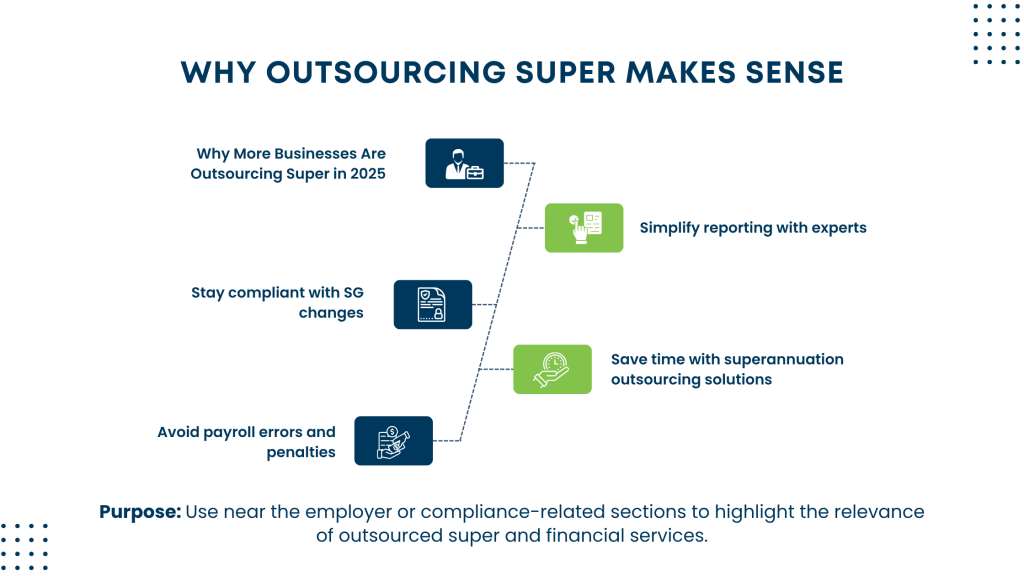

Setting up a Self-Managed Super Fund (SMSF) comes with a great deal of flexibility and control, but with that freedom comes responsibility. Many trustees turn to outsourced SMSF services to ensure they’re operating within the complex borrowing framework while keeping up with compliance demands.

One of the areas that generates a lot of confusion is around SMSF borrowing restrictions. While the idea of leveraging your retirement savings to invest in assets like property is appealing, there are strict limitations in place to prevent misuse and maintain the integrity of your fund.

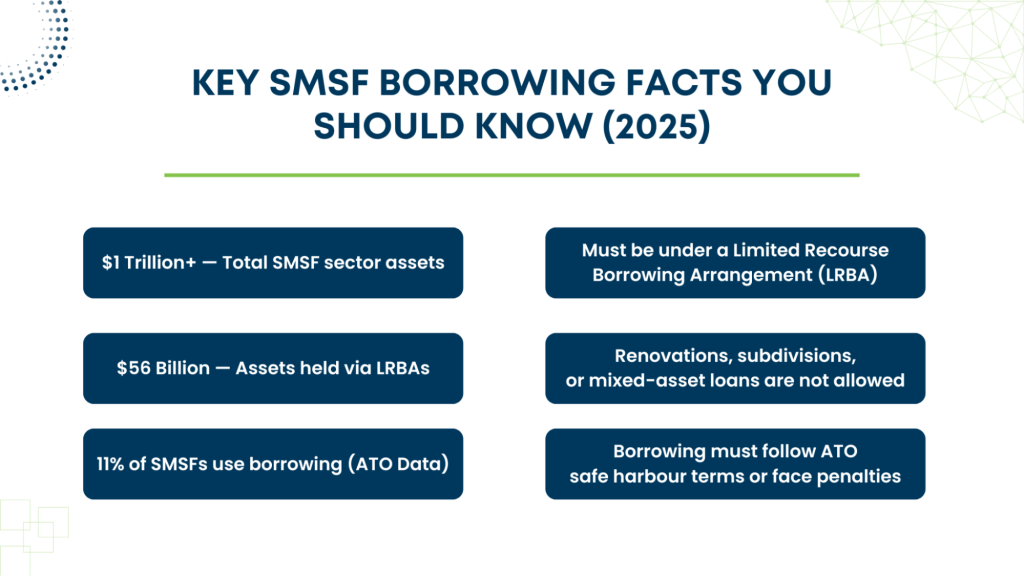

As per the latest SMSF statistics available on data.gov.au, the sector now manages over $1 trillion in assets, with borrowing via Limited Recourse Borrowing Arrangements (LRBAs) accounting for roughly $56 billion. This reflects not only growing interest in leveraging for property but also the need for strict oversight and adherence to SMSF borrowing restrictions.

