It’s 2025, and AI is no longer a buzzword in the accounting world, it’s a daily reality. Whether you’re running a solo bookkeeping business or managing a mid-sized CPA firm, chances are you’ve already come across the rising chatter around ChatGPT in accounting practice and the growing universe of accounting AI.

As firms try to keep up with modern demands, many are turning to tech-powered solutions alongside traditional outsourcing accounting service models, blending human support with AI-powered tools for a smarter workflow

But how practical is it really? Can AI genuinely support accounting tasks without risking accuracy, compliance, or client trust? And what’s the smart way to start?

Let’s break down how firms are using AI today, what tools are gaining traction, and where it’s all headed

The Rise of AI and Accounting in 2025

The accounting profession is no stranger to technology. Spreadsheets once felt revolutionary; then came cloud accounting platforms, automation for bank feeds, and now, AI tools for accounting that think, write, and analyse like never before.

In 2025, we’re seeing firms big and small embedding accounting AI software into everyday workflows. From automatically categorizing transactions to generating management reports with natural language summaries, AI isn’t just automating tasks, it’s augmenting how accountants deliver value.

What Is ChatGPT and Why Is It Making Waves?

ChatGPT for accountants refers to the use of OpenAI’s language model (like the one you’re reading from now) to support financial professionals with tasks that involve text, logic, research, or workflow design.

Here’s what it’s capable of:

- Summarizing tax law updates or accounting standards

- Drafting email replies to client queries

- Creating templates for engagement letters or SOAs

- Explaining financial ratios in plain English

- Generating first drafts of cash flow narratives or monthly board reports

Essentially, ChatGPT in accounting practice is like having a hyper-efficient assistant that can read, write, and think across multiple domains, with the caveat that human review is still essential for anything regulatory, legal, or sensitive.

How Are Firms Using AI for Accounting in 2025?

A recent article in The Australian reported that most Australian companies are now using AI across their financial processes, from budgeting to compliance workflows. The uptake is no longer limited to tech firms, even traditional finance teams are using AI to support operations and decision-making. Here’s a look at where AI for accounting firms is making an actual difference:

1. Client Communication & Admin

Need to explain GST changes to a client in layman terms? Or summarize a 15-minute meeting in two sentences? ChatGPT handles that swiftly, letting teams focus more on the actual client work.

2. Compliance & Reporting

AI helps flag anomalies in general ledgers, generate initial drafts of reports, and even identify missing supporting documents. It’s not replacing accountants, it’s helping them be faster and more confident.

3. Bookkeeping & Reconciliations

AI-powered tools can auto-match transactions, detect duplicates, or highlight GST inconsistencies before BAS time. This blends beautifully with cloud software like Xero, MYOB, or QuickBooks.

4. Training & SOP Support

Internal teams are using AI to create onboarding guides, help junior staff understand workflows, and even troubleshoot common software issues, all through conversational AI tools.

Real-World Use Cases of ChatGPT in Accounting Practice

To make it even more tangible, here are examples of how firms are using ChatGPT right now:

- Advisory Reports: Generating narrative analysis to accompany profit & loss comparisons

- ATO Correspondence Drafts: Creating the first draft of client response letters for ATO queries

- FAQs for Clients: Building a living document of answers to common accounting and tax questions

- Workflow Checklists: Auto-generating task lists for tax season prep or new client onboarding

In many mid-sized firms, it’s common to see an outsourced bookkeeping expert collaborating with AI tools like ChatGPT, together speeding up everything from reconciliations to board-ready reports. It’s this hybrid approach that’s proving most effective in 2025.

These are all time-intensive tasks that benefit from speed, consistency, and a first draft that’s 80% there, giving you time back for review, client insights, and higher-level thinking.

Benefits of Using Accounting AI in 2025

The firms that are thriving today aren’t necessarily bigger, they’re just smarter with their tools.

A 2025 feature by The Australian highlighted how major accounting firms have freed up substantial time for their staff thanks to AI, with some reporting a 50% reduction in admin hours. This means more bandwidth for analysis, strategy, and client-facing work. AI is clearly doing more than automating, it’s actively reshaping the role of accountants.

Here’s why more accountants are leaning into AI:

- Time efficiency: Get 10 hours’ worth of admin done in 3 hours

- Accuracy support: Catch mistakes earlier, especially on routine items

- Better client experience: Quicker replies, clearer reports

- Competitive edge: Smaller firms can offer high-value services like advisory or insights, not just compliance

AI isn’t just doing the job, it’s elevating the way professionals work.

