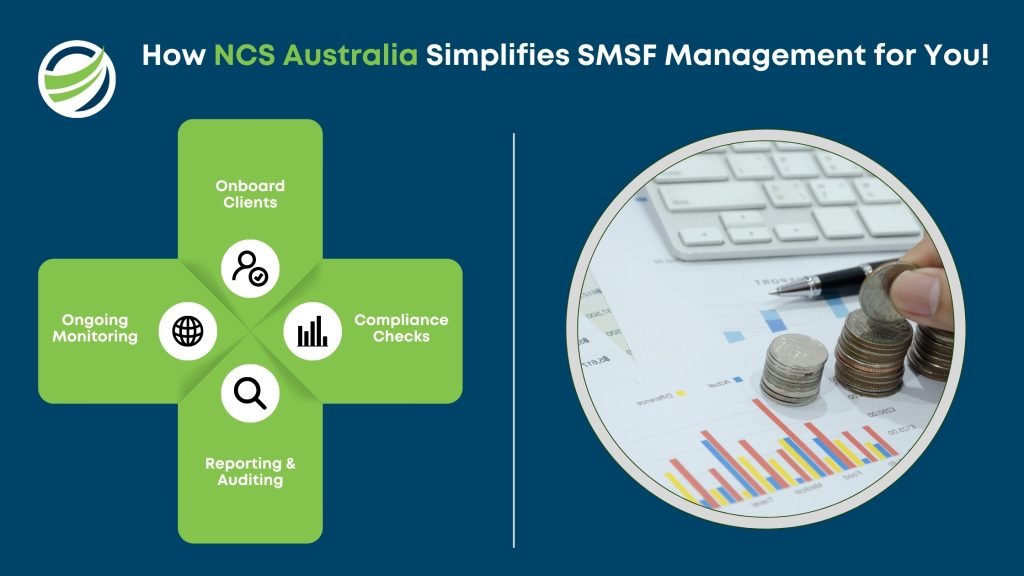

Managing Self-Managed Super Funds (SMSFs) requires precision, expertise, and significant time investment. NCS Australia simplifies SMSF management by offering specialised, cost-effective outsourcing solutions.

Continue readingNCS Australia Advanced Approach to SMSF Outsourcing for Smarter Investors

Advanced SMSF Outsourcing for Financial Advisors in Australia

Self-Managed Super Funds (SMSFs) are revolutionising retirement savings for Australians, offering investors more control over their financial futures. However, navigating the complexities of SMSF management—including compliance, tax regulations, and administrative tasks—can overwhelm even seasoned professionals.

NCS Australia provides cutting-edge SMSF outsourcing services, enabling accountants, CPAs, and financial advisors to focus on delivering high-value advice while offering smarter investment solutions for their clients.

In this blog, discover how NCS Australia advanced outsourcing approach helps streamline processes, mitigate risks, and unlock the full potential of SMSFs. Here’s why we’re the trusted SMSF outsourcing partner for Australian financial professionals.

1. The Challenge of Managing SMSFs in 2024

The landscape of SMSFs is becoming increasingly complex. Australian accountants, CPAs, and financial advisors face several challenges in managing SMSFs for their clients, including:

- Regulatory Complexity: Constant changes in superannuation laws and tax regulations require in-depth knowledge to stay compliant.

- Time-Consuming Administration: Managing SMSF compliance, investment strategy reviews, and financial statements takes significant time and effort.

- Risk Management: Incorrect handling of SMSF funds can lead to penalties, audits, and reputational damage for financial advisors.

Despite these challenges, SMSFs remain a popular choice due to their investment flexibility, tax advantages, and customised strategies for retirement planning. Partnering with NCS Australia ensures you can capitalise on these benefits without the administrative burden.

2. Why Choose NCS Australia for SMSF Outsourcing?

At NCS Australia, we offer comprehensive SMSF outsourcing solutions tailored to the needs of accountants, CPAs, and financial advisors.

Why Choose NCS Australia for SMSF Outsourcing?