In this blog, we’ll walk through what’s allowed, what isn’t, and the consequences of getting it wrong.

Can SMSFs Borrow Money?

Yes, but only in very specific circumstances. Under the SMSF borrowing ATO rules, borrowing is only allowed through a structure called a Limited Recourse Borrowing Arrangement (LRBA). This ensures that if the fund defaults on the loan, the lender can only claim the asset tied to that loan, not the rest of the fund’s assets.

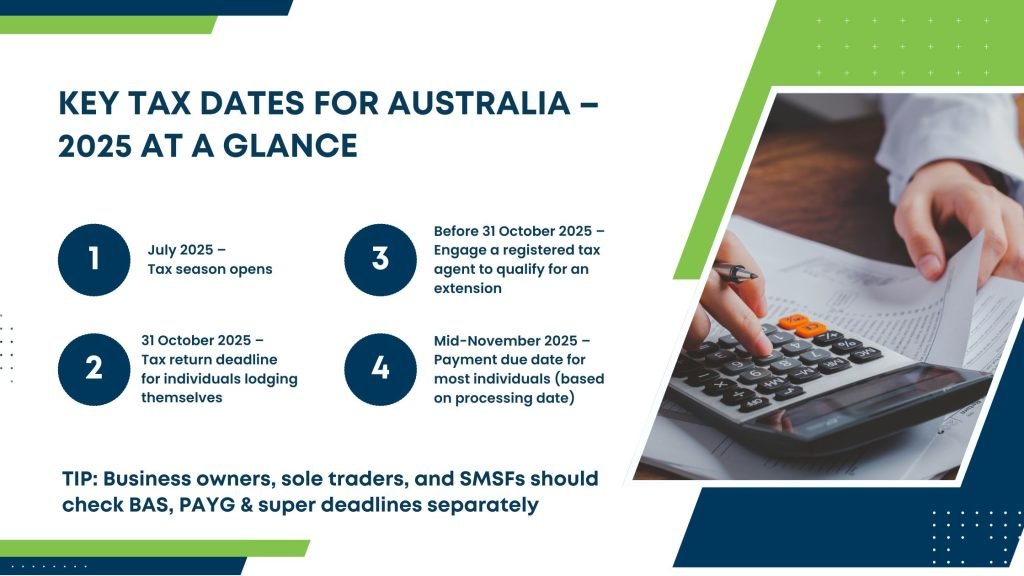

According to the ATO’s SMSF newsroom, borrowing arrangements remain one of the most closely monitored areas in self-managed super fund compliance. Trustees are encouraged to stay updated with guidance and regulatory alerts, especially as changes around contribution caps, LRBAs, and safe harbour terms evolve year by year.

This is an important protection mechanism designed to keep members’ retirement savings secure.

What You Can Do

1. Borrow to Acquire a Single Asset

One of the most common strategies involves SMSF borrowing for property. You can use an LRBA to acquire a single acquirable asset, such as a residential or commercial property. In some cases, a collection of identical assets that are treated as one (e.g., a parcel of identical shares) may also qualify.

That said, the asset must be held in a separate trust (often referred to as a bare trust), and the fund must have the right to acquire the legal title once the loan is repaid.

2. Borrow from a Related Party

A question that often comes up is: can SMSF borrow money from members? The answer is yes, but only under strict terms. The loan must reflect commercial terms (interest rate, repayment schedule, security, etc.) as if it were from an external party. If not, the ATO may view this as a breach of the SMSF lending rules ATO outlines.

To stay on the safe side, many trustees refer to the ATO’s safe harbour guidelines, which specify acceptable loan terms for related-party loans.

3. Refinance an Existing LRBA

You can refinance an existing LRBA provided that the new loan meets the same strict criteria as the original one. This might be useful if you find a better interest rate or want to change lenders. However, refinancing must not involve changes to the asset or loan structure that violate LRBA requirements.

4. Conduct Repairs and Maintenance

You are allowed to use borrowed funds for repairs and maintenance of the asset. For instance, if the property purchased through your SMSF needs a new roof, you can use the LRBA loan for this. But this does not extend to renovations or improvements that change the fundamental nature or value of the asset.

