Accountant Shortage in Australia: Causes & Solutions in 2025

- Aesha Shah

- July 23, 2025

- 6 minutes

- Blogs

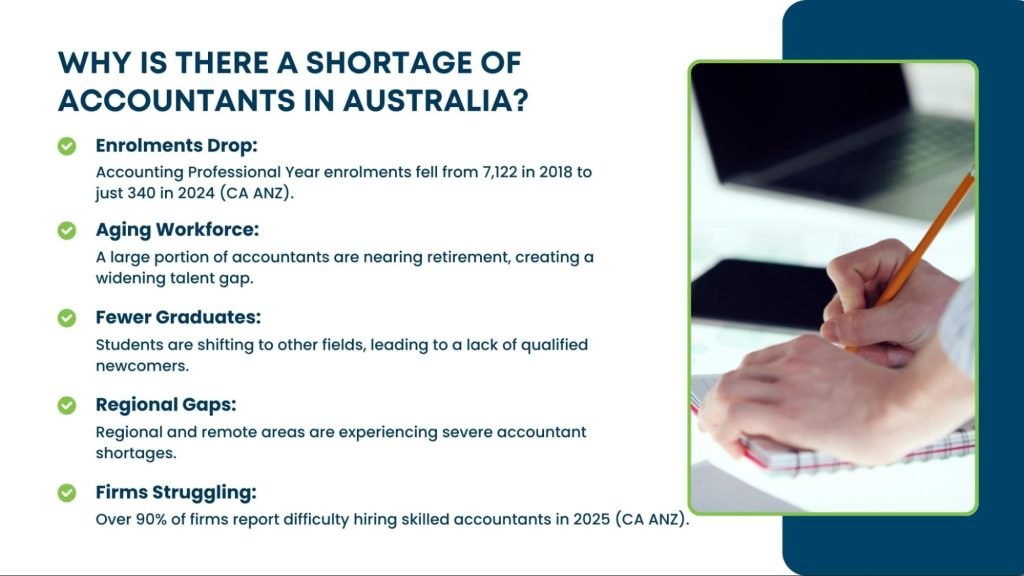

In 2025, Australia is facing an acute accountant shortage that is disrupting financial operations across sectors. According to Chartered Accountants ANZ, over 90% of firms are struggling to recruit skilled accountants, leaving many roles unfilled for extended periods.

This growing accounting talent shortage is placing immense pressure on existing staff, leading to burnout, delayed reporting, and heightened compliance risks. The shortage is particularly severe in regional areas, where the accounting talent pool has significantly diminished.

The accountant shortage in Australia is deepening as fewer students enrol in accounting degrees. CA ANZ reported that enrolments in Australia’s Accounting Professional Year program declined dramatically, from 7,122 in 2018 to just 340 in 2024, underscoring the sharp drop in accounting program participation and deepening the accounting talent shortage.

As more experienced CPAs retire and fewer graduates enter the field, the CPA shortage in Australia threatens workforce continuity and the broader economy. To stay ahead, many organisations are turning to experienced firms and trusted accounting partners to bridge the talent gap with scalable, strategic support.

Key Causes of Australia’s Accounting Shortage

The accountant shortage in Australia is being driven by several structural and systemic issues, backed by concrete data:

- Demographic Shifts

A large segment of Australia’s accounting workforce is approaching retirement, intensifying the talent gap. According to the Australian accountants daily, the median age of accountants is around 41, with nearly 40% aged over 45, creating a widening talent gap as retirements outpace new entrants. - Declining Enrolments in Accounting Programs

There has been a steep decline in accounting enrolments across Australia. CPA Australia reported that the Accounting Professional Year Program’s enrolments dropped from 7,122 in 2018 to merely 340 in 2024, exemplifying the broader trend of falling student uptake. - Changing Career Preferences Among Graduates

Graduates are increasingly attracted to careers in fintech, data analytics, and software engineering, which offer faster entry, greater perceived innovation, flexible work options, and often more competitive entry-level pay. This trend is further fueling the growing shortage of accounting talent in Australia. - Rigorous CPA Certification Requirements

While the CPA designation remains prestigious, the lengthy and expensive certification process can deter potential candidates, who are increasingly drawn to quicker, less burdensome alternative career paths. - Shortage of Accounting Educators

Australia is also experiencing a decline in accounting academics. With fewer qualified educators available to mentor students, reducing the number of graduates entering the profession.

The Impact of the Accountant Shortage in Australia

The accountant shortage in Australia is not merely a talent issue, it poses a growing risk to business continuity, financial governance, and economic resilience. Here’s how this talent gap is already affecting the country across multiple fronts:

- Strained Business Operations and Compliance

As the shortage of accountants in Australia deepens, many organisations are experiencing delays in core functions such as tax reporting, payroll, and financial analysis. Companies can outsource bookkeeping to maintain timely reporting and compliance without overburdening their limited staff.

