Bookkeeping remains one of the most essential financial functions for Australian businesses, safeguarding compliance with Australian Taxation Office (ATO) requirements and giving business owners reliable financial visibility.

Yet the average cost of bookkeeping services can vary significantly. In Australia, small business accounting costs depend on factors such as transaction volume, reporting needs, software usage, and whether you choose an in-house employee, an outsourced bookkeeping solution, or a freelance bookkeeper.

In this article, NCS Australia breaks down the true bookkeeping rates for small businesses, explores the typical accounting fees for a small business, and explains how business activity and complexity influence overall pricing.

The goal is simple: to help business owners understand what they should realistically budget for and choose a bookkeeping model that supports compliance, clarity, and long-term growth.

Key Takeaways

- Bookkeeping costs in Australia vary widely from $125/month for micro-businesses to $5,000+/month for high-volume companies, driven mainly by transaction volume and reporting complexity.

- Outsourcing remains the most cost-effective model for small and medium businesses, offering predictable monthly fees and access to qualified experts without the overhead of hiring in-house.

- Understanding bookkeeping services pricing and monthly bookkeeping fees helps business owners budget accurately, avoid compliance risks, and choose the right support level for their needs.

- Your choice of bookkeeping model, freelance, in-house, or outsourced, directly impacts cost, compliance, and long-term scalability, making it essential to evaluate business activity, growth plans, and required expertise.

Understanding Bookkeeping and Its Importance

- Bookkeeping is the structured process of recording, tracking, and organising all financial transactions, including sales, purchases, payroll, receipts, and operational expenses.

- Accurate bookkeeping supports ATO compliance, simplifies Business Activity Statement (BAS) lodgements, and strengthens financial planning for future growth.

- The cost of bookkeeping services varies widely because pricing depends on the time, expertise, and systems required to maintain accurate records.

- Monthly transaction volume is one of the biggest cost drivers: more transactions mean more reconciliations, more reporting, and more hours required.

- As highlighted by the Institute of Certified Bookkeepers (ICB), “Effective bookkeeping provides a clear picture of financial health, reducing the risk of ATO penalties.”

- High-volume industries such as retail, hospitality, and manufacturing generally face higher bookkeeping fees due to the complexity and scale of their financial data.

- Lower-volume businesses, including sole traders and micro-businesses, typically benefit from more affordable bookkeeping packages as their requirements are simpler and less time-intensive.

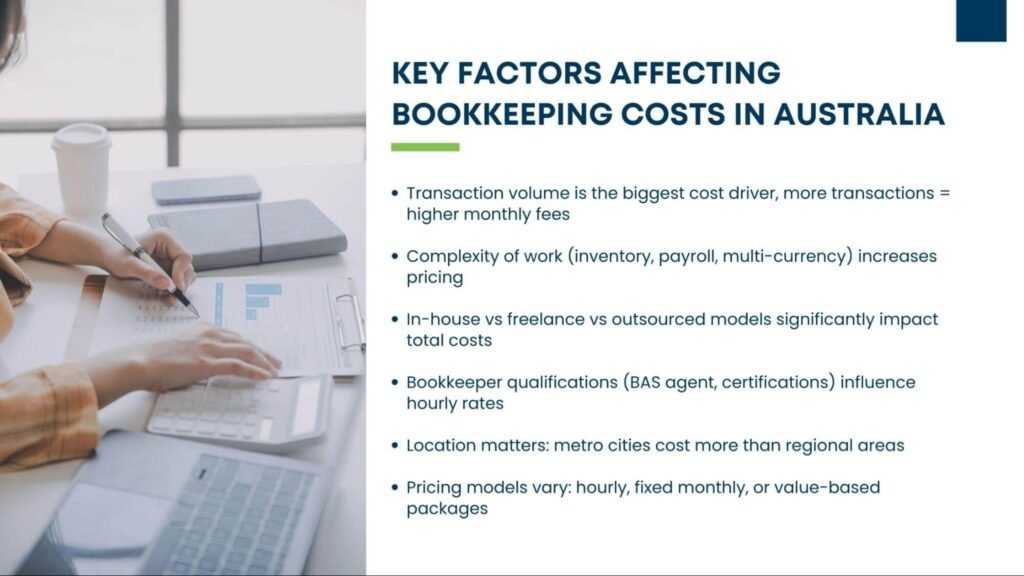

Factors Influencing the Cost of Bookkeeping

Several variables shape the cost of bookkeeping in Australia, and understanding these helps business owners estimate the typical accounting fees for small businesses more accurately.

