If you’ve been paying attention to the evolving rules around retirement savings, you’ll know that superannuation in Australia is rarely ever still. New rules, new thresholds, new responsibilities, and 2025 is no exception. With a fresh round of updates kicking in from 1 July, there’s a lot to unpack.

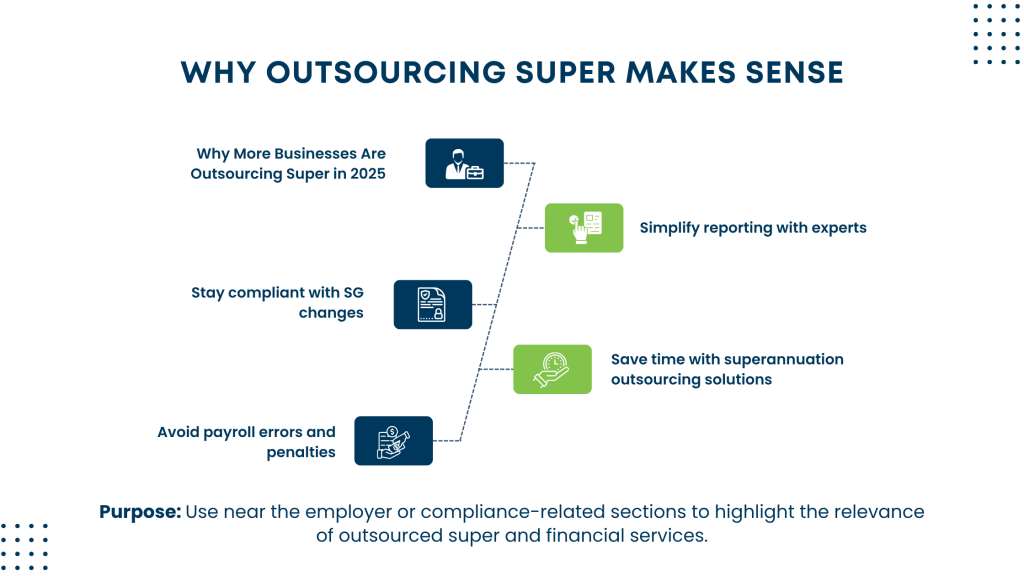

Whether you’re an employer trying to stay compliant or a worker making the most of your contributions, or someone managing payroll through outsourced super services, these superannuation changes 2025 will likely affect you.

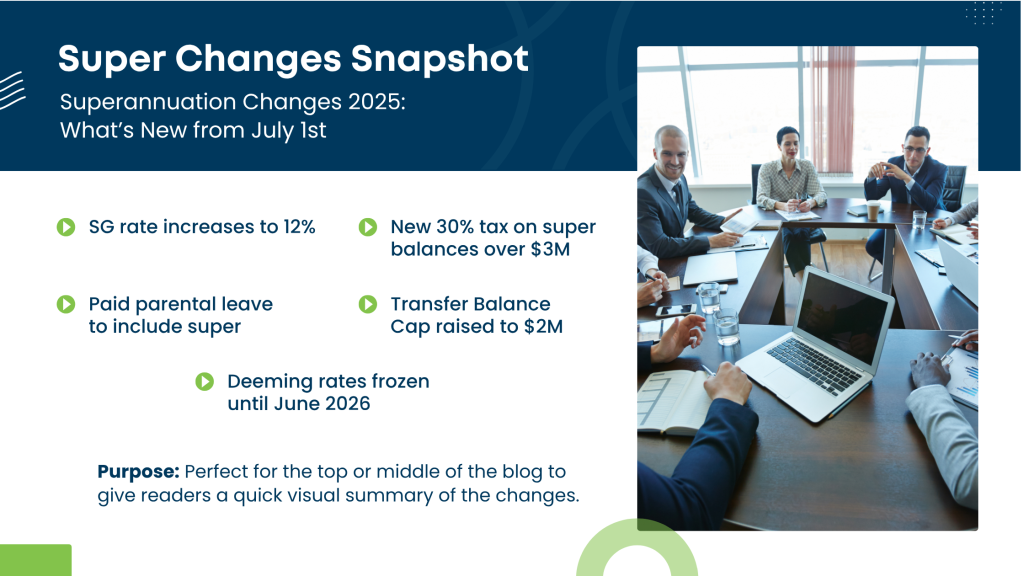

From increases to the super guarantee rate to a new tax on high super balances, these adjustments are designed to modernise the system, but they come with some fine print.

Let’s break it down, section by section.

The Super Guarantee Rate Is Set to Hit 12%

This one’s been a long time coming. As part of a phased approach introduced years ago, the Australian super percentage 2025 will officially increase from 11.5% to 12% on 1 July 2025. That means for every dollar you earn (up to the maximum super contribution base), your employer will now contribute 12 cents into your super fund.

According to a recent report by News.com.au, this boost could translate into $125,000 more in retirement savings for a 30-year-old on a $100,000 salary by the time they retire. Even someone earning the median wage of $75,000 could see an extra $20,000, helping many Aussies inch closer to the comfortable retirement benchmark of $595,000.

So what does this mean?

If you’re an employee, it’s great news, more money goes toward your retirement without any extra effort on your part. And for employers? It’s a signal to double-check your payroll systems and budgeting plans.

The rise to 12% marks the final step in the series of superannuation rate changes that started in 2021.For many small businesses, managing the SG increase alongside routine payroll can stretch internal resources. That’s why more employers are turning to superannuation outsourcing solutions, giving them peace of mind around compliance and reporting accuracy.

