In today’s evolving business environment, many organisations are turning to outsourced accounting as a smarter, more cost-effective way to manage their finances. Instead of maintaining large in-house teams, businesses are leveraging specialised providers who combine advanced technology with financial expertise.

This shift not only reduces operational costs but also gives leaders access to accurate, real-time insights that support better decision-making.

With remote work and digital platforms becoming the new normal, outsourcing has gained even greater momentum in Australia. Recent surveys by CPA Australia highlight that more than 60% of firms are adopting technology-driven accounting solutions to stay competitive.

In this guide, we’ll explore what outsourced accounting services really mean, the advantages they offer, and the types of businesses best positioned to benefit from this approach.

What is Outsourced Accounting?

Accounting service outsourcing, also called outsourced accounting, is when a business hires a specialised third party to handle the accounting and finance functions of the organisation. Instead of relying solely on internal staff, businesses partner with professionals who bring expertise, advanced systems, and scalable support customised to their needs.

These outsourced accountants can oversee a wide range of financial responsibilities, including bookkeeping, payroll processing, preparation of financial reports, management accounting, tax compliance, accounts payable and receivable, debtor follow-ups, and other critical finance-related tasks.

By adopting this model, organisations gain access to the same level of accuracy and professionalism as an in-house team, often at a fraction of the cost, while freeing up internal resources to focus on growth and strategy.

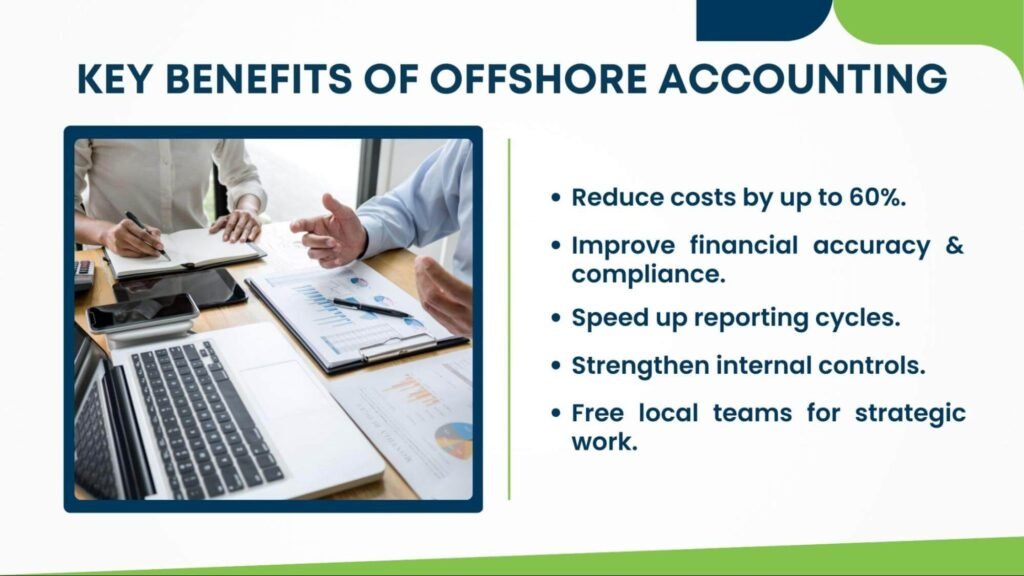

What Are the Benefits of Outsourced Accounting?

Partnering with an outsourced accounting firm offers significant advantages. The outsourcing of accounting services not only reduces costs but also gives businesses access to skilled professionals and advanced tools that would otherwise be expensive to maintain in-house.

By leveraging specialist support, companies can strengthen financial accuracy, reduce risks, and free up resources to focus on growth opportunities.

Key Benefits of Outsourced Accounting

Save Money

Outsourcing accounting work is significantly more cost-effective than hiring a full in-house team. Instead of shouldering the overheads of staff and infrastructure, businesses can channel resources directly into growth.

- Save on major costs including salaries, superannuation, office rent, and insurance.

- Eliminate costs related to recruitment, onboarding, and training.

- Only pay for the accounting services you need, exactly when you need them.

- Gain access to a team with a wider skill set than a single employee could provide.

Access Expertise

Through accountant outsourcing, organisations can tap into the knowledge of specialists with advanced skills across multiple areas of finance. This ensures accuracy, compliance, and reliable reporting.

