Expert SMSF Outsourcing Services in Australia

Designed for CPAs, Accountants and Advisors managing complex SMSF workflows who need a reliable, compliant partner.

Strict compliance requirements and tight deadlines make SMSF management challenging. Our SMSF outsourcing services in Australia help accounting professionals streamline operations while maintaining focus on strategic priorities.

Backed by 16,000+ SMSFs processed, our proven SMSF management services adapt to your software and workflows delivering reliability, accuracy, and efficiency every time.

We handle the entire SMSF lifecycle with precision:

- Administration: Transaction processing, financial reporting, and member statements

- Compliance: ATO reporting and regulatory monitoring

- Tax & Audit: Complete SMSF tax return and audit service coordination

- Actuarial Certificates: Obtained via qualified Australian actuaries

When you outsource SMSF administration services, you gain reduced workload, timely ATO compliance, cost efficiency, and scalability, allowing your practice to grow without capacity constraints.

Our SMSF Outsource Services Include

- Annual Financials and Tax Returns

- Electronic Work Papers for Audit

- Trustee Resolutions, Minutes, and Documents

- Investment Portfolio Reporting and Benchmarking

- SMSF Establishment and Setup Services

- Backup File Preparation and Delivery

- Auditor Liaison for Query Resolution

- SMSF Annual Return Lodgement Support

- Contribution and Pension Calculation Management

- Actuarial Certificate Procurement Assistance

Broader Investment Opportunities

Our SMSF management services give access to a broad range of investments, including property, shares, bonds, term deposits, and collectables. We help you design a personalised investment strategy aligned with client goals while managing all administrative and compliance tasks efficiently.

Complete Control & Flexibility

With our SMSF admin and compliance services, you maintain complete control over fund strategy and investment choices. We handle the paperwork, data processing, and ATO reporting so you can stay focused on advising clients and driving portfolio performance with full confidence.

Maximise Tax Benefits

When you outsource SMSF administration, our experienced team manages tax returns and audits to ensure full ATO compliance. We identify eligible deductions, apply tax-efficient strategies, and deliver timely reporting that supports stronger financial outcomes for your firm and clients.

Reduce Costs as Funds Grow

Our SMSF outsourcing solutions provide scalable cost savings through efficient systems and fixed administrative fees. As your funds expand, your costs reduce, allowing your firm to maintain profitability, improve turnaround times, and focus on value-driven client services.

Why Partner with NCS Australia for SMSF Outsourcing

Expert outsourcing ensures accuracy, compliance, and efficiency, freeing your firm to focus on clients, not admin.

About NCS Australia

NCS Australia is a leading outsourcing firm delivering a wide range of accounting, tax preparation, and SMSF administration services to Australian accountants, financial planners, and businesses. With a dedicated team and a strong presence in Australia, we deliver timely, accurate, and reliable solutions built on deep industry knowledge and extensive experience.

We take great care to handle every task thoroughly and are committed to meeting the highest standards of quality and professionalism. NCS is an initiative of Navkar Institute, a respected educational organisation that has successfully trained over 40,000 students and more than 5,000 Chartered Accountants and CPAs around the world, earning a reputation for excellence in the field.

Our advanced delivery centre in India operates from a 100,000+ square foot facility equipped with modern infrastructure and the latest technology. This robust setup enables us to provide efficient, scalable, and secure support for all accounting and compliance requirements, helping