New 30% Tax on Super Balances Above $3 Million

This is one of the more debated updates and is considered one of the more notable Labor superannuation changes in recent years.

Starting from 1 July 2025, individuals with superannuation balances over $3 million will face an additional tax. Specifically, earnings on the portion of their balance exceeding $3 million will be taxed at 30%, instead of the usual 15%.

Why is this happening?

The government argues it’s about fairness, ensuring that tax concessions within the super system are better targeted. While it only impacts a small percentage of account holders (around 0.5% of Australians), those with self-managed super funds (SMSFs) or large defined benefit schemes might need to reconsider their strategies.

In fact, as highlighted by The Guardian, only around 80,000 Australians, less than 0.5% of account holders, are expected to be affected. The reform, which has drawn both support and criticism, aims to improve equity by better targeting super tax concessions.

Expect more focus on rebalancing, capital gains considerations, and potential early withdrawals.

Transfer Balance Cap Lifts to $2 Million

The Transfer Balance Cap, the limit on how much you can move into a tax-free retirement income stream, is increasing from $1.9 million to $2 million.

This change is more than just a technical adjustment. If you’re nearing retirement, this increase offers more headroom to move funds into the pension phase, where earnings are typically tax-free.

It also means:

- More flexibility for retirement planning

- Better estate planning options

- Opportunities to review timing of pension commencement

This change is part of a broader set of changes to superannuation Australia that aim to give retirees more breathing room.

Contribution Caps: No Change, But Timely Reminders

Not all thresholds are shifting. The concessional contribution cap remains at $30,000 for FY 2025–26, and the non-concessional cap stays at $120,000. However, one important timeline to remember: unused concessional contributions from 2019–20 will expire at the end of 2024–25.

If you’ve been carrying forward unused concessional caps under the five-year rule, this is your last chance to use the 2019–20 portion before it disappears. So if you’ve had inconsistent income over the past few years (say, due to a career break or COVID-related slowdown), this might be the year to catch up.

Paid Parental Leave Will Now Attract Super Contributions

Historically, one of the big gaps in Australia’s super system has been how paid parental leave is treated. In most cases, superannuation wasn’t paid during this time, which disproportionately impacted women.

Starting from 1 July 2025, this changes.

The government will begin paying the super guarantee on the Commonwealth Paid Parental Leave scheme, giving a much-needed boost to those who take time out for caregiving.

Although the actual payments will commence from 1 July 2026, the policy will be effective from 2025. It’s a major win for equity in retirement outcomes and reflects growing awareness of the gender super gap.

According to abc.net.au, the reform is expected to benefit approximately 180,000 families every year. Based on the full 26 weeks of parental leave, this could add up to over $3,000 in super contributions per parent, making it one of the most meaningful superannuation changes July 2025 Australia has seen for carers and women.

Deeming Rates Frozen Until Mid-2026

While not strictly part of super fund management, deeming rates directly impact Age Pension eligibility and income assessments. The government has extended the freeze on deeming rates until 30 June 2026.

For retirees, this means:

- More predictable Centrelink assessments

- Stability in planning retirement income streams

- A potentially higher Age Pension payment if actual earnings exceed deeming assumptions

This complements the broader superannuation changes July 2025 Australia by giving retirees and near-retirees one less variable to worry about, at least for another year.

Coming Soon: Payday Super from July 2026

While it doesn’t kick in until the following year, it’s worth mentioning that from 1 July 2026, employers will be required to pay super on the same day as wages.

Dubbed “payday super,” this reform will:

- Reduce unpaid super issues

- Improve retirement savings compounding

- Require major updates to business payroll systems

Although it’s not part of the changes proper, businesses and bookkeepers should start preparing now to avoid a last-minute scramble next year.

Who Is Impacted Most?

Here’s a quick overview of how different groups may be affected:

- Employees: More in super due to the 12% SG, plus long-term benefits from parental leave reforms

- High net worth individuals: Hit with extra tax on super earnings over $3 million

- Employers: Face higher super outgoings and must prepare for future payday super

- Near retirees: Get a boost from the raised Transfer Balance Cap

- Women and primary carers: Benefit from SG contributions during paid parental leave

- SMSF holders: Must reconsider tax and contribution strategies

What Should You Do Now?

Here are some practical steps to consider before and after 1 July 2025:

For employers:

- Update payroll systems for the super guarantee rate 2025 (12%)

- Prepare communications for your staff

For employees:

- Review your contributions and check if you can take advantage of carry-forward caps

- Look at your total super balance, will the high-balance tax affect you?

For SMSF trustees and financial planners:

- Assess which members are approaching the $3 million threshold

- Discuss the impact of the increased Transfer Balance Cap with clients

Final Thoughts

The superannuation changes 2025 are part of an evolving retirement system that tries to balance fairness, sustainability, and future-proofing. While some changes (like the high-balance tax) are stirring debate, others, such as the parental leave super and the SG increase, are broadly welcomed.

As with all financial rules, the devil is in the details. Staying informed, getting the right advice, and acting early can make all the difference. If the complexity feels overwhelming, it might be time to outsource tax preparation service to professionals who understand the latest super rules and compliance obligations inside out.

And remember: super is no longer a “set-and-forget” part of your finances. These changes to superannuation Australia prove it’s something worth paying attention to, whether you’re 25 or 65