- Certified professionals manage tax, payroll, bookkeeping, and compliance.

- Reduce the risk of errors that may lead to costly penalties.

- Benefit from industry best practices and up-to-date knowledge.

- Access insights and advice that support strategic decision-making.

Save Time

Delegating financial responsibilities allows business leaders to focus on what truly matters, innovation and growth. With outsourced professionals managing the details, operations become more streamlined.

- Spend less time managing accounts and financial reports.

- Free up management bandwidth for business development.

- Ensure timely board reports and financial presentations.

- Reduce stress around compliance and regulatory deadlines.

Improve Productivity

Outsourced accountancy services empower businesses with reliable reporting and actionable insights. With a dedicated team handling finance, productivity across the organisation naturally improves.

- Access real-time financial insights for better decisions.

- Improve cash flow management and budgeting accuracy.

- Streamline internal processes through automation and efficiency.

- Enjoy peace of mind knowing all compliance and accounting tasks are covered

Common Mistakes People Make When Outsourcing

While outsourcing accounting work delivers significant benefits, businesses often fall into common traps when selecting a partner. Being aware of these mistakes can help organisations make better choices and build long-term, successful relationships with their providers.

- Choosing a Firm with Unaligned Values

- Outsourcing is a partnership, not just a transaction.

- If the provider’s values don’t align with yours, collaboration will be limited.

- Shared vision and principles create trust and long-term success.

- Always choose a firm that understands your goals and culture.

- Selecting a Provider Who Doesn’t Understand Your Business

- Some providers focus only on completing tasks without context.

- Lack of understanding can lead to missed insights and poor decisions.

- A strong outsourcing partner will analyse your industry to provide customised solutions.

- customised solutions go beyond compliance and support real growth.

- Focusing Only on Cost Instead of Quality

- Cost savings are important but shouldn’t be the only factor.

- The cheapest option may lack expertise, tools, or reliability.

- Poor-quality service can lead to compliance risks and hidden costs.

- Prioritise value, expertise, and scalability over price alone.

What to Do Before You Hire an Outsourced Accountant

Before engaging in financial accounting outsourcing, it’s essential to clearly define what you expect from the partnership. Too often, businesses rush into outsourcing without identifying their priorities, which can lead to mismatched expectations. A thoughtful approach ensures you choose the right provider and maximise the value of the relationship.

Steps to Take Before Hiring an Outsourced Accountant:

- Identify the Services You Need

- List the accounting functions you want to outsource, such as bookkeeping, payroll, tax compliance, reporting, or transaction monitoring.

- Be clear on whether you need full-service support or only specific functions.

- Prioritise areas that consume the most time or create the biggest challenges in-house.

- Ensure the provider you select has proven expertise in these areas.

- Clarify Your Business Goals

- Go beyond tasks and define what outcomes you want to achieve.

- Examples include improving cash flow, increasing efficiency, or gaining real-time visibility into your finances.

- A strong outsourcing plan looks beyond short-term fixes and supports long-term growth.

- Communicate these goals clearly so your provider can customise solutions.

- Assess Technology and Tools

Ensure the outsourced accountancy services, including payables outsourcing and other financial functions, use modern, cloud-based tools like Xero or MYOB.

- Check that reporting systems are accessible, transparent, and secure.

- Confirm that automation and digital processes are part of their offering.

- Look for providers who can integrate efficiently with your existing systems.

- Evaluate the Partnership Fit

- Choose a firm that understands your business and industry.

- Check if their values and communication style align with yours.

- Ask about their process for tailoring services to individual needs.

- Prioritise firms that offer flexibility and proactive advice, not just task completion.

Conclusion

In an era where efficiency and accuracy define business success, outsourced accounting has become more than a cost-saving tactic, it’s a strategic move. By leveraging the expertise of specialised providers, businesses in Australia can streamline financial operations, ensure compliance, and access the latest digital tools, all while focusing their energy on innovation and growth.

Outsourcing empowers leaders to reduce risks, scale with confidence, and gain clear visibility into their financial health. As organisations continue to adapt to digital transformation and remote collaboration, the value of outsourcing accounting services will only grow stronger.

Whether it’s saving money, improving productivity, or achieving long-term financial clarity, partnering with the right outsourced accounting team can make the difference between simply managing numbers and driving meaningful business outcomes.