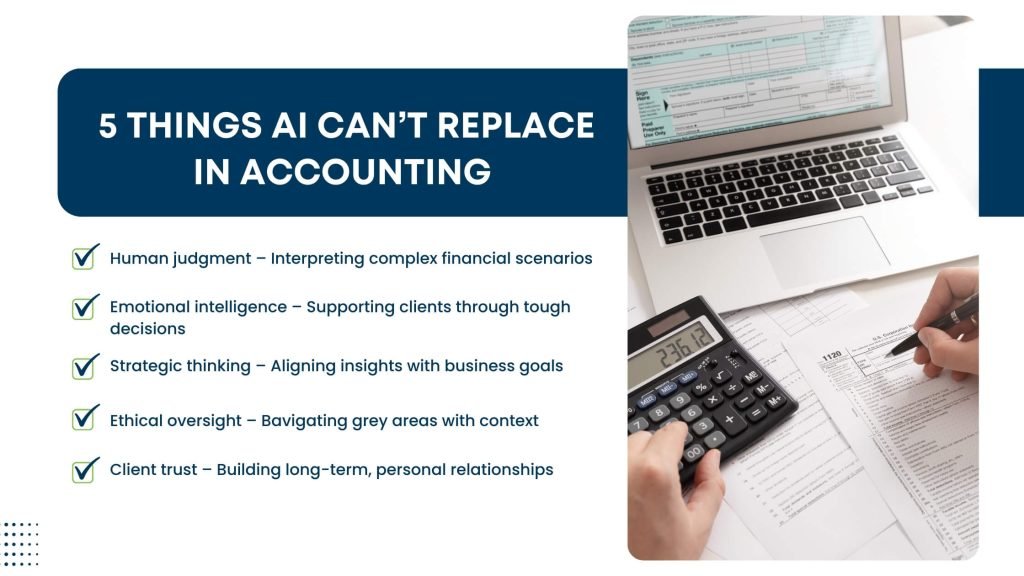

Cautions and Limitations

As useful as accounting AI software is, it isn’t magic.

Some key risks include:

- Data privacy: Uploading sensitive client data into public AI tools can breach confidentiality rules

- Regulatory compliance: AI can’t (and shouldn’t) give tax or legal advice

- Accuracy: AI can hallucinate, that is, confidently make up wrong answers, unless closely supervised

- Overdependence: Relying too much on AI for judgment-based work can lead to poor decision-making

So how do you stay safe? Use secured, enterprise-level AI tools, don’t input confidential information into public tools, and always validate AI output, just as you would when delegating to a junior team member.

Compliance and Ethics in the Age of AI

In Australia and other regulated jurisdictions, accounting bodies like CPA Australia, CA ANZ, and the TPB are watching AI adoption closely.

Firms must:

- Ensure AI tools don’t breach professional codes

- Avoid using AI for tasks requiring professional judgment (e.g., tax advice)

- Establish internal policies for AI use (e.g., client consent, disclosure)

It’s not about fearing AI, it’s about integrating it responsibly.

AI and Accounting 2025: What’s Next?

Still, there’s a word of caution. According to Deloitte’s comments reported in The Australian, Australia’s “she’ll be right” mindset may be putting firms at risk of being left behind. As global adoption accelerates, local firms need to act fast or lose their competitive edge.

Expect continued evolution, including:

- Predictive analysis that offers cash flow projections based on seasonality

- Client dashboards powered by AI, highlighting business health in real time

- Natural language interfaces within accounting software (e.g., “Show me overdue invoices for clients spending over $10,000”)

- Voice-command bookkeeping: think Siri or Alexa, but for finance

The line between accountant and technologist is blurring. Those who embrace this hybrid role will lead the future of the profession.

How to Introduce AI into Your Accounting Firm

If you’re wondering where to start, here’s a practical roadmap:

- Audit your current workflows

Identify where time is being lost or repeated tasks occur. - Start small

Use AI for low-risk tasks like internal checklists, email drafting, or SOP creation. - Train your team

Introduce AI literacy sessions and make AI use part of your firm culture. - Use the right tools

Explore AI tools for accounting that offer business-grade security, integration, and reliability. - Review & Refine

Always monitor how tools are being used, where accuracy dips, and how AI is impacting client outcomes.

Final Thoughts: Accounting AI Is Here, And It’s Useful When Used Wisely

To answer the big question: Yes, you can use AI and ChatGPT in accounting practice in 2025, and many already are.

Whether you’re adopting ChatGPT for accountants, exploring broader AI tools for accounting, or simply testing out accounting AI software or exploring outsourcing financial processes alongside AI, the goal remains the same: to work smarter, not harder.

AI isn’t about replacing professionals, it’s about empowering them.

Use it to save time. Use it to communicate better. Use it to stay ahead. It’s not something to fear. It’s something to shape.