- Business Volume (Transaction Volume):

The number of monthly transactions remains the strongest cost driver. As volume increases, so do reconciliation hours, coding requirements, and reporting frequency, directly impacting the average cost of bookkeeping services across industries. - Complexity of Transactions:

Businesses handling inventory, payroll, or multi-currency requirements may need additional services such as payroll outsourcing, which increases total bookkeeping costs. - Type of Service (In-House, Freelance, Outsourced):

Outsourcing often provides predictable monthly fees and access to expert support. Businesses exploring business outsourcing solutions can reduce overhead significantly compared to hiring internally. - Location of the Business:

Rates vary nationally, with Sydney and Melbourne charging more than Adelaide or regional towns due to the cost of living and demand for talent. - Expertise and Qualifications:

Bookkeepers with BAS agent registration or advanced certifications typically charge higher fees but deliver greater accuracy and compliance protection. - Pricing Model:

Depending on the provider, pricing may be hourly, fixed monthly, or value-based. Smaller operators often prefer fixed packages to keep the small business accounting costs predictable.

Average Bookkeeping Costs in Australia for 2026

In 2026, the average cost of bookkeeping services varies depending on hourly billing or fixed monthly plans.

1. Hourly Rates

- Entry-Level Bookkeepers: $30–$50/hour

- Experienced Bookkeepers: $50–$80/hour

- Registered BAS Agents: $80–$150+/hour

Hourly pricing is often used by micro-businesses that are still evaluating the cost of bookkeeping services for small businesses before committing to a monthly plan.

2. Fixed Monthly Outsourced Packages

- Micro Businesses (0–25 transactions): $125–$250/month

- Small Businesses (25–100 transactions): $300–$800/month

- Medium Businesses (100–500 transactions): $800–$2,500/month

- High-Volume Businesses (500+ transactions): $2,500–$5,000+/month

These packages help manage small business accounting costs consistently, making them one of the most popular models for SMEs.

3. In-House Bookkeepers

- Typical Salary (2025): $70,000–$80,000/year

- Best suited for 500+ transaction businesses

- Too costly for most small businesses compared to outsourcing

For SMEs, in-house hiring significantly increases the small business accounting cost, making outsourcing a more cost-effective alternative.

How Business Volume Impacts Costs

Transaction volume remains the largest determinant of the typical accounting fees for small businesses. As monthly transactions increase, so does the workload across reconciliation, payroll, coding, and BAS lodgement.

Low-Volume Businesses (0–25 Transactions/Month)

- Typical Cost: $125–$200/month outsourced

- Best suited for consultants, freelancers, and sole traders

Medium-Volume Businesses (100–500 Transactions/Month)

- Typical Cost: $800–$1,500/month outsourced

- Common in cafés, trades, retail, and service businesses

High-Volume Businesses (500+ Transactions/Month)

- Typical Cost: $2,500–$4,000/month outsourced

- Common in e-commerce, manufacturing, and multi-entity groups

These cost brackets represent the most common bookkeeping rates for small businesses, adjusted for complexity and reporting needs.

Regional Variations in Bookkeeping Costs

Location plays a major role in determining the average cost of bookkeeping services:

- Sydney & Melbourne: $45–$75/hour or $300–$2,500/month

- Perth & Adelaide: $40–$70/hour or $250–$2,000/month

- Regional Areas: $30–$60/hour or $125–$1,500/month

Metro rates tend to be higher due to labour and operational expenses.

Tips for Managing Bookkeeping Costs

- Outsource repetitive tasks through bookkeeping administration services.

- Adopt cloud platforms like Xero or MYOB to automate data entry.

- Select fixed monthly packages for budgeting certainty.

- Verify BAS agent credentials to prevent compliance errors.

- Review transaction volume regularly to avoid overpaying for unused service capacity.

- Add supporting processes like document digitising to streamline record-keeping.

Conclusion

The average cost of bookkeeping services in Australia can range from $125 per month for micro-businesses to well over $5,000 per month for larger, high-volume enterprises.

Understanding bookkeeping services pricing helps business owners make informed financial decisions, especially as fees shift based on transaction volume, reporting complexity, and industry requirements.

Smaller businesses, such as freelancers and consultants, often benefit most from outsourced bookkeeping, gaining expert support without the overhead of hiring internally. As organisations grow, predictable monthly bookkeeping fees make it easier to budget, especially when supported through broader financial compliance support.

Whether you choose an in-house bookkeeper, a freelance professional, or an outsourced accounting partner, selecting the right model ensures your business stays compliant, organised, and prepared for future growth. For personalised guidance, you can always contact our team for customised support.