Transform Your SMSF Workflow for Long-Term Success

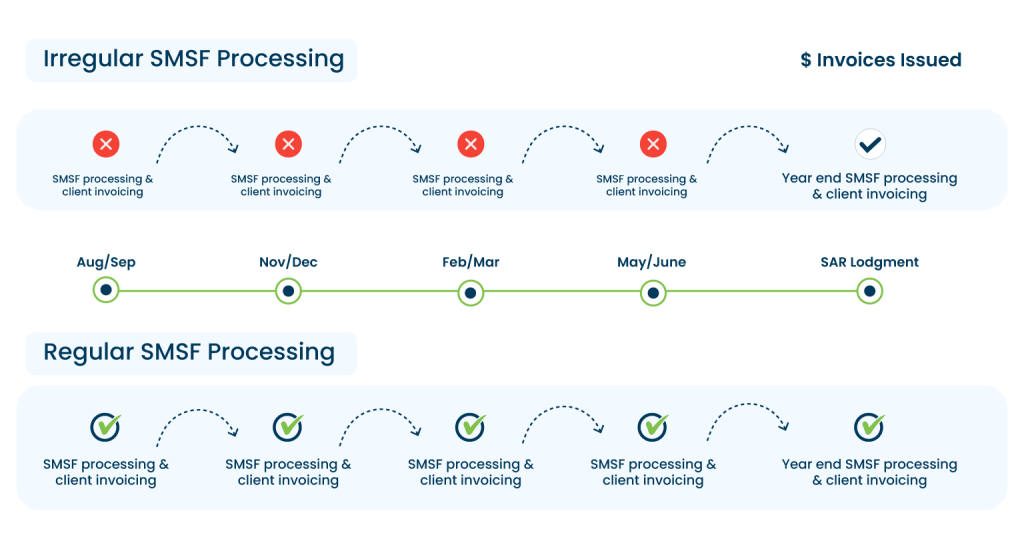

Our SMSF management services keep your practice compliant, profitable, and efficient all year long without operational pressure.

Certification and Partnerships

Global Quality Management

ISO 9001:2015 certification demonstrates our commitment to consistent service quality and continuous process improvement, ensuring reliable accounting support for your firm.

Data Security & Privacy Assurance

SOC 2 Type 2 certification confirms that client data is managed securely, meeting stringent cybersecurity standards and maintaining confidentiality at all times.

Information Security Framework

ISO/IEC 27001 certification validates our structured approach to information security, protecting your financial data and ensuring regulatory compliance across all operations.

How Our SMSF Outsourcing Services Works

Detailed Fund Setup or Review

We establish new SMSFs or review existing structures ensuring compliance with retirement goals. Our team handles documentation, registrations, and financial advisor coordination for a strong SMSF foundation.

Compliance & Documentation

Our Offshore experts manage ABN, TFN, trust deeds, and regulatory requirements through our SMSF outsourcing services. We ensure accurate documentation and ongoing record keeping for complete ATO compliance.

Ongoing SMSF Management

Complete SMSF admin and compliance services handling daily transactions, investment tracking, and fund accuracy. We provide superannuation accounting support, ensuring accuracy when you outsource SMSF administration.

Final Tax Return & Audit

We prepare tax returns and coordinate audit services with licensed professionals. Our SMSF tax return and audit service simplifies year-end obligations and ensures complete regulatory compliance.

Software Acquaintance

Transform Your SMSF Management Today

Let’s discuss how we support your SMSF administration needs with reliable expertise, quick processing, and seamless compliance every step.

Frequently Asked Questions (FAQs)

Outsourcing SMSF administration helps reduce your overhead and operational costs by leveraging our experienced team. We handle tasks efficiently, improving accuracy and saving you time so you can focus more on growing your business and supporting your clients.

Yes, you keep full control of your client relationships. NCS Australia provides SMSF outsourcing services that support your business quietly behind the scenes, ensuring you maintain direct contact and strong trust with your clients at all times.

We follow strict privacy regulations and use advanced security measures to safeguard all client financial information. Confidentiality and data protection are priorities throughout the SMSF administration process to maintain your clients’ trust.

Our SMSF outsourcing services include compliance management, preparing and lodging tax returns, coordinating audits, handling transaction processing, and ongoing SMSF fund management. This package ensures your SMSF runs smoothly and meets all regulatory requirements.

Our SMSF outsourcing services include compliance management, preparing and lodging tax returns, coordinating audits, handling transaction processing, and ongoing SMSF fund management. This package ensures your SMSF runs smoothly and meets all regulatory requirements.