Key Benefits of Partnering with Us:

- Expertise and Compliance: Stay ahead of regulatory changes with our SMSF specialists, who provide accurate, timely reports to keep funds compliant and reduce risks.

- Efficiency and Time Savings: Eliminate time-consuming tasks like paperwork and audits, allowing you to focus on providing strategic advice.

- Customised Client Solutions: Every SMSF investor is unique. Our services are tailored to align with individual investment strategies and retirement goals.

- Cost-Effective Scalability: Reduce overhead costs while scaling your practice with high-quality outsourcing solutions.

3. Streamlining SMSF Compliance and Reporting

Ensuring compliance with ATO regulations is a critical yet time-intensive task. NCS Australia simplifies this process with a comprehensive approach to SMSF compliance and reporting:

- Superannuation Compliance: We ensure adherence to tax obligations, contribution caps, and other SMSF-specific regulations.

- SMSF Auditing Services: Prepare seamlessly for audits with our specialised services, minimising errors and penalties.

- Financial Statements and Tax Returns: From preparation to submission, we handle your clients’ SMSF reporting requirements with precision.

By outsourcing to NCS Australia, you not only save time but also protect your clients from costly compliance risks.

4. Transforming SMSF Administration Through Outsourcing

SMSF administration involves tracking contributions, monitoring asset performance, and maintaining member records—all of which can drain resources.

Outsourcing these tasks to NCS Australia offers:

- Scalability for Growing Practices: Handle more clients without increasing operational costs or staffing requirements.

- Error-Free Administration: Our experts use the latest tools to reduce errors, ensuring accurate fund management.

- Advanced Technology Integration: Access cutting-edge SMSF software for automated workflows and real-time updates.

5. Strengthening Client Relationships Through Outsourcing

A strong client relationship is the foundation of a successful practice. By outsourcing SMSF tasks to NCS Australia, you can enhance the value you deliver to clients.

- Timely and Transparent Reporting: Provide clients with accurate, real-time updates on their SMSF performance.

- Custom Investment Strategies: Offer tailored solutions that align with each client’s long-term financial goals.

- Proactive Risk Mitigation: Identify potential risks early and take corrective action to protect your clients’ investments.

By partnering with NCS Australia, you not only elevate your service offerings but also foster trust and satisfaction among your clients.

6. Future-Proofing SMSF Outsourcing with NCS Australia

As SMSFs continue to grow in popularity, financial professionals require innovative solutions to meet rising demand. NCS Australia remains committed to staying at the forefront of industry trends, offering:

- Innovative Tools and Technology

- Scalable and Cost-Effective Services

- Dedicated Support for Accountants and CPAs

With our expertise, you can future-proof your practice while delivering exceptional value to your clients.

Conclusion:

NCS Australia—The Smarter Choice for SMSF Outsourcing

Outsource SMSF services to NCS Australia to unlock the full potential of your clients’ retirement savings. By streamlining compliance, reducing risks, and tailoring strategies, we empower accountants, CPAs, and financial advisors to focus on what matters most—delivering smarter investment solutions.

Partner with NCS Australia today and transform how you manage SMSFs. Together, let’s build a smarter future for your clients and your practice.

Master Payroll Management for Australian Businesses: Boost Compliance, Efficiency, and Growth

Master Payroll Management for Australian Businesses: Boost Compliance, Efficiency, and Growth

In the dynamic world of business, payroll management often stands as a cornerstone of operational success. For Australian companies, especially those navigating tight regulations and an evolving workforce, effective payroll management is more than just crunching numbers—it’s about creating stability, trust, and growth. This blog explores the key aspects of efficient payroll systems, the challenges businesses face, and why partnering with NCS Australia can revolutionise how you handle payroll.

What is Payroll Management?

Payroll management is the process of calculating salaries, managing tax deductions, ensuring compliance with Australian regulations, and overseeing benefits and bonuses. It’s a critical function that impacts not only employees’ morale but also a company’s financial health and reputation.