To stay compliant and avoid errors, an increasing number of firms are turning to outsourced accounting and outsourced CFO services. While this helps fill short-term gaps, it also highlights how reliant businesses have become on external solutions to cope with internal capacity shortages. Partnering with payroll outsourcing companies ensures payroll accuracy, frees internal staff for strategic work, and mitigates compliance risks.

- Rising Workloads and Professional Burnout

With fewer qualified professionals in the pipeline, existing accountants are being asked to do more with less. This mounting pressure is contributing to widespread burnout, job dissatisfaction, and attrition within the profession.

According to the CA ANZ Remuneration Survey, 68% of members cited flexible working as their most valued non-monetary benefit, a clear signal that professionals are seeking relief from unsustainable working conditions.

- Higher Risk of Tax and Audit Errors

A diminishing talent pool increases the risk of errors in financial reporting, audits, and tax compliance. Small to mid-sized enterprises are particularly vulnerable, as they often lack the resources to retain high-level accounting staff.

This increases their exposure to ATO audits, penalties, and reputational damage, making the accounting shortage Australia faces a compliance concern as much as an operational one.

- Broader Economic Ramifications

Beyond individual firms, the accountant shortage is beginning to affect Australia’s broader economic infrastructure. Accurate financial reporting underpins effective business investment, lending, and regulatory oversight.

When organisations can’t access skilled professionals, it undermines decision-making and may weaken investor confidence. If the accounting talent shortage is not addressed, it could place long-term strain on Australia’s economic growth and financial transparency.

Solutions to the Accountant Shortage in Australia

Solving the accountant shortage Australia is a complex challenge that requires collective action from government, education providers, industry bodies, and businesses. Here’s how Australia can tackle the accounting talent shortage in 2025 and beyond:

- Attracting Students to Accounting

Government-supported scholarships and revamped university courses (e.g. data-driven accounting programs at UNSW, Melbourne) are helping reposition accounting as a future-ready career. National campaigns by CPA Australia and CA ANZ also highlight the profession’s wider societal and business impact. - Tackling the Educator Shortage

Low academic incentives are a bottleneck. Industry collaboration (e.g. firms like Deloitte providing guest lecturers) and better research funding could attract more professionals into teaching roles, per the Australian Business Deans Council. - Supporting CPA Candidates

High certification costs and rigid timelines hinder progress. CPA Australia now offers payment plans and flexible, remote exam structures to support working professionals and regional talent. - Embracing Automation & Outsourcing

Over 52% of firms use AI for routine tasks, while others leverage accounts receivable outsourcing services to manage demand spikes, freeing in-house staff for advisory roles. - Improving Pay & Work-Life Balance

Despite a 7.6% pay rise (CA ANZ 2024), 40% feel underpaid. With 68% valuing flexible work most, firms are responding through hybrid models, wellbeing programs, and even 4-day workweek pilots.

The Future of Accounting in Australia

Despite current challenges, the future of accounting in Australia is on an upward trajectory. Universities are modernising accounting curricula and addressing educator shortages through industry partnerships and academic support. Professional bodies like CPA Australia and CA ANZ are making certification more accessible with flexible learning models and financial support.

At the firm level, accounting outsourcing and automation are helping ease workloads and combat the accountant shortage Australia faces. Meanwhile, businesses are investing in wellbeing initiatives and flexible work options to retain talent.

As the profession addresses the root causes behind why there is a shortage of accountants, collective action from educators, policymakers, and industry leaders is shaping a modern, resilient accounting profession ready to thrive in 2025 and beyond.

FAQ: Accounting Shortage in Australia

Are accountants in demand in Australia?

Yes, accountants are in strong demand across Australia in 2025, with the profession listed as a priority on the Skills Priority List. According to Jobs and Skills Australia, accounting is listed as a priority occupation, with increased demand in sectors such as audit, tax, and financial advisory, especially as businesses navigate regulatory complexity and digital transformation.

Is there a shortage of accountants?

Absolutely. Australia is currently experiencing a severe shortage of accountants, driven by low graduate numbers, migration barriers, and high attrition due to workload pressures. CA ANZ has flagged a talent gap that could exceed 10,000 professionals by 2027 if action isn’t taken.

Which profession has shortages in Australia?

In 2025, key shortages include accountants, nurses, aged-care workers, engineers, IT professionals, and teachers, according to Australia’s latest Skilled Occupation List. Accounting remains a top priority due to its vital role in every industry.

Are accountants well paid in Australia?

Yes, though pay varies by experience and speciality. In 2025, the average accountant salary in Australia ranges from AUD 90,000 to AUD 120,000, while senior roles can command upwards of AUD 150,000. The 2025 CA ANZ Remuneration Survey shows 58% of members received a pay increase in the past year, and 68% listed flexible working as their most valued non-financial benefit.

How many accountants are there in Australia?

Data from IBISWorld reveals that in 2025 there are approximately 36,717 accounting services businesses operating in Australia. Across those firms and industry, there are around 215,000 professional accountants, though many are nearing retirement, contributing to the effective talent gap.