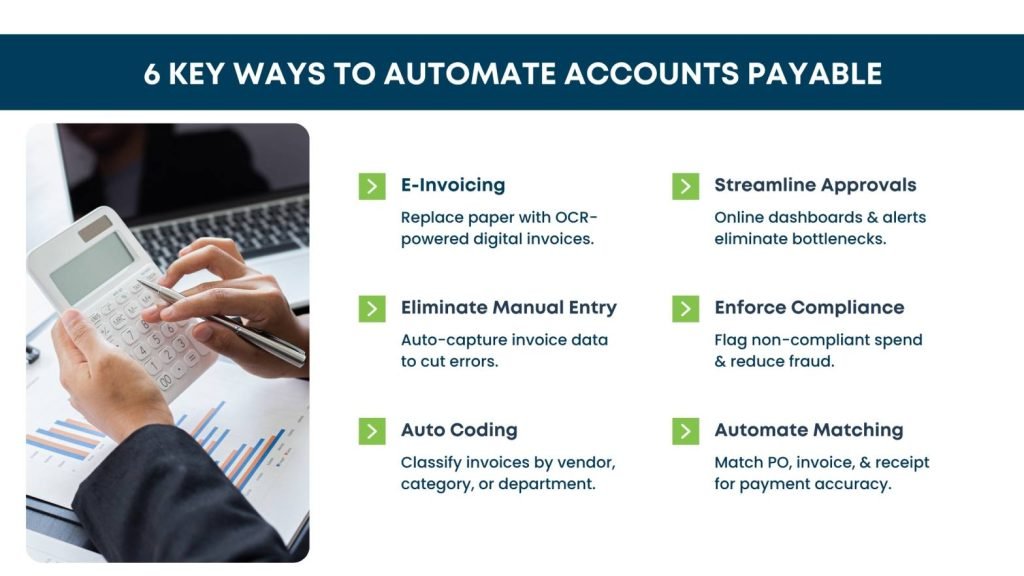

Many trustees find that managing the paperwork and structuring of Limited Recourse Borrowing Arrangements (LRBAs) is easier when they use outsourced SMSF administration services. It helps ensure accuracy, compliance, and peace of mind when navigating strict ATO lending rules.

What You Can’t Do

1. Fund Renovations or Development Projects

Here’s where many trustees go wrong. While you can repair or maintain a property, you cannot use borrowed funds to renovate or develop it in a way that changes its character. So if you’re thinking: can a self managed super fund borrow money to buy property and then renovate it to flip for a profit? The answer is a hard no.

Development or subdivision generally breaches the SMSF property rules ATO has set. Any significant changes can be interpreted as acquiring a new asset, which the LRBA structure does not allow.

2. Purchase Multiple Assets

Another key restriction: an LRBA must be used for a single acquirable asset. That means you can’t use one loan to buy two different properties, or a mix of different assets. Even buying two adjacent blocks of land may not qualify unless they are legally treated as one.

3. Use Borrowed Funds for Operating Expenses

Borrowing can only be used to acquire an asset. You cannot borrow to pay for SMSF operating expenses, management fees, insurance, or member benefits. Doing so would be a breach of both superannuation law and the fund’s investment strategy.

4. Offer Additional Security

Under an LRBA, only the asset being acquired can be used as security. You can’t use other assets from your SMSF to back the loan. This restriction protects the fund from overexposure to lending risks.

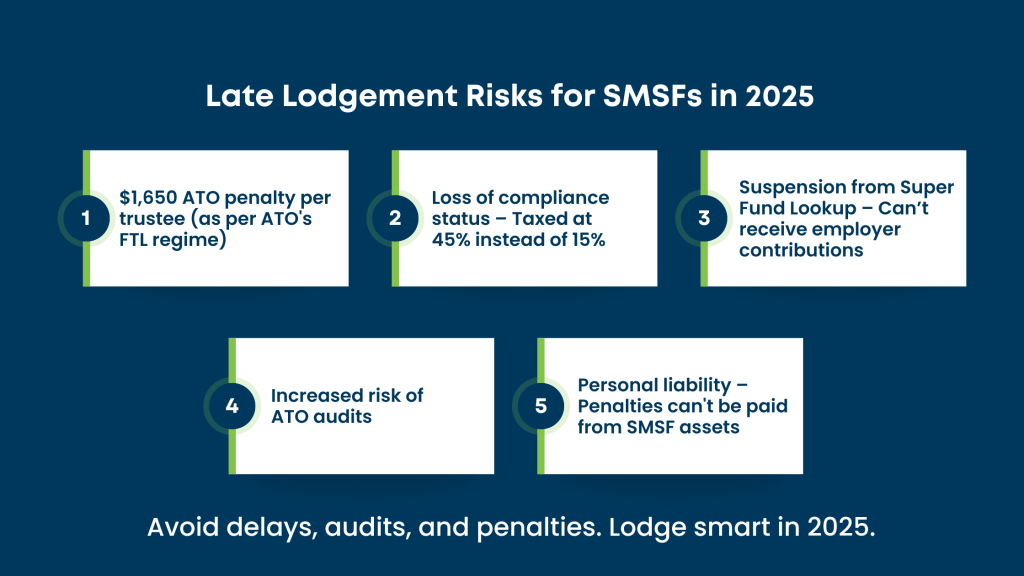

What Happens If You Get It Wrong?

