starting 1 July 2026, employers will need to pay superannuation at the same time as wages, a reform known as Payday Super. The move is designed to ensure employees receive their entitlements faster, reducing the risk of unpaid super. While this doesn’t impact the quarterly superannuation due dates 2025, it marks a significant shift employers should prepare for in advance

Monthly Super Payment Due Dates in Australia

While quarterly payments are common, some employers are required to make monthly contributions under certain rules. If you’re required to follow monthly cycles, here are the general monthly super payment due dates Australia:

| Month | Payment Due Date |

|---|---|

| January 2025 | 28 February 2025 |

| February 2025 | 28 March 2025 |

| March 2025 | 28 April 2025 |

| April 2025 | 28 May 2025 |

| May 2025 | 28 June 2025 |

| June 2025 | 28 July 2025 |

| July 2025 | 28 August 2025 |

| August 2025 | 28 September 2025 |

| September 2025 | 28 October 2025 |

| October 2025 | 28 November 2025 |

| November 2025 | 28 December 2025 |

| December 2025 | 28 January 2026 |

Each payment must be received by the employee’s super fund by the due date. Always allow a few days for fund processing, especially if using clearing houses. Whether you process contributions monthly or quarterly, partnering with firms that offer financial services outsourcing can ease your administrative load. This is especially helpful when managing contributions for multiple employees.

What If You Miss a Super Deadline?

Missing your ATO super payment due dates 2025 triggers several issues:

- Super Guarantee Charge (SGC):

You must lodge a Super Guarantee Charge Statement and pay the SGC to the ATO. - Loss of Tax Deduction:

Contributions made after the deadline are no longer tax-deductible. - Interest & Administration Fees:

SGC includes interest (currently 10%) and a $20 admin fee per employee, per quarter.

You must lodge an SGC statement, even if you pay shortly after the deadline.

Super Contribution Deadlines in Australia: Why They Matter

Aside from avoiding penalties, staying on top of super contribution deadlines Australia is essential for business efficiency and trust. Employees rely on their super payments being made consistently and correctly. It also shows that your business takes compliance seriously.

Staying Ahead of Super Obligations

Here are a few ways to make managing super contributions easier:

- Automated Payroll Software:

Choose a system that integrates with super clearing houses to automatically calculate and submit payments. - Calendar Reminders:

Sync all superannuation payment due dates 2025 to your business calendar. - Internal Controls:

Allocate responsibilities clearly within your finance team. - Professional Support:

Working with a qualified bookkeeper or accountant ensures accuracy and timeliness. This is especially useful if you’re juggling multiple obligations like BAS, payroll, and reporting.

Many employers find that staying compliant with payment schedules and contribution rules can be time-consuming and confusing, especially as legislation evolves. Engaging an outsourced super expert can help streamline this process and reduce the risk of penalties.

Super and Tax: The Timing Connection

Timely super payments are not just a compliance issue; they also impact your business’s tax position. Super contributions are only tax-deductible in the financial year they’re received by the fund. Paying early in June ensures you can claim the deduction in that year. Paying late means the deduction shifts to the next financial year, or is lost entirely if you’re hit with the SGC.

Looking Ahead: Policy Changes and Reforms

The superannuation landscape is evolving, and not just in terms of payment timelines.

According to News.com.au, the government has proposed a new tax, Division 296, that would apply an additional 15% tax on superannuation earnings for individuals with balances exceeding $3 million. It’s estimated this would affect around 80,000 Australians and generate $2.3 billion annually.

While this measure won’t change the ATO super payment due dates 2025, it’s a signal of greater scrutiny around high balances and the push for a fairer system. Employers, particularly those managing super for high-income earners, should stay informed about these changes to avoid future surprises.

With upcoming changes like Payday Super and Division 296, businesses may find value in seeking superannuation administration support to remain compliant and future-ready.

Frequently Asked Questions (FAQs)

1. What are the quarterly superannuation payment due dates for 2025?

The quarterly superannuation due dates for 2025 are 28 January, 28 April, 28 July, and 28 October. Payments must be received by the fund by these dates. Initiating the payment isn’t enough. If it’s late, you risk penalties and losing tax deductibility.

2. When are monthly superannuation payments due in 2025?

Employers who report monthly must ensure super is received by the fund by the 28th of the following month. Industry awards or contracts may require earlier payment. Timely processing is essential to stay compliant and avoid penalties or reporting issues.

3. What happens if a super payment due date falls on a weekend or public holiday?

If a superannuation due date falls on a weekend or public holiday, the payment must reach the employee’s fund by the last business day before that date. Late payments even by one day can result in penalties or Super Guarantee Charge (SGC) obligations.

4. What are the consequences of late super payments?

Late super payments trigger the Super Guarantee Charge (SGC), which includes 10% interest, admin fees, and loss of tax deductions. You must also submit an SGC statement to the ATO. Even a one-day delay can create extra reporting and financial burdens.

5. How does using a clearing house affect super payment dates?

Using a clearing house doesn’t change your obligation. Payments must be made early enough often 5 to 10 business days ahead for the fund to receive them by the due date. The ATO only considers the payment complete once it reaches the employee’s fund.

6. Are there plans to change the frequency of super payments?

Yes. From 1 July 2026, the Payday Super reform will require employers to pay super on payday, not quarterly. According to the ATO, this change is designed to reduce unpaid super and improve retirement outcomes. The 2025 rules still remain in effect.