Australian Federal Budget 2025–26 Summary for Advisors

- Aesha Shah

- June 27, 2025

- 6 minutes

- Blogs

Australian Federal Budget 2025 Summary: Key Takeaways for Advisors

The Australian federal budget 2025 summary is out, and it’s already sparking discussions among financial professionals, business owners, and everyday Aussies alike. With a clear shift in tone from the previous two surplus years, this budget steps into deficit territory again. But unlike the doom-and-gloom predictions you might expect, there’s a deliberate strategy behind the scenes.

Let’s break it all down in a way that makes sense, especially for advisors looking to translate government speech into real-world action for their clients.

A Quick Look: What’s Different This Year?

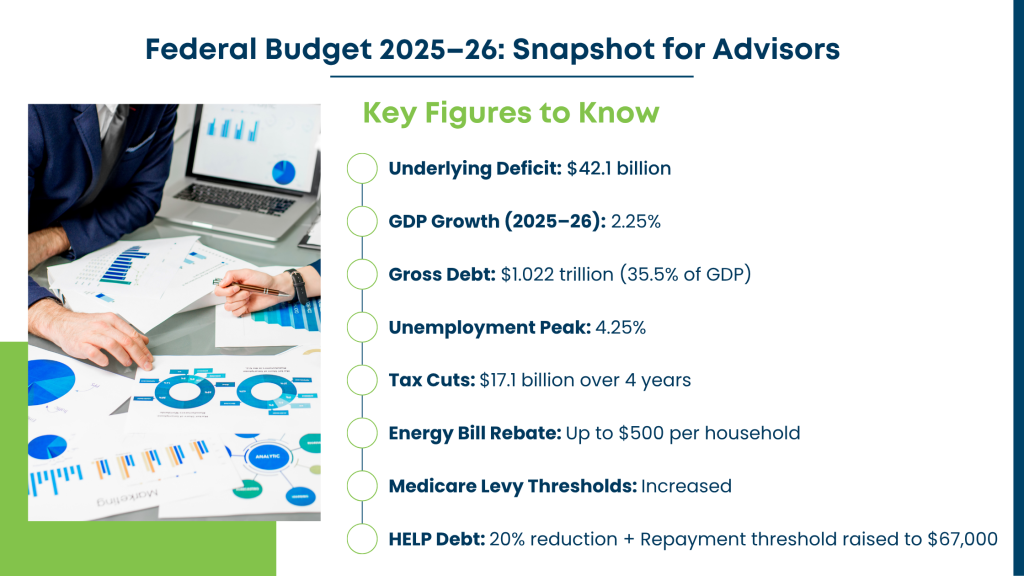

This year’s federal budget 2025-26 Australia pivots away from fiscal restraint and moves toward relief, without going full throttle on spending. Treasurer Jim Chalmers handed down the budget on 25 March 2025, forecasting an underlying cash deficit of $42.1 billion, marking the end of the recent surplus streak. While this may sound concerning, there’s more nuance when you dig into the actual numbers.

Australia’s economy is still expected to grow by 2.25% in 2025–26, with inflation cooling within the Reserve Bank’s target range. Unemployment is forecast to peak around 4.25%, which is relatively stable.

So, while the headline may be about a deficit, the broader fiscal policy in Australia remains focused on sustainable growth, affordability, and productivity.

Why Advisors Should Care

Let’s face it, many clients skim over budget headlines or get lost in the jargon. But a well-informed advisor can turn dry announcements into clear opportunities or warnings. Whether you’re advising individuals, small business owners, or investors, understanding the summary of the federal budget helps you guide them with clarity.

The 2025–26 Budget introduces several policy changes that impact tax, rebates, student debt, housing affordability, and healthcare. Knowing what’s new (and what’s not) can help advisors recalibrate strategies for tax planning, investment, and compliance.

Tax Cuts Take Centre Stage

Let’s start with what most people want to know, tax cuts federal budget 2025.

With tax brackets shifting and new savings opportunities emerging, advisors using outsourced accounting support can stay nimble. Having access to up-to-date modelling, forecasting, and compliance reviews makes it easier to adjust strategies quickly without overloading in-house teams.

This year’s budget delivers around $17.1 billion in tax cuts over four years. Here’s the breakdown:

- The 16% tax bracket drops to 15% from July 2026, and again to 14% from July 2027.

- Low and middle-income earners will see modest increases in their take-home pay, around $268 in 2026–27 and $536 in 2027–28.

These savings vary by income level. If you’re curious about how much your clients or business owners might save, 9News has a detailed breakdown of what “every single Australian taxpayer” can expect from the 2025 tax cuts. For financial planners, this is a cue to revisit cash flow planning and tax minimisation strategies with clients. Even though the cuts aren’t massive, they can influence super contributions, savings decisions, and debt repayment strategies.

Cost-of-Living Relief: Who Gets It?

A big portion of the federal budget summary focuses on easing cost-of-living pressures. Here’s what stands out:

- Energy bill rebates (up to $500 per household) will continue until December 2025.

- Medicare levy thresholds have been raised, meaning more Australians on lower incomes will pay less or no Medicare levy.

- PBS medicine prices are being capped, offering ongoing relief for households dealing with chronic health conditions.

This is great news for retirees, young families, and low-income earners. Advisors should take note from this Government Fact Sheet, this budget offers some breathing room but also signals that clients may lean more heavily on rebates and relief programs to balance their budgets. The budget’s cost-of-living focus spans rebates, Medicare thresholds, and student debt relief. The Guardian’s summary provides a useful overview of these targeted measures in one place.

Super, Student Debt, and Health: What’s New?