Why is Payroll Management So Important?

- Ensures compliance with Australian taxation and employment laws.

- Builds trust and loyalty among employees by ensuring timely payments.

- Minimises errors that could lead to penalties or employee dissatisfaction.

Common Payroll Challenges Faced by Australian Businesses

Even the most successful businesses can face hurdles when it comes to payroll management. Here’s a breakdown of the common challenges:

1. Complex Regulatory Environment

Australian payroll regulations are intricate, covering areas like superannuation, PAYG withholding, and award wages. Keeping up with these laws can be overwhelming for businesses without dedicated payroll expertise.

2. High Risk of Errors

Manual calculations or outdated software can result in payroll errors, leading to financial losses and employee frustration.

3. Time-Consuming Processes

For small and medium enterprises (SMEs), managing payroll in-house diverts valuable time away from core business activities.

4. Data Security Concerns

Handling sensitive employee information increases the risk of data breaches if security measures are not robust.

The Impact of Poor Payroll Management:

Failing to manage payroll effectively can have far-reaching consequences:

- Financial Penalties: Non-compliance with Australian tax laws can lead to hefty fines.

- Low Employee Morale: Delayed or incorrect payments erode employee trust and satisfaction.

- Operational Inefficiency: Time spent fixing payroll issues could be better used on strategic business initiatives.

The Benefits of Outsourcing Payroll to Experts:

Outsourcing payroll to specialists like NCS Australia is a game-changer for businesses aiming to simplify their operations and focus on growth.

1. Enhanced Accuracy and Compliance

At NCS Australia, we ensure that your payroll aligns perfectly with Australian laws, reducing the risk of costly errors or penalties.

2. Cost Savings

By outsourcing payroll, businesses save on hiring and training in-house payroll staff and investing in software.

3. Time Efficiency

Our streamlined processes free up your team’s time, allowing them to concentrate on what matters most—growing your business.

4. Advanced Security Measures

With state-of-the-art encryption and secure systems, we safeguard sensitive employee data, offering peace of mind.

5. Scalable Solutions

Whether you’re a startup or a large enterprise, our payroll solutions are tailored to fit your needs, making it easy to scale as your business grows.

How NCS Australia Simplifies Payroll Management

When you partner with NCS Australia, you’re not just outsourcing payroll—you’re investing in a seamless experience that drives success.

Our Approach:

- Understanding Your Needs: We take the time to understand your business structure, workforce, and payroll requirements.

- Customising Solutions: Our team crafts solutions tailored to your unique needs, ensuring maximum efficiency.

- Leveraging Technology: Using cutting-edge payroll software, we automate repetitive tasks and deliver error-free results.

- Providing Continuous Support: Our dedicated team is always on hand to address your queries and ensure smooth operations.

Signs It’s Time to Outsource Your Payroll

Wondering if it’s the right time to outsource payroll? Here are some indicators:

- You’re spending too much time on payroll tasks.

- Compliance is becoming a headache.

- Employees have raised concerns about delayed payments.

- You’re expanding and need scalable solutions.

The Role of Technology in Payroll Management

Modern payroll systems are driven by technology, offering features like:

- Automated Calculations: Minimising errors and ensuring accuracy.

- Cloud-Based Access: Allowing employees and management to access payroll data anytime.

- Real-Time Updates: Staying compliant with the latest regulations without manual intervention.

Conclusion: Build Your Success with NCS Australia

Streamlined payroll management is the foundation of business success in Australia. By ensuring compliance, enhancing accuracy, and saving time, it empowers businesses to grow without unnecessary hurdles. NCS Australia is your trusted partner in achieving this goal. With our expertise, technology-driven solutions, and commitment to excellence, we provide the foundation your business needs to thrive.

Don’t let payroll complexities slow you down—partner with NCS Australia today for efficient, compliant, and secure payroll solutions!

How to choose the right bookkeeper?

Every business, no matter how manageable, is required to keep detailed books of account. A professional bookkeeper can be useful when it comes to

Continue reading