The penalties for breaching SMSF borrowing restrictions are significant. Your fund could be deemed non-compliant, resulting in its assets being taxed at the highest marginal rate. Trustees could also face personal fines, disqualification, or even civil and criminal penalties depending on the severity of the breach.

Worse still, any loans or assets acquired under a non-compliant LRBA may have to be unwound, a complicated and expensive process.

In mid-2025, The Australian reported that SMSF borrowing could become a casualty of the newly proposed Division 296 tax reforms. The article noted that some political parties are pushing to ban borrowing altogether within SMSFs, citing concerns over financial system risk and fund mismanagement. While no decision has been made, trustees should keep a close eye on policy developments that may tighten or restrict SMSF borrowing ATO provisions even further.

Common Mistakes Trustees Make

- Incorrect structuring: Not setting up the bare trust correctly.

- Improper loans: Failing to document related-party loans on commercial terms.

- Property improvements: Using borrowed funds for renovations instead of repairs.

- Mixing assets: Trying to fund multiple acquisitions under one loan.

These errors often stem from misunderstandings of what constitutes an allowable LRBA.

Alternatives to Borrowing

Not every SMSF needs to borrow. Depending on your fund’s size, risk appetite, and goals, you might consider alternatives:

- Pool contributions among members to purchase assets outright.

- Invest in managed funds or ETFs.

- Consider unit trusts or joint ventures with other SMSFs or parties (subject to strict compliance rules).

Sometimes, the risks and restrictions tied to borrowing may outweigh the benefits, especially for smaller funds.

Get Professional Guidance

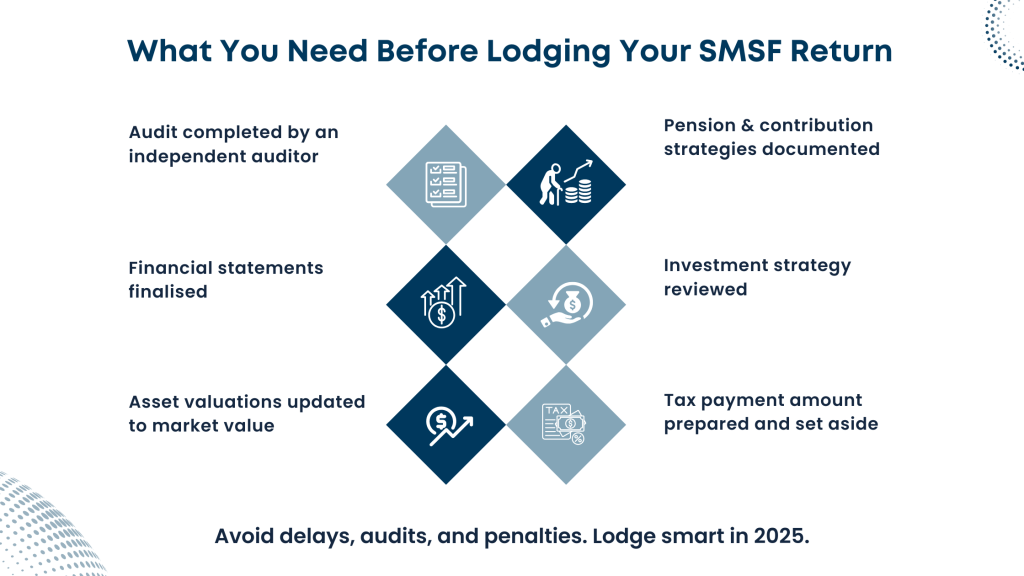

The bottom line? Borrowing through an SMSF is legal, but it’s not simple. The smsf lending rules ATO has laid out require a high level of compliance. Every step, from loan structure to asset type, must be carefully planned and documented.

A licensed financial adviser or SMSF specialist accountant can help assess whether borrowing aligns with your fund’s strategy, and ensure you don’t unintentionally break the rules.

Final Thoughts

To sum it up, can a self managed super fund borrow money to buy property? Yes, but only under a strict and narrow framework.

Understanding SMSF borrowing restrictions is essential before diving into any loan arrangement. While borrowing can unlock new investment opportunities, non-compliance can lead to harsh penalties.

As a trustee, the best thing you can do is approach borrowing with caution, clarity, and expert advice. Leveraging outsourced financial services can be a smart way to access specialist support without overloading yourself with compliance and technicalities. Know what you can do, be clear on what you can’t, and always document everything.

Key Takeaway:

Don’t let the complexity discourage you, but don’t underestimate it either. If you’re considering SMSF borrowing for property, make sure your structure passes the ATO’s compliance test.

When in doubt, get help. It’s your retirement future on the line.