While there were no major superannuation policy changes, there are developments worth noting:

1. HELP Debt Relief

- A 20% reduction in student debt is on the table for past indexation shocks.

- The repayment threshold will rise from $54,000 to $67,000.

This matters for young professionals and graduates just entering the workforce. It also changes how advisors model cash flow for those juggling debt and savings.

2. Healthcare Upgrades

- $8.4 billion is being invested into bulk-billing and urgent care clinics.

- 50 new urgent care centres are being rolled out, including 17 in regional areas.

While there were no sweeping changes to superannuation, the rising importance of accurate contributions, recordkeeping, and timing strategies means many firms are relying more heavily on outsourced super services to ensure accuracy, efficiency, and compliance. compliance.

Housing & Infrastructure: Investment with a Twist

The government has made bold moves in the housing space, aiming to address affordability and supply issues head-on:

- Ban on foreign investors buying existing homes starting April 2025.

- An extra $10 billion for the Housing Australia Future Fund.

- Funding for social and affordable housing projects continues to rise.

On the infrastructure side, there’s a hefty $17.1 billion spend on transport, education, and energy projects, including major regional developments. That’s important not just for job creation but also for long-term investment opportunities in affected sectors.

Small Business and Investment Takeaways

The budget keeps it simple here:

- The instant asset write-off remains available for small businesses until June 2025.

- Energy-efficiency grants are available to help SMEs lower their operational costs.

- No new tax hikes for businesses, just a steady push to comply with ATO rules.

For accountants and bookkeepers, this means minimal disruption in the short term but continued emphasis on proper record-keeping and planning. The compliance net is tightening, especially with nearly $1 billion allocated to boost ATO enforcement.

Industry and Sustainability: Green is the Theme

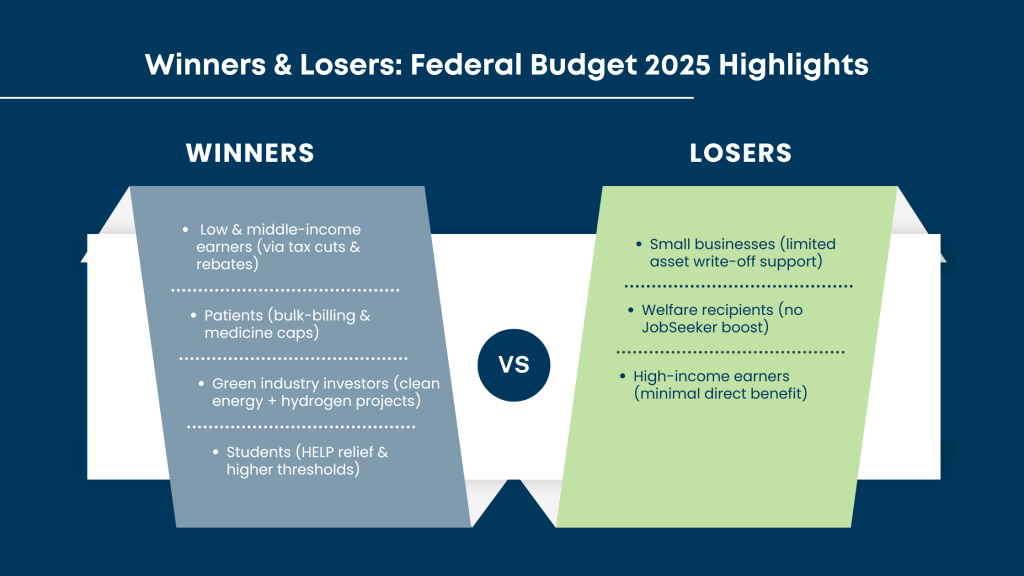

The federal budget 2025 winners and losers list includes a clear winner: the green economy.

Under the “Future Made in Australia” plan, billions are being directed to:

- Green hydrogen projects

- Battery production

- Critical minerals mining

- Even Whyalla’s green steel plant is getting a multi-billion-dollar boost

Investors with an eye on ESG (Environmental, Social, and Governance) should pay close attention here. The government is making long-term bets on clean energy, and advisors can help clients align portfolios accordingly.

Education, Skills, and the Next Generation

A strong focus on skilling up the workforce is evident:

- More investment in free TAFE and early childhood education.

- Universities get reform funding, but the spotlight is really on accessibility and affordability.

This shift isn’t just about future jobs; it’s also about recalibrating fiscal policy in Australia to ensure long-term resilience and reduced reliance on temporary migration for skills shortages.

Election Vibes and What’s Missing

While not explicitly branded as a pre-election budget, there are signs:

- Tax cuts, rebates, and debt relief appeal to the majority demographic.

- No major structural reforms or disruptive announcements.

- Some measures (like changes to capital gains or trust reforms) have been quietly delayed, likely until after the election.

So, if you’re an advisor looking to forecast future policy risks, this is your cue: the summary of the federal budget gives you the big picture, but there’s plenty happening behind the curtain.

Final Thoughts for Advisors

In summary, the Australian federal budget 2025 summary isn’t just about dollars and deficits. It’s about subtle shifts that affect real people, your clients.

Here’s what advisors should focus on:

- Update tax planning assumptions based on bracket changes.

- Advise eligible clients to take advantage of rebates, grants, and student debt relief.

- Revisit cash flow and investment planning for clients impacted by healthcare, housing, and green industry changes.

- Keep an eye on compliance and potential changes deferred until after the next election.

As policies evolve, firms that leverage financial services outsourcing will be better equipped to respond with speed, accuracy, and insight, no matter what the next federal budget delivers.

While the government manages the macroeconomics, advisors can make a real difference by translating the federal budget summary into meaningful advice that helps Australians make smarter decisions.